Jun 11, 2024 | Charts

In this update, we’re going to discuss the most recent market timing signals from the Expert system within our Trading Expert Pro platform. On your screen is a daily chart of the Dow Jones Industrial Average with a price phase indicator underneath, displaying Heiken Ashi-mode candles. The green bars indicate an uptrend, red bars show a downtrend, and the bars that are neither green nor red are based on a color study indicating a high market rating.

To explain these market ratings: over 400 rules run through an inference engine—a decision tree process where 400 different indicator states are evaluated. When one rule fires, it triggers the evaluation of certain other rules. These decision pathways contribute to a high expert rating, either up or down, which can signal a change in market direction. The expert rules are based on historical Dow Jones price action and the internals of the New York Stock Exchange, such as new highs, new lows, and advancing/declining issues, evaluated using numerous indicators.

Every day, we generate an expert rating. Most ratings are neutral, meaning few or no rules fired. For instance, on June 4th of this year, the rating was neutral. Once the rules’ weighting reaches beyond 95 up or down, it’s a significant level. On the price chart, buy and sell points are indicated for ratings greater than 95. I’ve marked only the first in a batch of signals; subsequent signals reinforce the initial one. For example, a sell signal is marked by a yellow bar indicating a 96 down rating, signifying importance.

Each day, an expert rating is shown on the chart. Scrolling forward, you’ll see the numbers change. White bars indicate a 95 or greater up signal, while yellow bars show a 95 or greater down signal. The charts are annotated with buy and sell signals. When multiple buy signals occur, we focus on the first one, with subsequent signals reinforcing it. The same applies to sell signals.

We haven’t updated these market timing signals in a while. Starting back in late February 2024, there was a buy signal on February 22nd, indicating a 95 rating for the upside. The rules contributing to this signal include the advanced decline oscillator turning positive, viewed as bullish in the market. The New York breadth data’s new high/low indicator reversing to the upside also supports this bullish signal.

Price action moved up slightly before flattening out, followed by a sell signal. Examining the sell signal rules, volume accumulation percentages decreased, and the stochastic moved below the 80% line, indicating bearish conditions. Buy and sell signals appear consistently, with some leading to short-term gains.

Recently, on June 6th, there was another sell signal, reinforcing a previous one. Rules indicated negative shifts in the advanced decline line and up-down volume oscillator. These strong signals suggest a continued downtrend. The system, tested over 37 years, uses an inference engine decision tree process, providing standardized market analysis.

For a closer look, visit aiqsystems.com and try our service for a month for just $1, including end-of-day data. This system’s consistency over the years speaks for itself.

May 22, 2024 | Charts

June 19, 2024 4 – 5.30pm London Time

An exclusive opportunity to join Ray and Steve in a premium workshop where we’ll cover some of the most common questions raised by clients. In this 90-minute session we’ll cover

- Drawing tools how to use them effectively in Charts

- Charting shortcuts save time and energy

- Adding and Saving indicators

- Effective use of taglists

- Application of Fibonacci tool

- How to use WinWay MACD and RSI

- Using WinWay Stock Reports

- Application of Group/Sector Rotation Reports and Market Log

All sessions are recorded.

