May 8, 2017 | bonds, EDS, EDS code, educational newsletters, ETFs, jay kaeppel

There is great trepidation in the bond market these days. Most investors seem to have the “interest rates are sure to rise” mantra playing on auto loop in their head. And this is not entirely unwarranted. Given the historical tendency for bond yields to move in long, slow trends (20 years or more essentially in one direction is not uncommon), I for one am pretty confident in believing that interest rates will be higher 20 years from now than they are now.

But that is not the fear that is playing in people’s heads. The fear in people’s heads is that rates are rising soon (like immediately) and in a big way. This however, may or may not prove to be the case.

Figure 1 displays a history of 10-year treasury yields through about 2012 (FYI 10-yr. yields are roughly in changed since that time). Note the long-term nature of interest rate trends and that while there are “spikes” here and there, most major moves play out over time and not in “here today, sharply higher tomorrow” fashion.

Also, you can see in Figure 2 – one can make a compelling argument that bond yields are not “officially rising”, at least not yet.

Figure 2 – Yields still “officially” in a downtrend

Bonds are Due to Bounce – But Will They?

One way to identify important turning points in any market is when a market doesn’t do something that it would normally be expected to do. For example, here is a simple thought process:

1) The bond market is oversold

2) In the past 30 years, pretty much anytime it would get oversold a rally ensued

3) Therefore, bonds should rally soon

But will they – that is the question. And in my opinion, the answer is important.

*If bonds rally soon (i.e., over the course of say the next several months) then “the status may still be quo”.

*If bonds do not rally soon, then it may be a sign that “things are changing”

Which Way Bonds?

Figures 3 and 4 below display ticker TLT (an ETF that tracks the long-term treasury bond) with an indicator I call UpDays20. In this case we are looking at weekly bars and not daily bars, but the concept is the same.

UpDays20 is calculated by simply adding up all of the weeks that have showed a weekly gain over the past 20 weeks and then subtracting 10 (the WinWay Charts Expert Design Studio code appears at the end of this article, after the disclaimer).

If 10 of the past 20 weeks have showed a weekly gain then the upDays20 indicator will read 0 (i.e., a total of 10 weeks were up minus 10 = 0). If only 6 weeks showed a gain in the past 20 weeks then the UpDays20 indicator will read -4, etc.

What to look for: Typically (at least in the declining rate environment of recent decades) when UpDays20 rises by a value of 2 from a low of -2 or less, a decent rally in bonds has ensued.

For example, if UpDays20 falls to -4 then a rise to -2 or higher triggers a buy signal. If it falls only as low as -3 then a rise to -1 or higher is required. If it falls only as low as -2 then a rise to 0 or higher is required.

Figures 3 and 4 highlight signals since roughly 2004.

Figure 3 – Ticker TLT with UpDays20 weekly buy signals (2004-2010); (Courtesy

WinWay TradingExpert )

Figure 4 – Ticker TLT with UpDays20 weekly buy signals (2010-2017); (Courtesy

WinWay TradingExpert )

As you can see in Figures 3 and 4, most of the signals highlighted were followed by at least a decent short-term rally.

In 2017, buy signals from the UpDays20 indicator occurred on 1/13 and 4/14. TLT is up +0.3% since the 1/13 signal and down -1.4% since the 4/14 signal.

Summary

Either:

1) This is an excellent time to buy the long-term bond (looking for at least a short to intermediate term rally) as a rally is overdue

OR

2) The “times they may be a changing” for bonds

So keep an eye on TLT over the next several months.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

WinWay TradingExpert Expert Design Studio Code for UpDays20

Up1 if [close] > val([close],1).

Up2 if val([close],1) > val([close],2).

Up3 if val([close],2) > val([close],3).

Up4 if val([close],3) > val([close],4).

Up5 if val([close],4) > val([close],5).

Up6 if val([close],5) > val([close],6).

Up7 if val([close],6) > val([close],7).

Up8 if val([close],7) > val([close],8).

Up9 if val([close],8) > val([close],9).

Up10 if val([close],9) > val([close],10).

Up11 if val([close],10) > val([close],11).

Up12 if val([close],11) > val([close],12).

Up13 if val([close],12) > val([close],13).

