May 15, 2014 | bonds, ETFs, group sector rotation, trading strategies

…and down will come, well just about everything, as far as I can tell.

OK, for the record maybe it should say “If the Dow Breaks.” After all I am still firmly ensconced here at “Camp Bull.” I would like to attribute this to disciplined nerves of steel, but it would be an understatement to say that that would be an overstatement. The truth is my crystal ball broke a very long time ago (sadly I continued believing what it portended for a long time before I realized it was actually broken). So I have long since held dual citizenship in “Camp Trend Follower”.

But I have got be honest…..I am feeling the urge to run like a sissy through the woods to “Camp Yikes”.

The Overall Market

Defining the “overall” market is something of a crapshoot these days, as some of the “overall” market seems to be going one way and another part of the “overall” market seems to be going another way. In Figure 1 we see the Dow, the S&P 500, the Nasdaq 100 and the Russell 2000.

Figure 1 – The Four Major Averages with 200-day moving averages (charts courtesy AIQ TradingExpert Pro)

In a nutshell, the “Generals” are still marching but the “Troops” are in retreat. Now every market pundit seems to be offering up their opinion as to whether the “Generals” will ultimately lead the troops higher or the other way around. With my crystal ball still out of order I must unfortunately go with my stock answer here of “it beats the heck out me.” And “hey things are swell here at Camp Bull.” But I have been around this business long enough to remember several instance where the “Troops” led the way (1984, 1987, 1990, 2000, 2008) and the “Generals” followed. So we’ll see what we see.

OK, just in case that little segment was not foreboding enough, let’s get to the really “scary” part.

Sectors Suck in Summer (during Mid-term years)

One caveat before I even launch, the sample size of what I am about to detail is very small (6 calendar years each four years apart starting in 1990). Also, that’s the good news. As a “seasonalaholic” (“Hi, my name is Jay”) I am acutely aware of the following facts:

1. The market tends to perform better between the end of October and the third trading day of the following May than it does from the third trading day of May through the end of October (also known as “Where We Are Now.”)

2. This is a mid-term election year.

I also do a lot of work with sectors and sector funds as I have found that investing at the right sector at the right time is – all kidding aside – one heck of a great way to invest.

So I was curious as to which sectors tended to perform the best during the May to October period during mid-term election years. Here is the short list:

Health Care. Period.

Everything else. Well on a buy in May and sell in October basis – let’s just say it isn’t pretty. So here is the test I ran:

Tracking the growth of $1,000 invested in each Fidelity Select Sector fund only:

*Between the close of May trading day 3 and the end of September (for the record, October tends to be an OK month during mid-term election years – more on this topic in a future article) during each mid-term election year.

The results appear below in Figure 2. If you are squimish you might want to brace yourself.

|

Fund

|

%+(-)

|

|

FBIOX

|

(12.1)

|

|

FBMPX

|

(34.5)

|

|

FBSOX

|

(36.9)

|

|

FCYIX

|

(28.8)

|

|

FDCPX

|

(42.4)

|

|

FDFAX

|

(3.7)

|

|

FDLSX

|

(45.9)

|

|

FIDSX

|

(55.9)

|

|

FNARX

|

(35.4)

|

|

FPHAX

|

(18.6)

|

|

FSAGX

|

(1.6)

|

|

FSAIX

|

(65.7)

|

|

FSAVX

|

(71.4)

|

|

FSCGX

|

(58.9)

|

|

FSCHX

|

(49.7)

|

|

FSCPX

|

(31.2)

|

|

FSCSX

|

(35.9)

|

|

FSDAX

|

(62.7)

|

|

FSDCX

|

(38.2)

|

|

FSDPX

|

(57.5)

|

|

FSELX

|

(71.0)

|

|

FSENX

|

(42.9)

|

|

FSESX

|

(65.3)

|

|

FSHCX

|

(20.1)

|

|

FSHOX

|

(79.1)

|

|

FSLBX

|

(59.1)

|

|

FSLEX

|

(49.6)

|

|

FSMEX

|

(12.0)

|

|

FSNGX

|

(47.5)

|

|

FSPCX

|

(27.2)

|

|

FSPHX

|

41.6

|

|

FSPTX

|

(42.0)

|

|

FSRBX

|

(59.5)

|

|

FRESX

|

(26.4)

|

|

FSRFX

|

(61.2)

|

|

FSRPX

|

(43.8)

|

|

FSTCX

|

(35.4)

|

|

FSUTX

|

(12.1)

|

|

FSVLX

|

(59.1)

|

|

FWRLX

|

(32.8)

|

|

FNARX

|

(35.4)

|

Figure 2 – Net %+(-) invested only between 3rd trading day of May and last trading day of September during mid-term election years (1990 , 1994, 1998, 2002, 2006, 2010, 2014)

Anyone notice a trend? To see just how bad things can be, once you are able to work yourself back up out of the fetus position, take a glance at Figure 3, which shows the three worst performers during the May-Sep mid-term year period – FSAIX (-71%), FSELX (-71%) and FSHOX (-79%).