Discounted price $99

only $25

Apr 25, 2024 | Charts

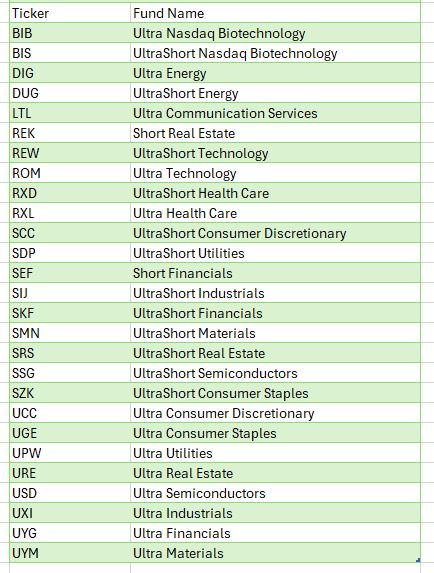

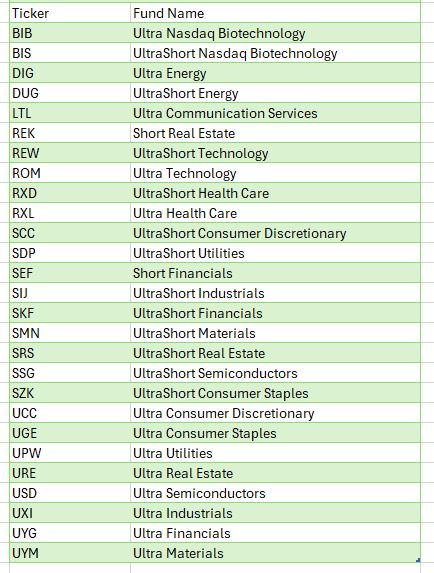

There are many ETF families in the market today, and of course, the oldest and most popular ETF, SPY has been around since 1993. Ultra ProShares Exchange Traded Funds (ETFs) developed by Profunds and traded on the AMEX. are one of the most actively traded areas of the markets. With $billions pouring into the UltraShort QQQ ETF, QID, it’s evident that it’s become one of the most actively traded ETFs globally.

Whether you’re a trader or investor, these Ultra ETFs serve as valuable tools capable of enhancing returns while mitigating risks.

Ultra bullish and UltraShort ETFs on broad market indices expanded some years ago to include leveraged bullish and bearish Sector and International ETFs. These additions enable investors to hedge or amplify sector exposure effortlessly. Moreover, these Ultra and UltraShort ETFs are compatible with IRAs or retirement accounts, where shorting or margin trading is typically restricted.

From a trader’s perspective, the liquidity and leverage of Ultra Bullish and UltraShort ETFs, which move two times the underlying index or inversely track it, offer a simpler and less risky alternative to options, futures, or shorting stocks.

For day traders, the highly liquid QQQ ETFs, QLD and QID, along with S&P500 ETFs, SDS and SSO, have become favored vehicles. The volatility of these ETFs presents opportunities for swift gains.

For investors and portfolio managers, ProShares ETFs offer a plethora of risk management tactics and asset allocation strategies. They provide flexibility to hedge against market risk or capitalize on market fluctuations. Furthermore, leveraging Ultra ETFs in asset allocation frees up capital for further diversification, allowing for strategic positioning across various sectors and markets. Sectors, in particular, have gained importance in recent times, with ProShares Sector ETFs offering exposure to Dow Jones Sectors.

For further leveraging the leverage, listed options on Ultra ETFs bring new possibilities for creative strategies. Covered call writes on bearish ETFs or options on Ultra ETFs provide avenues for managing risk and capitalizing on market movements with added leverage.

Given these ‘options on steroids’ move so quickly, only spend as much as you can afford to lose keeping in mind the thought “Have a hunch – buy a bunch. Hunch is wrong – bunch is gone”. While using Puts or Calls on Ultra Short and Ultra ETF’s requires some upside down and out-of-the-box thinking they add are few arrows to the trader’s quiver.

In conclusion, the Ultra ProShares ETFs have revolutionized trading and investing, offering opportunities previously inaccessible to individual investors.

There’s a WinWayCharyts list of the Proshares Sector ETFs available for download at https://aiqeducation.com/PROSECT.lis

This list file needs to be in your /wintes32 folder

Apr 2, 2024 | Charts

Making the Most of Your WinWayCharts – An hour-long session with UK Director Ray Foreman covering the power features in your WinWayCharts platform – great for new clients and those getting started.

Support and resistance levels are well-known concepts in technical analysis that help traders identify key price levels for making informed trading decisions. In this session, Steve Hill, CEO of AIQ Systems will guide you through the key characteristics of support and resistance; not every peak and trough qualifies.