Up14 if val([close],13) > val([close],14).

Up15 if val([close],14) > val([close],15).

Up16 if val([close],15) > val([close],16).

Up17 if val([close],16) > val([close],17).

Up18 if val([close],17) > val([close],18).

Up19 if val([close],18) > val([close],19).

Up20 if val([close],19) > val([close],20).

UpCount is (Up1+ Up2+Up3+Up4+Up5+Up6+Up7+Up8+Up9+Up10+Up11+Up12+Up13+Up14+Up15+Up16+Up17+Up18+Up19+Up20)-10.

Apr 28, 2017 | Charts, Market Charts, Support

Action keys

A Toggle vertical date cursor line to a diamond and back

D Quick-change the date

G Toggle grid lines on or off

F Display fundamental information

W Toggle between daily and weekly data

M Toggle trendline drawing on or off (also crosshairs)

S Process a stock split or mutual fund distribution

T Add ticker to a tag list

U Untag ticker from tag list

O Overlay feature

P Print active chart

L Toggle Log Scales on or off

V Set tag list

Z Toggle Zoom feature on or off (temporarily hide current indicators)

Function keys

F1 Help

F5 Close all open charts

F10 Toggle Control Panel on or off

Ctrl+O Display Chart Ticker dialog box

Esc Display Chart Ticker dialog box

Enter Toggle between Indicator and Explore panels

Ctrl+M Display Market Charts

Ctrl+Enter Display Indicator Constants box

Ctrl+left/right arrow Quick search for Expert Ratings

Alt+N Display ticker Notes

? Display ER rules

+ Explore right

– Explore left

* Explore up

/ Explore down

Left/right arrows Move date one period

Up/down arrows Select indicators or scroll through a list

Apr 7, 2017 | educational newsletters, ETFs, indicators, jay kaeppel

First things first: I am primarily a trend-follower (this is based on, a) the relative long-term benefits of following trends and b) my lack of ability to actually “predict” anything – but I digress).

As a trend-follower I love the fact that the stock market has been trending higher and the fact that there is so much “angst” regarding the “inevitable top.” Still, like a lot of investors I try to spot “early warning signs” whenever possible. Here are the four “things” I am following now for signs of trouble.

Fidelity Select Electronics

In Figure 1 you see, a) the blow-off top of 1999-2000 and b) today. Are the two the same? I guess only time will tell. But the point is, I can’t help but think that if and when the bloom comes off of the electronics boom, overall trouble will follow. Here is hoping that I am not as correct here as I was

here.

Just asking.

Transportation Index

As you can see in Figure 2, the Dow Transports has a history of making double tops which is followed by trouble in the broader market. Are we in the process of building another double top? And will trouble follow if we are? Dunno, hence the reason it is on my “Watch List” rather than on my “OH MY GOD SELL EVERYTHING NOW!!!!! List”.

I guess we’ll just have to wait and see.

Ticker XIV

Ticker XIV is an ETF that is designed to track inverse the VIX Index. As a refresher, the VIX Index tends to “spike” higher when stocks fall sharply and to decline when stocks are rising and/or relatively quiet. To put it in simpler terms, in a bull market ticker XIV will rise. As you can see in Figure 3 one might argue that XIV has gone “parabolic”. This is a potential warning sign (assuming you agree that the move is parabolic) as a parabolic price move for just about anything is almost invariably followed by, well, let’s just say, “not so pretty”.

Let’s hope not. Because if it does qualify as parabolic that’s a very bad sign.

Ticker BID

This one may or may not be relevant but for what it is worth, Sotheby’s (ticker BID) has on several occasions served as something of a “leading indicator” at stock market tops (for the record it has also given some false signals, so this one is more for perspective purposes rather than actual trading purposes). Still, if this one tops out in conjunction with any or all of the above, it would likely serve as a useful warning sign.

Summary

There is no “urgent action” to be taken based on any of this. Bottom line: Nothing in this article should trigger you to run for the exits.

Still, it might be wise to at least take a look around and “locate the exit nearest you.”

You know, just in case.

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Mar 23, 2017 | educational newsletters, indicators, MACD

There are many ways to use the MACD indicator developed long ago by Gerald Apel. This is one of them. Maybe. Nothing more, nothing less.