Figure 3 – FSAIX, FSELX, FSHOX – growth of $1,000 May through Sep of mid-term election years (1988-present)

Now I have an obvious flare for the obvious (which I think should be pretty obvious – also I tend to repeat myself) but I am not even going to comment on Figures 2 and 3.

The Good News

The one mistake you should not make based on looking at these numbers and charts is to assume that it is not possible to make money in sector funds between May and September of mid-term years. It just requires something better than a buy and hold approach. Several momentum systems and seasonal plays that I have developed over the years have still managed to show some pretty good gains historically “among the ruins” of midterm election summer months.

But if you’re gonna play, you’d better bring your “A” game.

Summary

Repeating now – I am still in “Camp Bullish.” And ideally I’d like to spend the summer. There seems to be a lot of fear and loathing among the “crowd” that I follow regarding the stock market. Typically that’s a good thing and suggests that the stock market just might surprise everyone this time around. And I hope that it does.

But I will be keeping a pretty close eye on my “camp mates” in the days and week ahead. Any sign of “trouble” (i.e., Dow, S&P breaking below 200-day moving averages) and they are going to have to send a search party out to find me……

Jay Kaeppel

Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

May 3, 2014 | chart patterns, Risk management, Seasonality, trading strategies

I have to admit I am a little surprised. It is the last day of April and so far I have only seen a couple hundred thousand “Sell in May and Go Away” related articles, as opposed to the usual several hundred bazillion such articles that usually make their appearance about his time each year. Still, what with May due to pop up at midnight tonight it seems like as good a time as any to chime in.

What You Probably Already Know

Historically the stock market has performed much better between the end of October and the third trading day of May that it has between the third trading day of May and the end of October. To wit, sees Figure 1 and 2.

.

Figure 1 – $1,000 in the Dow from October 31st through 3rd trading day of May (1960-present)

Figure 2 – $1,000 in the Dow from 3rd trading day of May to October 31st (1960-present)

Starting on 10/31/60:

* $1,000 invested in the Dow Industrials each year at the close of trading on the last trading day of October and held through the close of the third trading day of May grew to $47,280.

* $1,000 invested in the Dow Industrials each year at the close of trading on the third trading day of May and held through the close of the last trading day of October decreased to $599.

So to put it in blunt terms:

October to May = +4,628%

May to October = (-40%)

So clearly there is something to the “Sell in May” thing. There is a caveat, however. As you can see from a perusal of Figure 2 it is not as though the stock market declines each and every year during the May to October period. So during many years selling in May and getting back in at the end of October would cause your returns to trail that of the overall market (and we can’t have that now can we?).

So that explains why roughly half of the bazillion annual “Sell in May” related articles warn against blindly selling in May.

What You Probably Don’t Know

Like they always say, sometimes it’s not what you know but who you know that counts. Or in this case, not even someone I have personally met but do associate with. Rob Hanna is the head of Hannah Capital Management (www.QuantifiableEdges.com) and is a colleague of mine in AAPTA (American Association of Professional Technical Analysts). Rob revealed in some of his work the following “guide” for determining whether to “sell in May” or not:

-If the S&P 500 experiences a drawdown of 5% or more between December 31st and April 30th, then sell in May.

-If the S&P 500 DOES NOT experience a drawdown of 5% or more between December 31st and April 30th, then DO NOT sell in May.

Doesn’t get much simpler than that. Since 1960 there have been 14 years during which the S&P 500 did not experience a 5% drawdown and an investor would have simply remained in the market. The results appear in Figures 3 and 4.

Figure 3 – $1,000 in the Dow during bullish periods applying Hanna Sell in May Filter (1960-present)

Figure 4 – $1,000 in the Dow during bearish periods applying Hanna Sell in May Filter (1960-present)

In cold hard numbers:

* $1,000 invested in the Dow Industrials each year durung the “bullish” periods described grew to $70,244.

* $1,000 invested in the Dow Industrials each year duirng the “beairsh” periods describeed decreased to $403.

So to put it in blunt terms, applying Rob Hanna’s Sell in May Filter:

*October to May (plus May to October when no Sell in May IS NOT triggered) = +6,924%

*May to October (only during years when Sell in May IS triggered) = (-59.7%)

Here’s The Bad News

As you can see in Figure 5, the S&P 500 experienced a drawdown of -5.76% between the end of December and the end of April. And -5.76% is greater than -5% (OK, mathematically speaking -5.76 is technically LESS than 5%, but you get my drift – there was a drawdown in excess of 5%).

Figure 5 – S&P 500 for 2014

So by that rule, the Sell in May model that I prefer says to sell at the close on the third trading day of May and to buy back in at the end of October (although for the record, buying at the end of September is typically better in a mid-term election year, but that’s a topic for another article).

Summary

So because the S&P 500 experienced a -5.76% drawdown is the stock market absolutely, positively doomed to decline between May and the end of October? Of course not. But the historical odds seem to suggest that caution may be in order.

Jay Kaeppel Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Apr 21, 2014 | chart patterns, indicators, Moving averages, trading strategies

OK, first off you have to admit that we are getting a little bit soft, don’t you think? I mean, after marching relentlessly higher to the tune of 34% since the November 2012 low, the Dow pulls back about 4.3%. And from all of the racket you would think that the end of the freaking world is apparently just around the corner. We used to be made of sterner stuff. Or so it seemed.