Mar 19, 2024 | EDS, EDS code, ETFs

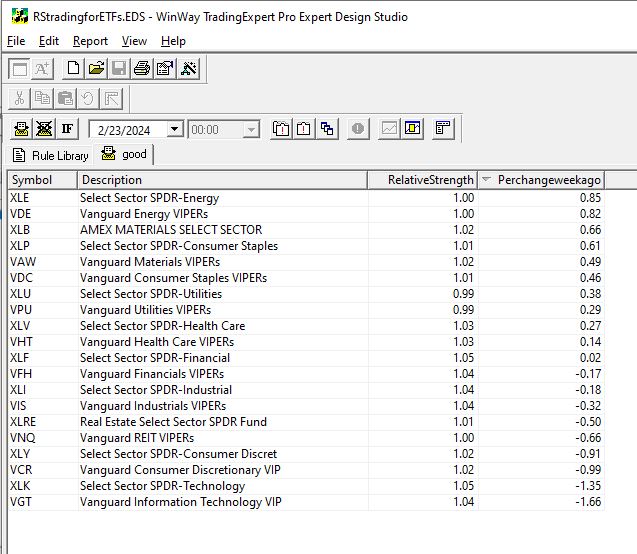

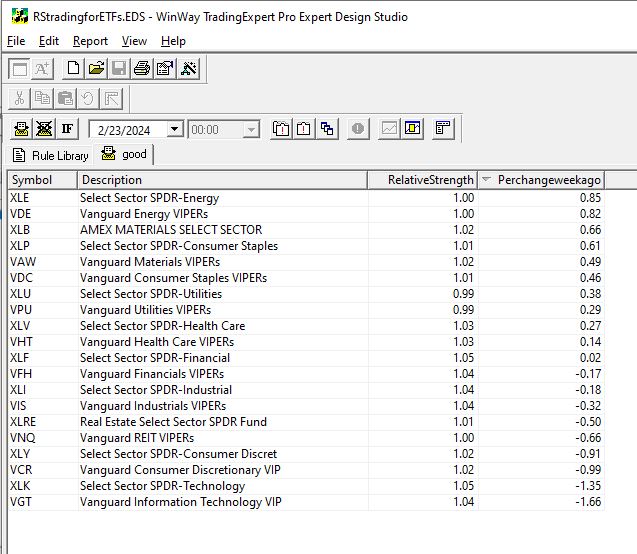

WinWayCharts pre-built Relative Strength report offers a valuable tool for those seeking to capitalize on sector rotation. By shifting the focus to ETFS and cloning the report as closely as possible in the AIQ Expert Design Studio, we gain the ability to apply additional screening criteria. This adds a layer of flexibility, that can achieve significant market outperformance. . Through WinWayCharts Expert Design Studio (EDS) program, users gain the freedom to create their personalized screening techniques.

The approach we aim for is to utilize an EDS model that seeks out high relative strength. To refresh your memory, the short-term Relative Strength report considers the last 120 trading days, divides this period into quarters, and then calculates the average percent change for each quarter with a heavier weight on the most recent quarter. Here’s the EDS code:

RelativeStrength is 0.4Period1+ 0.2Period2 + 0.2Period3 +0.2Period4.

Description is Description().

RSvalue5daysback is valresult(RelativeStrength,5).

Perchangeweekago is ((RelativeStrength – RSvalue5daysback)/RSvalue5daysback)*100.

! change is Perchangeweekago.

good if 1.

Using this code, an EDS report can be generated to rank ETF sectors from strongest to weakest. While investing in high relative strength sectors can be effective, some individuals might feel uneasy about buying when prices are already high. Often, they regret not entering the market earlier upon seeing a high RS sector.

For those preferring to enter a trend earlier, we can integrate a new screening into our EDS report. We’ve discovered that monitoring the weekly change in RS ranking is valuable for determining whether a sector is gaining or losing momentum.

Relative Strength serves as the primary screening metric, where the objective is to hold positions that appear at the top of the report. Instead of purchasing assets immediately when they top the report, some traders may opt to utilize the Change column to identify sectors with the strongest upward momentum. By selecting sectors with the highest Change numbers, you are essentially investing in sectors exhibiting robust momentum in relative strength.

Traders can easily sort sectors by the Change column by clicking on its title. The benefit of entering sectors with a high Change score is the potential for earlier trend entry. However, the drawback is the possibility of false signals—instances where a trend fails to materialize, causing the sector to stagnate in the relative strength ranking.

Investing in high relative strength sectors or sectors with improving relative strength figures presents a solid strategy for entering industry sectors. These approaches can be combined to create a more dynamic strategy. With the combination strategy, the goal is to identify sectors with both high Relative Strength readings and positive Change readings, indicating strength and ongoing improvement.