First the caveat: what follows is NOT a “trading system” or even something that you should consider on a standalone basis.

MACD

The MACD indicator uses exponential moving averages to identify the underlying trend for a given security and is also used by many traders to identify divergences which may signal an impending change of trend.

Figure 1 displays the daily MACD for ticker SPY.

Figure 1 – Ticker SPY with MACD Indicator (Courtesy

WinWay Charts )

While this is NOT intended to be a mechanical signal, I am going to put specific rules on it just to give it some structure. The rules:

1) If the daily MACD (12,26,9) has declined for at least 7 consecutive trading days AND

2) The 2-day RSI is at 64 or above

Then an “alert” signal is flashed. The key thing to note is that if the MACD ticks higher on the day that the 2-day RSI rises above 64, the signal is negated.

Before proceeding please note that the 12,26,9 parameter selection is simply the “standard” for MACD. Also, there is nothing magic about 7 consecutive days – so one might experiment with different values there. Finally, using the 2-day RSI and a “trigger” value of 64 are also both arbitrary. There may be better values and/or different overbought/oversold indicators to use.

Ticker GS

A “classic” example of the MACD Tell appears in Figure 2 using ticker GS.

The MACD Tell is typically best used as a short-term indicator. In this case a short-term trader might have considered playing the short side of GS – or even better – using option strategies such as buying puts or selling bear call spreads.

Summary

No one should rush out and start trading put options based on this indicator (or any other indicator for that matter) without spending some time doing some homework and testing out the viability for producing profits.

In reality, this is the type of indicator that should typically be combined with “something else” and/or used as a confirmation rather than as a standalone approach.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Mar 21, 2017 | EDS, EDS code, Moving averages, Stock trading

Please note that I tested the author’s system using the NASDAQ 100 list of stocks on daily bars rather than intraday bars from 12/31/2008 thru 2/10/2017. Figure 7 shows the resulting equity curve trading the author’s system with the cross-down exit. Figure 8 shows the ASA report for this test. The annualized return showed about a 17% return with a maximum drawdown of 19%.

FIGURE 7: Here are sample test results from the WinWay Portfolio Manager taking three signals per day and 10 concurrent positions maximum run on NASDAQ 100 stocks (daily bar data) over the period 12/31/08 to 2/10/07.

FIGURE 8: This shows the ASA report for the system, which shows the test metrics and settings.

!Volume-Weighted Moving Average Breakouts

!Author: Ken Calhoun, TASC Apr 2017

!Coded by: Richard Denning 2/11/17

!www.TradersEdgeSystems.com

!INPUTS:

smaLen is 70.

vwmaLen is 50.

SMA is simpleavg([close],smaLen).

VWMA is sum([close]*[volume],vwmaLen)/sum([volume],vwmaLen).

HasData if hasdatafor(max(smaLen,vwmaLen)+10)>max(smaLen,vwmaLen).

Buy if SMA < VWMA and valrule(SMA > VWMA,1) and HasData.

Sell if SMA > VWMA.

rsVWMA is VWMA / valresult(VWMA,vwmaLen)-1.

rsSMA is SMA / valresult(SMA,smaLen)-1.

Feb 27, 2017 | educational newsletters, ETFs, trading strategies

The stock market is off to a flying start in 2017. We have a buy signal from the January Barometer, the 40-Week Cycle just turned bullish and most of the major U.S. indexes soaring to new all-time highs. See Figure 1.

Figure 1 – Major U.S. Average hitting new highs (charts courtesy WinWay TradingExpert)

With the turn of the month near, what lies ahead for March and April? Well, it’s the stock market, so of course no one really knows for sure. Still, if history is an accurate guide (and unfortunately it isn’t always – and I hate that part), the odds for a continuation of the advance in the months just ahead may be pretty good.

Figure 2 displays the growth of $1,000 invested in the Dow Jones Industrials Average ONLY during the months of March and April starting in 1946.