So there is a part of me that wants to shout “Buck up, people”. As a TFF (“Trend Followin’ Fool”) from way back, I would like to think that given the fact that the major stock market averages are above their respective long-term moving averages, we should stop all of the hand wringing and simply acknowledge that (at least for now) the major trend of the stock market is still bullish.

And when I say “I would like to”, I mean I really would “like to”. But the truth is there are a lot of good reasons to be keeping a close eye on the exits. To wit:

Indexes vs. Moving Averages

There is nothing magical about the relationship between the price of an asset/stock/index and its 200-day moving average. That being said, I sure do rely on it a lot – maybe because the interpretation is pretty darn simple:

Price > 200-day moving average = GOOD

Price < 200-day moving average = BAD

In Figure 1 we see four major stock market indexes (the Dow, the Nasdaq 100, the S&P 500 and the Russell 2000 clockwise from upper left).

Figure 1 – Major stock indexes versus their 200-day moving averages (Courtesy: AIQ TradingExpert)

The thing to note is that with the exception of the Russell 2000 – which is only slightly above it’s MA – they are still well above their respective 200-day moving averages. Now granted this could change quickly if prices keep heading south. But the point is that for now, an objective trend-follower still has to designate the major trend as “up.”

Alright, I hope you enjoyed the “Good News”

Is Elliott Wave Waving “Goodbye” (to the Bull)?

Figure 2 displays the Elliott Wave count for the Dow and the Nasdaq 100 as calculated mechanically by ProfitSource by HUBB.

Figure 2 – Dow and Nasdaq completing Elliott Wave 5? (Source: ProfitSource by HUBB)

OK, a few things. For the uninitiated, the Elliott Wave Theory is based on work by – who else, a guy named Elliott – that suggests that price moves up in 5 waves – 3 waves up, 2 waves down – and then declines in 5 waves – 3 waves down and 2 waves up. Now the truth is that a lot of Elliott Wave counts don’t pan out. But I known a lot of people who’s market opinion I respect who follow “the Wave”.

As you can see in Figure 2 both the Dow and the Nasdaq 100 appear to have formed or are in the process of forming a completed 5-wave “up” pattern. The implication going forward is for lower prices ahead.

Sell In May – with MACD Filter (SMMF)

The “Sell in May” pattern was first reported by Yale Hirsch and since then The Hirsch Organization’s Stock Trader’s Almanac has kept track of an updated – and improved version – that uses the MACD indicator to determine the exact entry and exit dates.

By my calculations, this SMMF method issued an early “sell” signal on 4/7/14 as shown in Figure 3. This sell signal remains in effect until at least the end of September (which is significant, as we will see shortly).

Figure 3 – Early “Sell in May” signal on 4/7/14 as MACD Oscillator turns negative (Courtesy: AIQ TradingExpert)

Why does this SMMF signal matter? In Figures 4 and 5 you can see the growth of $1,000 during bullish and bearish periods as signaled by the “Sell in May with MACD Filter” Method since 12/31/1949.

Figure 4 – Growth of $1,000 invested in Dow Industrial when SMMF Method is bullish

Figure 5 – Growth of $1,000 invested in Dow Industrial when SMMF Method is bearish

Notice any difference? For the record – and excluding any interest earned while of the market:

Bullish Phase gain = +24,753%

Bearish Phase loss = (-68%)

This method is now deemed”bearish.” ‘Nuff said.

Mid-Term Election Time of Year

Let me sum up the historical trend for mid-term election years as succinctly as possible by stating:

“Everything until September 30th is a crapshoot, but ignore any bad news after that.”

This summary is nicely illustrated in Figure 6.

*The blue line in Figure 6 displays the growth of $1,000 invested in the Dow between December 31st of the post-election year and September 30th of the mid-term election year.

* The red line in Figure 6 displays the growth of $1,000 invested in the Dow between September 30th of the mid-term year and December 31st of the mid-term year.

Figure 6 – Stock market shows bullish trend September 30 of mid-term election year through December 31st (Red line)

Again, the interpretation is fairly simple:

Jan 1 to Sep 30 – “Whatever”

Oct 1 to Dec 31 – “Bullish (usually)”

Summary

As a dutiful trend follower – and with the major indexes still holding above their long-term moving averages – I am still wearing the “brave face” and hoping that the stock market will continue to move higher. But if weakness persists or accelerates, it would appear that investors might be wise to take some defensive action (hedge, raise cash, go short) and to check back around September 30th of this year.

Sounds like a good time to invoke one of the most useful old adages:

“Hope for the best, prepare for the worst”

Jay Kaeppel Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Apr 14, 2014 | Uncategorized

If there is one thing I have learned about trading over the years it is that there sure are a lot of ways to play. I mean there are literally thousands of stocks, bonds, funds, ETFs, options, FOREX, and so and so forth to choose from. From there a trader can analyze roughly a bazillion (give or take) different indicators, oscillators, trend following methods, fundamental factors, etc., etc.