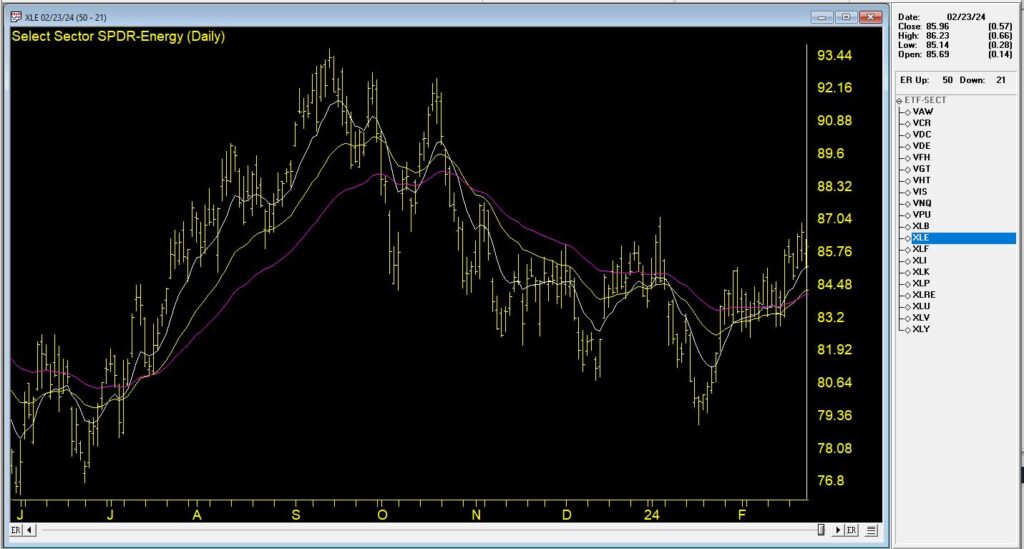

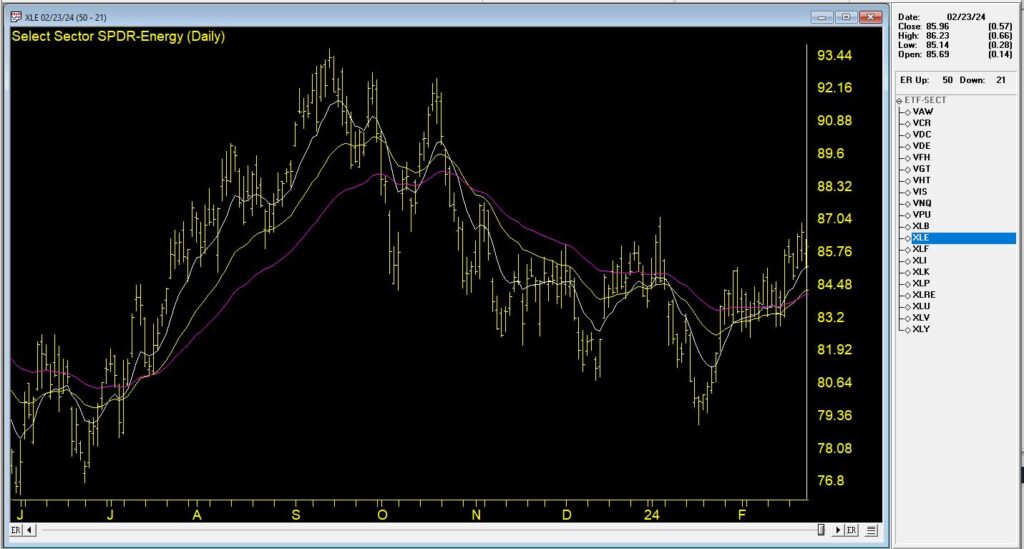

In this Chart, we see the top % change ETF from 2/23/24. The recent trend is up and it’s accelerated in the last week.

By employing the combination strategy, the focus typically narrows down to selections at or near the top of the Relative Strength column with positive Change readings. This dual approach ensures a focus on strong sectors and becoming even stronger, optimizing the potential for successful investments.

The EDS file mentioned in this article is available to download click here

Download and save this file to your /wintes32/ EDS Strategies folder.

The Sector ETF list is available to download click here

Download and save this file to your /wintes32/ folder.