Figure 2 – Growth of $1,000 invested in the Dow Jones Industrials Average ONLY during the months of March and April (1946-2016)

For the record, the months of March and April combined:

*Showed a gain 53 times (75% of the time)

*Showed a loss 18 times (25% of the time)

*The average UP year showed a gain of +5.2%

*The average DOWN year showed a loss of (-3.3%)

*The largest Mar/Apr gain was +15.9% (1999)

*The largest Mar/Apr loss was (-6.0%) (1962)

So is the stock market train sure to “roll on” during the March/April timeframe? Not at all. But with “all systems Go” at the moment and with a historically favorable period approaching – and despite a lot of overly bullish sentiment beginning to bubble up – I feel compelled to stay on board at least until the next stop..

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Feb 16, 2017 | EDS, EDS code, indicators, Stocks & Commodities Traders Tips

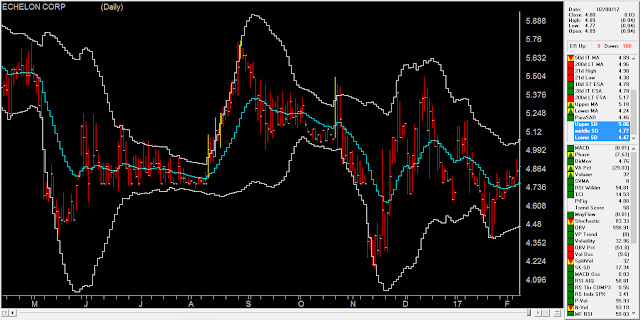

The AIQ code based on Vitali Apirine’s article in the 2017 issue of Stocks & Commodities magazine, “Exponential Standard Deviation Bands”

Editor note: “Author Vitali Apirine presented a method intended to help traders see volatility while a stock is trending. These bands, while similar to Bollinger Bands, are calculated using exponential moving averages rather than simple moving averages.

Like Bollinger Bands, they widen when volatility increases and narrow as volatility decreases. He suggests that the indicator can be used as a confirming indication along with other indicators such as the ADX.

Here’s a WinWay Chart with the Upper, Lower and Middle Exponential SD added as custom indicators.”

To compare the exponential bands to Bollinger Bands, I created a trend-following trading system that trades long only according to the following rules:

- Buy when there is an uptrend and the close crosses over the upper band. An uptrend is in place when the middle band is higher than it was one bar ago.

- Sell when the low is less than the lower band.

Figure 8 shows the summary test results for taking all signals from the Bollinger Band system run on NASDAQ 100 stocks over the period 12/9/2000 to 12/09/2016. Figure 9 shows the summary test results for taking all signals from the exponential band system on NASDAQ 100 stocks over the same period. The exponential band system improved the average profit per trade while reducing the total number of trades.

FIGURE 8: WinWay EDS. Here are summary test results for taking all signals from the Bollinger Band system run on NASDAQ 100 stocks over the period 12/9/2000 to 12/09/2016.

FIGURE 9: WinWay EDS. Here are summary test results for taking all signals from the exponential band system run on NASDAQ 100 stocks over the period 12/9/2000 to 12/09/2016.

!Exponential Standard Deviation Bands

!Author: Vitali Apirine, TASC February 2017

!Coded by: Richard Denning 12/11/2016

!INPUT:

xlen is 20.

numSD is 2.

!INDICATOR CODE:

ExpAvg is expavg([close],xlen).

Dev is [close] – ExpAvg.

DevSqr is Dev*Dev.

SumSqr is sum(DevSqr,xlen).

AvgSumSqr is SumSqr / xlen.

ExpSD is sqrt(AvgSumSqr).

!UPPER EXPONENTIAL SD BAND:

UpExpSD is ExpAvg + numSD*ExpSD. !PLOT ON CHART

!LOWER EXPONENTIAL SD BAND:

DnExpSD is ExpAvg – numSD*ExpSD. !PLOT ON CHART

!MIDDLE EXPONENTIAL SD BAND:

MidExpSD is ExpAvg.

!BOLLINGER BANDS FOR COMPARISON:

DnBB is [Lower BB]. !Lower Bollinger Band

UpBB is [Upper BB]. !Upper Bollinger Band

MidBB is simpleavg([close],xlen). !Middle Bollinger Band

!REPORT RULE TO DISPLAY VALUES:

ShowValures if 1.