No wonder people get confused and no wonder there is a tendency for a trader to “try” one method for “a while” and as soon as that one isn’t faring as well as something else they’ve heard about, well, that trader to move on to another method (you know who you are).

And then of course there are the pundits, you know wise guys like me who like to imply that they know everything there is to know about trading. And so traders sometimes feel compelled to listen to someone else if they assume that that person knows more about trading than them. The paradox here is that is that – as with any endeavor – it does make sense to listen people with more knowledge than you on given topic in order to learn things. But trading is a little trickier. So this seems like a good time to invoke:

Jay’s Trading Maxim #215: Whenever you hear someone say “In order to be successful in the markets you must……”, what they really should be saying is “In order for me to be successful in the market I must…..what you must do may be something completely different.”

In other words you need to take in a lot of information and then go through the painstaking process of stripping away about 90% of what you’ve been told and boil it down to just that which allows you to be successful. And whatever anyone else does is not relevant.

Buy the way it is not an easy process.

One other suggestion:

Jay’s Trading Maxim #218: Once you settle on a trading plan/method, DO NOT TINKER with it day in and day out. Revisit your trading plan/method a few times a year and see if you’ve learned anything that can add value. Otherwise “Trade, don’t Tinker.”

A Simple Signal

So all of that being said, I still can’t fight the urge to be a wise guy and offer up a simple “buy signal” using the Commodity Channel Index (or CCI). Now please not that there is no inference made that this is the “be all, end all” of trading. In fact, it really is only useful (I have found) for very short-term trading and for traders who are diligent about cutting losses. In other words if you have a recent history of buying something and then when it came time to cut a loss you said “Well, I’ll just give it a little while longer to see what happens”, then beware.

So any way here goes. If:

– SPY > 200-day moving average

– CCI drops to -90 or below and then turns up for one day

– then the next time SPY takes out the previous day’s high enter a long position

BUT WAIT! Before you even think about trying to use this idea note that you will need to develop some profit-taking and stop-loss criteria. One place to start would be to exit on the first profitable close. In other words, yes it can be that short-term in nature. If that is not your “cup of tea” you need to either, a) figure out a different way to use the idea, or b) ruthlessly discard it along with the 90% of ideas that you encounter that do you absolutely no good.

Again, there is no inference made that every new signal equates to “Happy Days are Here Again!” What I have described simply signals that maybe, just maybe the market will follow through at least a little bit to the upside. Do not read more into it than that.

In Figures 1 and 2 below, the green bars highlight days when CCI trend up from -90 or below while SPY was above its 200-day moving average. The red arrows highlight the next time SPY took out the previous day’s high. The key thing to note is that sometimes there is follow through and sometimes there is not.

It is how you deal with the “sometimes there is not” occasions that matters the most.

Figure 1 – SPY 2013-2014 (Courtesty: AIQ TradingExpert)

Figure 2 – SPY 2012 (Courtesty: AIQ TradingExpert)

Jay Kaeppel Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Mar 26, 2014 | Uncategorized

The AIQ code based on Perry Kaufman’s article in March 2014 Stocks & Commodities, “Timing The Market With Pairs Logic,” is provided at www.TradersEdgeSystems.com/traderstips.htm.

The code I am providing will backtest only the long trading and will not test the hedging portion of the system. For live trading, I provided a manual input for the total value of the open positions, which would have to be computed separately and then entered daily as an input before the daily report is run once the hedge rule becomes true.

!TIMING THE MARKET WITH PAIRS

!Author: Perry Kaufman, TASC March 2014

!Coded by: Richard Denning 1/7/2014

!www.TradersEdgeSystems.com

!INPUTS:

stoLen is 60.

idx is "NDX".

hedgeETF is "PSQ".

eLvl is 10.

xLvl is 50.

sLoss is 0.10.

hedgeLen is 60.

hedgeRatio is 0.50.

minP is 3.

invest is 5000.

totValOpenPos is 100000. !open position value must be set manually

H is [high].

L is [low].

C is [close].

O is [open].

idxH is tickerUDF(idx,H).

idxL is tickerUDF(idx,L).

idxC is tickerUDF(idx,C).

idxO is tickerUDF(idx,O).

hedgeC is tickerUDF(hedgeETF,C).

PEP is {position entry price}.

!STRESS CODE:

rngStk is highresult(H,stoLen) - lowresult(L,stoLen).

rngIdx is highresult(idxH,stoLen) - lowresult(idxL,stoLen).

stoStk is (C - lowresult(L,stoLen)) / rngStk.

stoIdx is (idxC - lowresult(idxL,stoLen)) / rngIdx.

stoDiff is stoStk - StoIdx.

rngDiff is highresult(stoDiff,stoLen) - lowresult(stoDiff,stoLen).

stressVal is ((stoDiff - lowresult(stoDiff,stoLen)) / rngDiff) * 100.

!PAIRS SYSTEM CODE:

Buy if C > minP and countof(C > minP,4,1)=4 and stressVal <= eLvl and symbol()<>hedgeETF.

StressExit if stressVal >= xLvl.

