WinWay TradingExpert

A history of excellence

- Trade US and UK stocks 90%

- Trade FOREX 80%

- Spread bet 60%

- Option Traders 48%

- ETF traders 71%

WinWay TradingExpert

Darren Winters started The Wealth Training Company in 2000. Since that time it has been growing rapidly and is now the market leader in the UK (and Europe) for stock market training. Darren Winters and The Wealth Training Company have successfully trained more people to invest than any other stock market training company in Britain.

It has been the No 1 choice for over 165,000 people in the UK and also attracted clients from abroad. It has maintained its number one position by providing very high quality training courses that teach easy to follow and easy to apply investment strategies. This has resulted in 1000’s of graduate success stories and testimonials, with happy clients then referring friends and family.

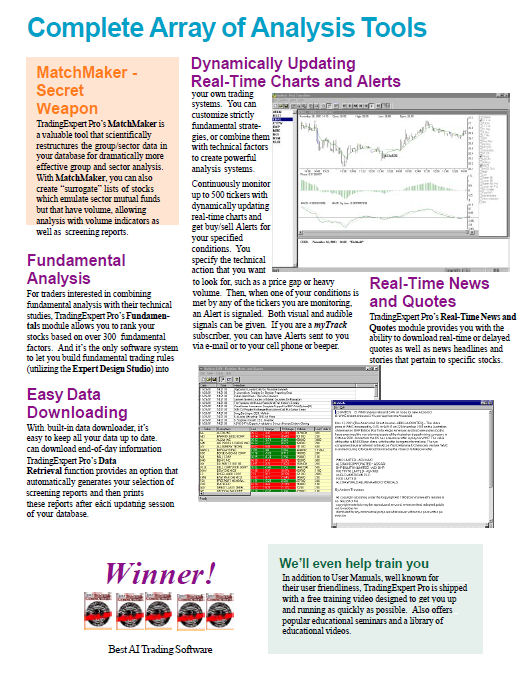

To meet the growing needs of its clients, Wealth Training has developed WinWay TradingExpert a trading support and analysis package which has become Darren’s preferred trading software; it is configured to Darren’s precise trading requirements and specifications and you will not find this software anywhere else. Only WinWay TradingExpert provides all the tools a trader could ever need, under one roof!

v

Here’s how clients use TradingExpert

Recent Blog Posts

Learn from the top thought leaders in the industry.