!TRADING SYSTEM USING EXPPONENTIAL SD BANDS:

UpTrend if MidExpSD > valresult(MidExpSD,1).

BreakUp if [close] > UpExpSD.

BuyExpSD if UpTrend and BreakUp and valrule(Breakup=0,1).

ExitExpSD if [Low] < DnExpSD. ! or UpTrend=0. !TRADING SYSTEM USING BOLLINGER BANDS: UpTrendBB if MidBB > valresult(MidBB,1).

BreakUpBB if [close] > UpBB.

BuyBB if UpTrendBB and BreakUpBB and valrule(BreakupBB=0,1).

ExitBB if [Low] < DnBB. ! or UpTrend=0.

Feb 2, 2017 | educational newsletters, jay kaeppel, seasonal, Stock trading

I’ve been seeing a number of panicked missives lately regarding the retailing sector. They typically go something like this:

“Despite new highs for most of the major market indexes, the retailing sector has been struggling – and in some cases hit hard – therefore it is clearly (paraphrasing here) THE END OF THE WORLD AS WE KNOW IT, AHHHHHHHHHHHHH……………………..”

Or something along those lines. And the truth is that they may be right. But as it turns out, with the retailing sector it is typically more a question of “when” and not “what” (or even WTF

Recent Results

The concerns alluded to above are understandable given recent results in certain segments of the retailing sector. Figure 1 displays the stock price action for four major retailers. It isn’t pretty.

(click to enlarge)

So if major retailers are performing poorly one can certainly see why someone might extrapolate this to conclude that the economy is not firing on all cylinders and that the recent rally to new highs by the major averages is just a mirage. And again, that opinion may ultimately prove to be correct this time around.

But before swearing off of retailing stocks, consider the following.

Retailers – When not What

For our test we will use monthly total return data for the Fidelity Select Retailing sector fund (ticker FSRPX). Figure 2 displays the growth of $1,000 invested in FSRPX only during the months of:

*February, March, April, May, November, December

Figure 2 – Growth of $1,000 invested in ticker FSRPX only during the “favorable” months since 1986

For the record:

*An initial $1,000 grew to $50,274, or +4,927% (this test does not include any interest earned during the months out of FSRPX).

*# of years showing a net gain = 27

*# of years showing a net loss = 4

*Average UP year = +17.0%

*Average DOWN year = (-3.4%)

*Maximum UP Year = +50.0% (1990)

*Maximum DOWN Year = (-5.9%) (1994)

The Year-by-Year Results appear in Figure 3

| Year |

% +(-) |

| 1986 |

26.2 |

| 1987 |

15.8 |

| 1988 |

12.2 |

| 1989 |

16.9 |

| 1990 |

50.0 |

| 1991 |

45.5 |

| 1992 |

8.0 |

| 1993 |

4.6 |

| 1994 |

(5.9) |

| 1995 |

3.0 |

| 1996 |

26.1 |

| 1997 |

18.1 |

| 1998 |

45.7 |

| 1999 |

4.0 |

| 2000 |

1.8 |

| 2001 |

12.5 |

| 2002 |

(0.1) |

| 2003 |

18.5 |

| 2004 |

11.3 |

| 2005 |

10.3 |

| 2006 |

0.1 |

| 2007 |

(2.8) |

| 2008 |

(4.7) |

| 2009 |

44.9 |

| 2010 |

24.5 |

| 2011 |

4.6 |

| 2012 |

10.8 |

| 2013 |

16.6 |

| 2014 |

11.5 |

| 2015 |

6.1 |

| 2016 |

9.2 |

Figure 3 – Year-by-Year Results for “Favorable” Months since 1986

The Rest of the Year

If for some reason you had decided to skip the months above and hold FSRPX only during all of the other months of the year, your results appear in Figure 4.

Figure 4 – Growth of $1,000 invested in ticker FSRPX only during the “unfavorable” months since 1986

For the record:

*An initial $1,000 grew to $1,037, or +3.7% (this test does not include any interest earned during the months out of FSRPX).