Mar 14, 2024 | Charts

Mar 1, 2024 | Charts

Recording of FREE Zoom webinar

February 21, 2024,

Getting Started Right with WinWayCharts and

What Works What Doesn’t – Indicator Confirmations for Trading

Making the Most of Your WinWayCharts – An hour-long session with UK Director Ray Foreman covering the power features in your WinWayCharts platform – great for new clients and those getting started.

Walk Forward Testing a Trading Strategy – Steve Hill, Founder of WinWayCharts will use two strategies both of which have 3 indicator confirmations, and run them through the WinWay Portfolio simulator to test their effectiveness using real-life walk-forward testing.

Jan 25, 2024 | Charts

In this video I’ve covered the last 6 months of up and down Market ratings generated by the Artificial Intelligence system in our TradingExpert Pro analysis platform.

You might also be interested in:

Learn key Technical Skills Essential to Trading Success

6 Video Series – nearly 4 hours of in-depth materials

Includes Seminar Notes in PDF on all sessions except Live Trading

+ BONUS eBook Mind Over Markets

6 in-depth videos

Video 1 – Darren’s Indicators

(56 Minutes).

Case Studies Of Some Of Darren’s Favourite Indicators Focusing On How Each Can Be Used As A Part Of Your Overall Stock Selection Strategy. Stoch12 WinWay, RSi WInWay And MACD WinWay Will Be Covered.

Video 2 – Sector Rotation Overview

(18 Minutes).

The Concept Of Market Sector Rotation Is Widely Accepted. Certain Segments Of The Market Are In Favour During Bull, Bear Market Topping, And Market Bottoming Phases.

Video 3 – Leverage Sector Rotation

(52 Minutes).

We’ll Use WinWayCharts Sector Tools Both To Help Determine Market Direction And To Make Stock Trading Decisions.

Video 4 – Mind Over Markets

(33 Minutes).

In This Session, We’ll Give You The Checklist Of Must-Do’s Required To Trade Successfully And Show You How To Avoid The Pitfalls Of An Undisciplined Trader.

Video 5 – Finding Long And Short ETFs

(18 Minutes).

Using Various Tools And Scans In WinWayCharts You’ll Learn How To Find ETFs In Different Market Segments Both Long And Short. There Are ETFs For Each Sector Of The Market And For Markets Themselves. These Are Often Available On The Long And Short Side Of The Market Or Segment. Less Risky Than Stocks And Yet Still Providing Good Liquidity They Are The Darlings Of The Stock Market.

Session 6 – Live Analysis And Trading

(56 Minutes).

WinWayCharts Putting It All Together This Was a Live Analysis Session Looking For Trading Candidates, Confirming Our Selections With Darren’s Indicators, And Placing Trades And Stops In A Real Trading Account.

YES I want Unlimited Access to all 6 Videos

Bonus eBook Mind Over Markets

#marketanalysis #markettiming #dowjones #ai #wealthtraining #wininvesting

Jan 4, 2024 | Charts

Wishing you a Happy and a Prosperous New Year!

As we reflect on the incredible journey of the past 17 years, we’re excited to share a milestone with you. It all began when Darren commissioned the creation of the WinWayCharts TradingExpert Pro trading analysis suite, and since then, we’ve been dedicated to enhancing your trading journey.

We’re thrilled to announce the official release of the new WinWayCharts TradingExpert Pro End-of-day version 2.55! After an extensive testing period with our dedicated testers, we’re confident this upgrade will elevate your trading experience.

Some of you who recently joined us may already have the new version, so no need to download the upgrade again. For others, this is an opportunity to embrace the latest enhancements.

Key Features of TradingExpert Pro 2.55:

- Introducing the new Heiken Ashi charting feature

- For detailed insights and a step-by-step demonstration, check out the upgrade page on our website

And the best part? This upgrade is entirely FREE of charge!

To download and install your FREE upgrade or explore the exciting features of this new version, visit https://winwaycharts.com/wordpress/255upgrade/.

We’re committed to providing you with tools that not only enhance your client experience but also equip you for success in trading. Here’s to a year of prosperity and successful trading ahead!

Not currently subscribed, but Interested in trying out this new version?

Try us for one month visit

https://winwaycharts.com/wordpress/free-trial/winway-tradingexpert/

Warm regards,

Steve and Ray

The Support Team

WinWayCharts