ExitBuy if countof(C > minP,5)<>5 or C/PEP-1 < -sLoss or StressExit.

!TREND CODE:

idxTrnd is simpleavg(idxC,hedgeLen).

Hedge if idxTrnd < valresult(idxTrnd,1) and symbol()=hedgeETF .

!SIZING CODE:

chgStk is C/valresult(C,1) - 1.

chgIdx is idxC/valresult(idxC,1) - 1.

idxSMA is simpleavg(idxC,hedgeLen).

size is floor(invest / C).

hedgeSize is floor(totValOpenPos / hedgeC*hedgeRatio) .

ShowAllValues if countof(C > minP,5)=5.

To get a correlated list of stocks that show good correlation to the index of choice (I used the NDX), AIQ has a matchmaker module that will quickly generate a list of stocks that show significant correlation to an index. In Figure 7, I show the matchmaker setup I used to quickly get a list of stocks in the NASDAQ 100 that were highly correlated to the NDX. In Figure 8, I show the results (part of which are hidden). After highlighting the ones desired for a list, simply click on the “data manager” button and a list is created, which is then used to run the tests.

FIGURE 7: AIQ, MATCHMAKER SETUP. Here is the setup used to get a list of stocks in the NASDAQ 100 that are highly correlated to the NDX.

FIGURE 8: AIQ, RESULTING LIST. Here are sample results of running the setup shown in Figure 7.

Mar 22, 2014 | Uncategorized

As I write the stock market is headed higher. As a trend-follower by nature (sorry it’s just my nature) I try to avoid sitting around and stewing in “The End is Near” type of thinking. For the record there is a lesson in that. Stop for a moment and think about all of the predictions of “the top” you have heard or read in roughly the last 17 months or so as the market has moved relentlessly higher (Thank you Fed – for now).

Those predictions all fall into one of three categories – Wrong, wrong or wrong.

Still, the phrase that “all good things got to come to an end” remains essentially a universal truth. My hope is that the major averages (and the majority of stocks) will break through to the upside and take out their recent highs and continue to power higher. But if this rally fails…………it might make sense to be prepared. Please note that I am not intending to imply that if the market fails to make new highs that Armageddon will ensue. But the market does appear to be losing some momentum (more on this topic in a moment). And once the “worm turns”, well, corrections tend to happen pretty quickly and at times pretty ferociously.

So my best advice at the moment is “enjoy the ride, but please take a moment to locate the nearest exit.”

Is The Market Losing Momentum?

Figure 1 displays the S&P 500 daily bar chart at the top with the 3-day RSI and the MACD (18/37/9) indicator at the bottom.

Figure 1 – RSI and MACD creating bearish divergence from SPX (Courtesy: AIQ TradingExpert)

Note that during the second half of 2013 as the S&P 500 moved higher both of the indicators confirmed the move. Since the first of this year both indicators have been forming a bearish divergence – i.e., price moves to a new high while the indicators do not. Now once again it should be noted that simple divergences happen from time to time and do not imply the end of the world as we know it. But they do flash a warning sign that alert traders should pay attention.

So there are two scenarios to watch for:

1) The S&P 500 index and other major average move to new highs and the indicators “stop diverging” and once again “start confirming” (This is “Good”).

2) The S&P 500 and other major average fail to make a new high or briefly reach new high ground and then reverse, while the indicators continue to signal weakness (This is “Bad”).

My advice is to pay close attention in the days and week ahead.

One Way to Play

This idea is merely “food for thought” and a little too soon to act upon in my opinion (i.e., the time to consider acting is if and when the market fails to follow through to a new high and the indicators remain weak). But if you want to consider a “cheap hedge” here is an example that uses the “Garbage Trade” I’ve written about (that I learned from Gustavo Guzman) of late.

The example trade displayed in Figure 2 involves:

Buying 1 June SPY 178 put option

Selling 2 June SPY 169 put options

Buying 1 June SPY 160 put options

At present prices this trade costs $67 to enter. If SPY got back down to about 181 this trade would generate an open profit in the range of 100%. If things actually did “fall apart” (again, not “predicting” just “preparing”) this trade would generate a profit of several hundred percent.

Again, not really a trade to make right now, but rather an idea to keep in the back of your mind, you know, just in case…..

Jay Kaeppel Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Mar 12, 2014 | Uncategorized

So you see what I was talking about, right? Under the category of “I hate it when I’m right”, last week I wrote “when I write an article about a trend that has been playing out time and time again over a several year period – that can pretty much be counted on to put an end to that trend”, referring to the fact that ticker VXX has been in a prolonged downtrend for a number of years.

Within minutes (or so it seems) the Russian Army is on the move. Coincidence? OK, probably so, but geez, maybe I should try picking tops and bottoms…

Anyway, in light of the newfound fear and loathing that popped back up over the weekend, it is time to review a useful strategy for traders concerned about the downside in the near term.

The Garbage Trade

Several years ago I learned a simple hedging strategy from Gustavo Guzman, a former colleague of mine. He dubbed it the “Garbage Trade”. But don’t be fooled by the name, for it is anything but.