Summary

Is the retailing sector guaranteed to generate a gain during our “favorable” months in 2017? Not at all. Still, given that retailing is presently beaten down a bit and the fact that the worst full year loss during the favorable months was -5.9%, it may be time to think about taking a look (although – as always, and for the record – I am not “recommending” retailing stocks, only pointing out the historical trends).

Still, as the old saying goes, the results below are what we “quantitative types” refer to as “statistically significant”.

*Favorable months since 1986 = +4,927%

*Unfavorable months since 1986 = +3.7%

Jan 20, 2017 | educational newsletters, ETFs, jay kaeppel, seasonal, Seasonality

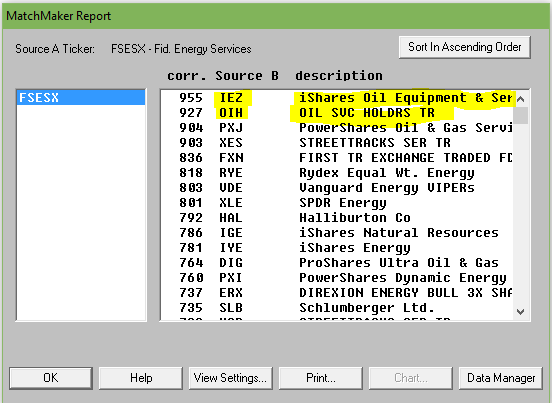

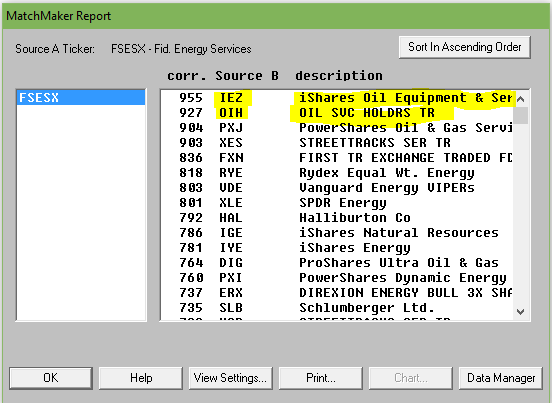

If you follow jay Kaeppel’s posts in this blog, you’ll know that he’s the master of research on all things seasonal. This past week he posted a seasonal article on energy using FSESX – Fidelity Select Energy Services. Previously he had noted the bullish tendency for ticker FSESX during the months of February, March and April. In his follow up piece, he added one more “favorable” month and then also looked at a 6-month “unfavorable” period. The article is included at the end of this post so you can see the results.As Mutual funds are not for everyone, we went in search of alternative tickers that could closely match FSESX in performance characteristics. Using WinWay Matchmaker we compared the price action of FSESX against our universe of stocks and ETFs looking for a match.

Matchmaker uses Spearman Rank Correlation analysis to identify a close match to FSESX. The closer the result to 1000, the higher the correlation. Anything over 950 is a very close match. Here’s the results.

Figure 1. MatchMaker correlation for last 4 years – FSESX vs stocks and ETFs

The ETF IEZ – iShares Oil and Equipment & Services showed a very high correlation over the 4 years we tested. OIH – Oil Service Holders, another ETF, also showed high correlation.

Here’s a WinWay overlay chart of recent daily price action comparing FSESX vs IEZ.

Figure 2. Recent daily price action comparing FSESX vs IEZ.

IEZ appears to be a good surrogate for FSESX at least over the last 4 years.

We also wanted a visual of the seasonal pattern in action. Fortunately we have a tool still in development at WinWay that’s just right for this. Basically it provides a price comparison of ‘x’ numbers of years of the same ticker overlaid on each other.

Here’s 3 of the last 4 years on IEZ, the average of the years displayed is in black. We highlighted the Feb, Mar, Apr and Dec in yellow. We could have included more years but for illustration purposes it was easier to show the 3 years (the chart gets busy with too many lines on it!)

Figure 3 – IEZ seasonal chart (beta) for 3 years with average.

The Feb, Mar, Apr period has a definite bullish tendency, the Dec period does Ok too. You’ll notice the tendency for IEZ to fall sharply in January. Conclusion? IEZ is a reasonable surrogate for FSESX if you’re contemplating this seasonal move.

_________________________________________________________

The article this follow up is based upon is by Jay Kaeppel and is included below. Jay is

Chief Market Analyst at JayOnTheMarkets.com and TradingExpert Pro client. http://jayonthemarkets.com/If you are looking for a market sector with some serious seasonal trends, look no further than the energy sector. Previously I had noted the bullish tendency for ticker FSESX during the months of February, March and April. In this piece, we will add one more “favorable” month and then also look at a 6-month “unfavorable” period.

For the record, the information that follows is not being recommended as a standalone strategy. It is presented simply to make you aware of certain long-term trends that have been very persistently bullish (or bearish as the case may be) in the energy sector.

4 Favorable Months

*The four “favorable” months for our test are February, March, April and December

Figure 1 displays the growth of $1,000 invested in ticker FSESX only during these four months every year since 1986 versus simply buying-and-holding ticker FSESX.

Figure 1 – Growth of $1,000 invested in FSESX only during Feb, Mar, Apr, Dec every year since 1986

Starting in 1986, an initial $1,000 investment grew to $76,019 (or +7,500%) versus $10,237 (or 923%) using a buy-and-hold strategy.

6 Unfavorable Months

The six “Unfavorable” months are June, July, August, September, October and November.

First the “positive” news:

*This 6-month period has managed to show a gain 14 times in 31 years – so by no means should you consider this period a “sure thing” loser

*During 4 separate years – 1997, 2003, 2004 and 2010 – the “unfavorable” months registered a cumulative gain in excess of +30%.

Doesn’t sound all that “unfavorable” so far does it? But here’s the catch: Despite the occasional 30%or more gain, it is fair to refer to this 6-month period as “unfavorable” as the cumulative long-term results of buying and holding FSESX during these months has been nothing short of devastating.

Figure 2 displays the growth of $1,000 invested in ticker FSESX only between the end of May and the end of November every year starting in 1986.

Figure 2 – Growth of $1,000 invested in FSESX only during June through November every year since 1986

Starting in 1986, an initial $1,000 investment declined to just $82, or a cumulative loss of -91.8%

Figure 3 displays some comparative data between favorable and unfavorable periods as well as using a Buy-and-Hold strategy.

| Measure |

Buy-and-Hold |

4 Favorable Months |

6 Unfavorable Months |

| Average Annual % +(-) |

12.8 |

16.5 |

(-4.2) |

| Median Annual % +(-) |

8.7 |

15.5 |

(-1.8) |

| Standard Deviation |

33.4 |

20.1 |

24.6 |

| # Years UP |

18 |

26 |

14 |

| # Years DOWN |

13 |

5 |

17 |

| Worst Year |

(-55.4) 2008 |

(-7.6) 1994 |

(-62.8) 2008 |

| $1,000 becomes |

$10,237 |

$76,019 |

$82 |

| Cumulative % +(-) |

+923% |

+7,500% |

(-92%) |

Figure 3 – Comparative Results

Figure 4 displays the year-to-year results for a Buy-and-Hold approach versus holding only during the 4 “favorable” months or the “Unfavorable” 6 months.