Essentially a hedging strategy, the basic idea of this simple option strategy is to risk a little bit of capital on something that most people don’t think is going to happen. If it doesn’t happen, OK, you lose a little. But if it does happen, you make a whole lot.

One word of warning: for the “average” investor – one whose basic approach to investing is one of “buy a stock or mutual fund or ETF and hope it goes up” – this type of trading is quite a foreign concept. Of course, given the world we live in today, considering alternative ideas to investing and trading might be a good thing.

The Starting Point

The basic idea Guzman taught was that after a market (especially the stock market) had experienced a good run up, a pullback of some sort was invariably due. So his suggestion was after a run up, buy a put option roughly 5% out of the money. Then go down the strike prices until you find a put option that you can sell two of which will pay for the first put option you bought (example to follow). Then if you had gone down say three strike prices from the option you bought to the option you sold, then go down three more strike prices and buy one put at that price.

Right now all of the “non option junkies” have their fingers poised over the arrow to go back to the Main Web Page. But wait!! Please at least consider the example below.

Figure 1 – Ticker IWM tracking the Russell 2000 Index (Courtesy: AIQ TradingExpert)

In Figure 1 we see a bar chart for ticker IWM, an ETF that tracks the Russell 2000. Now let’s assume that a trader is concerned about the potential for a pullback – let’s say based on current geopolitical goings on – but not necessarily outright bearish. In other words, he doesn’t want to “Sell Everything!”, but would like some protection if things go south for a while.

In Figure 1 we can see that if IWM starts to decline there are several natural “price targets” where a trader might consider taking a profit. But I am getting ahead of myself.

Using Guzman’s outline for the Garbage Trade, one possibility is as follows:

-IWM shares are trading on 3/4/2014 at 120.32.

-If we multiply this by 0.95 we get 114.30

-We can choose either the 114 or the 115 strike price put. Due to higher volume I will select the May 115 put.

-In order to take in enough premium to pay for the 1115 put we would sell 2 May 109 puts for 1.13 each (or $113 x 2 = $226 premium taken in)

-We then go own six more point and buy one May 103 put for 0.60, or $61.

All told, it costs all of $55 to buy a 1 by 2 by 1 position. The risk curves for a 10-lot position costing $550 appears in Figures 2 and 3.

So basically, one of a couple things will happen. In a nutshell, either IWM will suffer a pullback and this position will offer the potential to make a fairly high return on capital, or the trader stands to lose a maximum of $560.

A couple of things to note:

*If IWM moves to new highs the trader can either:

a. Exit the trade and cut his loss

b. Continue to hold the position – at least for a while – just in case something bad happens later rather than sooner

*If IWM does start to decline then the trader should have a profit target in mind and should pay attention to the price level at which the risk curve for the latest date will “peak” and start to “roll back down.” Figure 1 displays several potentially useful “price target levels” where a trader might consider taking a full or partial profit.

Summary

As always, this example is not presented as a “recommendation”. It is simply an example of one way to get a little exposure to the downside if you start to feel some “concern.”

The vast majority of traders who look to options focus on buying calls and puts in hopes of maximizing a specific market timing method, and/or selling covered calls against stocks they hold. Nothing wrong with these ideas, but the real power of options is that they afford you the opportunity to “attempt” things you normally could not or would not do using stocks, ETFs or futures.

The Garbage Trade is an example of one way to use options to risk small amounts of capital with the potential for significant percentage gains.

As always this example is not a “recommendation”, only an example. Note that it would seem like an illogical time to put on a trade like this. The stock market has bounced back from the Russia/Ukraine crisis in one day and the current trend clearly remains to the upside.

For the record: At exactly the point when the Garbage Trade seems like a waste of money….is exactly the time to consider putting it on.

Jay Kaeppel Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Feb 28, 2014 | Uncategorized

Sometimes you can just tell when something is going to turn around? Like for instance, when I write an article about a trend that has been playing out time and time again over a several year period – that can pretty much be counted on to put an end to that trend (sorry for the paranoia, but as far as the markets go, it’s a “learned response”).

So with that word of warning in place, here goes.

The ETF ticker VXX is intended to track the widely followed VIX Index. And it does in a sense, expect that really it doesn’t. To better understand that seeming bit of gibberish simply glance at Figure 1. In the top clip you see the actual VIX Index. In the bottom clip you see the price action for ticker VXX.

Figure 1 – VIX Index versus the ETF Ticker VXX (Courtesy: AIQ TradingExpert)

Notice any difference? While VIX has been trending sideways for some time now, VXX has been in a steady decline for several years – with a series of upward “spikes” along the way. Now the reason for this is something known as “Contango” and has to do with the fact that ticker VXX holds futures contracts and the prices for the further out months is generally always higher than the nearer months, blah, blah, blah. Forgive my laziness, but for those with intellectual curiosity regarding contango may I suggest the following link:

www.google.com Then type in the word contango.

And don’t even get me started on “backwardation.”

As with any persistent trend that I might find in the markets, as a proud graduate of “The School of Whatever Works”, my interest – an all candor – is not so much in asking “Why”, but rather, “How Often” and “How Consistently.” So how does one take advantage of the downward bias built into VXX? Well, there are lot’s possibilities, but let’s look at one specific approach.