| Year |

All 12 months % +(-) |

4 Favorable % +(-) |

6 Unfavorable % +(-) |

| 1986 |

(8.9) |

(5.2) |

(9.2) |

| 1987 |

(20.7) |

22.9 |

(40.1) |

| 1988 |

(4.2) |

22.8 |

(16.3) |

| 1989 |

50.3 |

27.1 |

16.2 |

| 1990 |

8.7 |

4.9 |

(11.2) |

| 1991 |

(19.9) |

4.1 |

(25.0) |

| 1992 |

4.9 |

(1.6) |

(1.3) |

| 1993 |

16.4 |

24.5 |

(10.7) |

| 1994 |

(0.5) |

(7.6) |

3.1 |

| 1995 |

40.0 |

33.7 |

2.0 |

| 1996 |

45.9 |

22.5 |

20.8 |

| 1997 |

43.9 |

(4.9) |

32.9 |

| 1998 |

(41.4) |

26.5 |

(50.5) |

| 1999 |

80.9 |

74.1 |

7.5 |

| 2000 |

51.7 |

77.6 |

(21.1) |

| 2001 |

(22.4) |

20.8 |

(32.4) |

| 2002 |

2.2 |

26.2 |

(18.0) |

| 2003 |

13.1 |

15.5 |

(16.0) |

| 2004 |

26.2 |

1.2 |

30.2 |

| 2005 |

47.4 |

4.8 |

34.0 |

| 2006 |

(9.1) |

(4.1) |

(1.8) |

| 2007 |

58.3 |

25.6 |

16.7 |

| 2008 |

(55.4) |

10.5 |

(62.8) |

| 2009 |

60.4 |

24.5 |

9.6 |

| 2010 |

31.7 |

21.6 |

33.7 |

| 2011 |

(18.5) |

3.1 |

(16.8) |

| 2012 |

(3.9) |

0.7 |

9.6 |

| 2013 |

14.1 |

0.3 |

11.5 |

| 2014 |

(19.5) |

7.2 |

(26.7) |

| 2015 |

(19.7) |

2.9 |

(17.9) |

| 2016 |

44.2 |

28.4 |

20.1 |

Figure 4 – Yearly % +(-) for Buy-and-Hold versus 4 Favorable Months versus 6 Unfavorable Months

Summary

There is no guarantee from year-to-year results of buying and holding ticker FSESX during the “Favorable 4” months will show a gain and/or outperform the “Unfavorable 6” months. And there is by no means any guarantee that the “Unfavorable 6” will show a loss during any given year (note that 2016 saw the Unfavorable 6 generate a cumulative gain of +20.1%!). So just remember that we are talking about some very long-term trends here.

Still, most investors can discern the difference between:

*Favorable 4 months gain = +7,500%

*Unfavorable 6 months loss = (-92%)

This type of difference is what we “quantitative types” refer to as “statistically significant.”

Jan 4, 2017 | ETFs, jay kaeppel, stock market, trading strategies

Before moving on to 2017 I want to revisit a couple of “old” ideas I wrote about recently.

One 9/23/16 I wrote

this article detailing a very aggressive bond trading strategy. The model detailed essentially combined two other models that I have used for a number of years – one a “timing” model, the other a “seasonal” model. If either model is bullish then ticker TMF (a triple leveraged long-term treasury bond fund) is held.

As shown in Figure 1, the first model turns:

*Bullish for Bonds when the 5-week moving average for ticker EWJ drops below the 30-week moving average for ticker EWJ

*Bearish for Bonds when the 5-week moving average for ticker EWJ rises above the 30-week moving average for ticker EWJ

Figure 1 – Bond Bull and Bear signals using ticker EWJ (Courtesy

TradingExpert)

The second model simply holds bonds during the last 5 trading days of each month

The rules for Jay’s Very Risky Bond Model (JVRBM) are as follows:

Bullish for TMF if:

*Ticker EWJ 5-week MA < Ticker EWJ 30-week MA, OR

*Today is one of the last 5 trading days of the month

Bearish for TMF if:

*EWJ 5-week MA > EWJ 30-week MA AND today IS NOT one of the last 5 trading days of the month

Figure 2 displays the growth of $1,000 invested in TMF if the bullish conditions above apply since 4/16/2009 (when TMF started trading).

Figure 2 – Growth of $1,000 invested in ticker TMF when JVRBM is Bullish (4/16/2009-12/30/2016)

Figure 3 displays the growth of $1,000 invested in TMF is the bearish conditions above apply since 4/16/2009 (when TMF started trading).

Figure 3 – Growth of $1,000 invested in ticker TMF when JVRBM is Bearish (4/16/2009-12/30/2016)

For the record:

*During the Bullish periods in 2016 ticker TMF gained +72%

*During the Bearish periods in 2016 ticker TMF lost -43%

Figure 4 displays the growth of $1,000 invested in ticker TMF during the Bullish versus Bearish periods in 2016.

Figure 4 – Growth of $1,000 invested in TMF during Bullish versus Bearish periods (12/31/2015-12/31/2016)

All in all not a bad year (Just don’t forget high degree of risk).

Summary

Make no mistake, this is a trading method that entails a great deal of risk. One can reasonably ask if a long position in a triple leveraged fund of any kind is really a good idea.

But, hey, the phrase “high risk, high reward” exists for a reason.