Whacking The VXX Mole

Basically the “theory” is that over the long run the downward bias in VXX will persist (with inevitable periods of strength. So the idea is simply that every time VXX “pops it’s head up”, we whack it and play the downside. The best way to do this – in my opinion – is with put options on VXX. The alternative is to sell short shares of VXX, but that involves unlimited risk, and potentially a lot of it – if something unexpectedly bad happens that affects the stock market, VXX is capable of shooting a great deal higher in a short period of time. Buying a put option on VXX at least insures limited risk.

One Way to Identify “Clobberin’ Time”

Just to make things needlessly complicated I am going to use something called “RSIAll”. RSIAll is simply the simple average of the 2-day RSI, the 3-day RSI and the 4-day RSI for ticker VXX. This indicator appears in the bottom clip in Figure 2.

So the play is simply this:

-When RSIAll rises to 80 or above (or some other value of your choosing)

-Look to sell short (i.e., buy put options on) VXX when it takes out the low of the previous two reading days.

Figure 2 displays several examples.

Figure 2 – Ticker VXX with several “Whack a VXX” opportunities highlighted (Courtesy: AIQ TradingExpert)

The other “key” is deciding when to get out. I am not going to address specifics in this article but there are many possibilities:

*First profitable close

*x-day RSI drops below y

*Some other indicator reaches oversold levels

*Etc.

Which Option to Buy

As far as which specific put option to buy, I am going to go with the “there is not necessarily one best option to trade” answer. Different traders have different levels of aggressiveness and risk tolerance when it comes to choosing trades. In general the shorter-term the option the greater the potential if you are exactly correct in your timing, but the more quickly you can lose money if the VXX goes sideways to higher for a while. So as a rule of thumb I would say it is better to consider options with a minimum of 30 days left until expiration. Beyond that, the basic choices are:

1) The lowest “Percent to Double”: This calculation measures how far the underlying must move in order for the option to double in price. This typically involves buying out-of-the-money options and is considered more of a “high risk, high reward” choice compared to the other choices that follow.

2) The highest “Gamma”: For people who don’t know the option “Greeks”, it can be boiled down pretty simply. “Delta” tells you how much the option should move if the underlying moves $1 in price. So a “Delta” of 50 means that if the underlying security moves $1 in price the option will move (roughly) fifty cents.

“Gamma” tell you how much the “Delta” will change if the underlying moves $1 in price. In more general terms “Gamma” can guide you to options with the most immediate “bang for the buck.”

3) Deep-in-the-money puts: This choice offers the least leverage but also limits the negative effect of time decay (because there simply isn’t much time premium built into the option price) and can start making money point-for-point with the underlying fairly quickly.

Summary

Now that I have planted the idea that playing the short side of VXX is a good idea I would not be surprised to see some unforeseen event cause volatility to trend sharply higher in the not too distant future. But remember, the purpose of this article is not to compel you to “take the next trade”, but to identify and consider opportunities that may occur on a fairly consistent basis into the future.

Jay Kaeppel Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Feb 20, 2014 | Uncategorized

Thursday night, I talked about the Baby Boomers and the impact they were having on government spending and the economy. Federal entitlement programs represent a large portion of the U.S Federal budget, and when you combine these programs with the interest on the debt, there isn’t much left over to run the country. As a matter of fact, there isn’t anything left over, and that’s why we need to borrow money every month just to keep the government running (and pay for things like Social Security, Medicare and Medicaid).

So during the Class, I polled the 61 students and asked them to raise their hand if they wanted to reduce Social Security. Nobody raised their hand.

Then I asked if anyone was in favor of reducing Medicare. Same thing, nobody raised a hand.

Finally, after talking about the enormous debt that we were creating with all these programs and the problems they were creating for the economy, I asked if anyone was in favor of reducing Medicare. Again, nobody raised their hand. Not one person in the Class was in favor of reducing or stopping any of these entitlement programs.

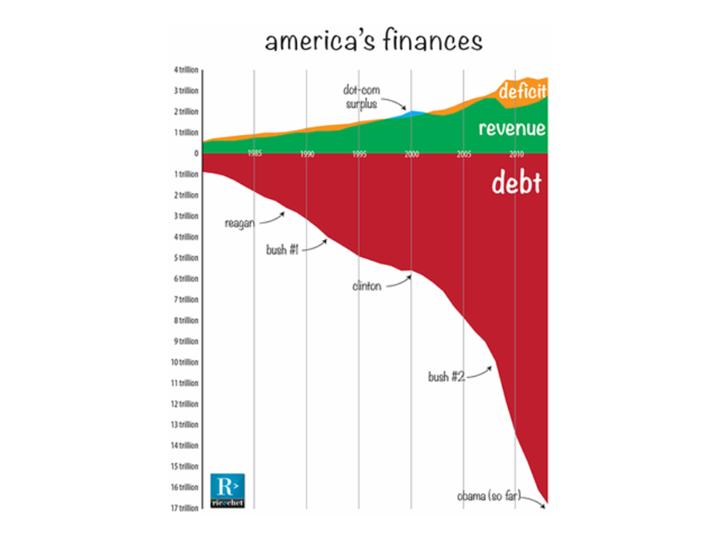

After the discussion, I showed them a chart (attached) of the current debt and how it has continued to grow over the years. I pointed out how the debt has grown independent of who was president. It grew because the majority of people in America want their entitlements.

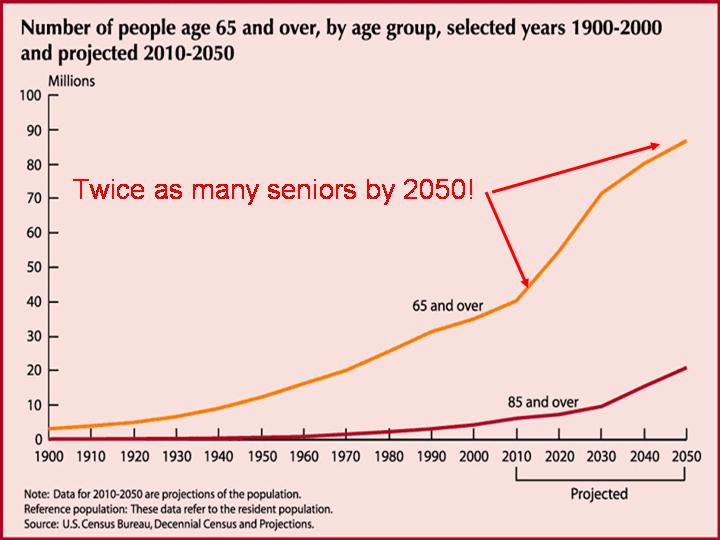

I then showed my students another chart (also attached) that depicts how the number of seniors will continue to grow in the next 25 years, adding to the debt.

After discussing the problems this enormous debt was creating for the economy and the job market, we talked about how the debt could be reduced or paid off.

I asked if anyone was in favor of increasing taxes. Not one hand went up. I asked if anyone would vote for a politician who wanted to raise taxes. Again, not one hand was raised. Hmmm?

So it appears that everybody wants to keep receiving the benefits, but really doesn’t want to pay for them.

Because of this, huge Federal deficits and increasing debt will likely continue in the future. So you need to ask yourself about interest rates. Will they be going up or down? You really don’t need Janet Yellen to tell you this. All you need to do is think about the interest payments on the current debt. They MUST stay low, not for the next few months, or years, but for the foreseeable future…and beyond. If interest rates start to rise, and people want to keep their entitlements, the government will have to borrow even more money, requiring even more interest to be paid to foreigners. The debt is so big now; it will likely NEVER be paid off.

So now you can understand why the Fed MUST do everything in its power to keep interest rates low. It’s not a question of stimulating the economy anymore; it’s a matter of survival!

OK, so how do we deal with this? Well, IF we know that interest rates will likely stay low in the future, we should focus on investments that should do well in a low interest environment.

Several come to mind, like utilities and the banks.

Utilities borrow a lot of money to keep their plants running and expand their facilities to meet the needs of a growing population. They are extremely interest rate sensitive.

I haven’t talked about the utes much on these pages, mainly because almost all of the Fed’s stimulus money was going into other sectors driving the Dow Industrials and NASDAQ technology stocks higher. But this could start to change in the months ahead.

As the Dow moves beyond 16,000, investors, especially seniors, are becoming more risk adverse. Most are only in the market now because they are being forced into it by the government’s low interest rate policy. They can’t live on the interest they receive from CDs or Money Market funds.

But now that the overall market is starting to look overbought and the utilities are near their lows, they are becoming more and more attractive.

Near the end of last year, I started to talk about Consolidated Edison, ED, my favorite Christmas stock. The ‘trade’ didn’t work out this year as ED turned negative after a small pop in mid-November. The stock was in a downtrend when we first looked at it, and wasn’t ready to move higher.

But now, a clear TLB pattern has formed and the PT indicators have turned Green once again. I’m ready to give it another shot. So I will be buying a few shares of ED on Tuesday as a ‘trade’. These shares will go into my IRA account. Remember, ED is still in a down trend, so I can’t fall in love with it. But IF the PT indicators stay Green and it ‘Jumps the Ropes’, I’ll start to add additional shares.

Finding stocks to take advantage of the low interest environment will be the focus of my Big Picture Strategy for 2014. And contrary to popular belief, not all stocks will be able to do this. I’ll discuss why in the days ahead, but it mostly has to do with jobs and the economy.

Fed day pay day

Talking about the Fed. I’m teaching a very special hour long seminar on March 13. 2014 and I’d like to see you there. During this seminar you’ll learn how to cash in on fed day and get two BONUS insights included. It’s perfect for exploiting the fed day.

Feb 11, 2014 | Alerts, Charts, Quotes and Barometer, Support

The US end of day ticker symbols work with streaming data except for NASDAQ stocks which need the suffix -QB input after the symbol in QUOTES and ALERTS. A list of NASDAQ stocks can be found at http://www.nasdaq.com/screening/companies-by-industry.aspx?exchange=NASDAQ®ion=North+America