Jun 14, 2016 | Uncategorized

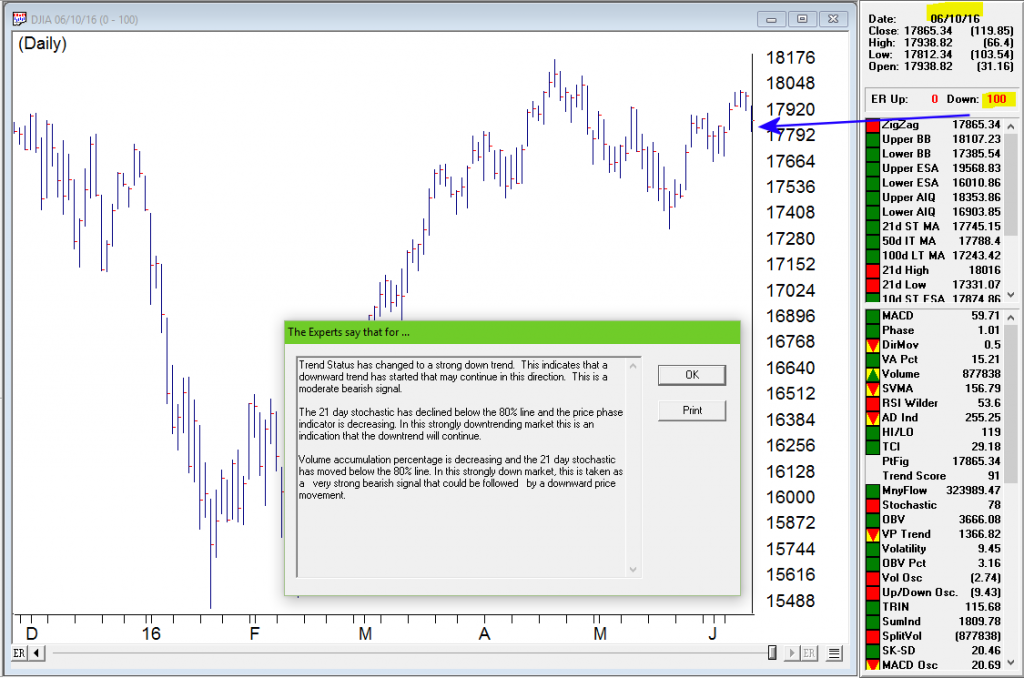

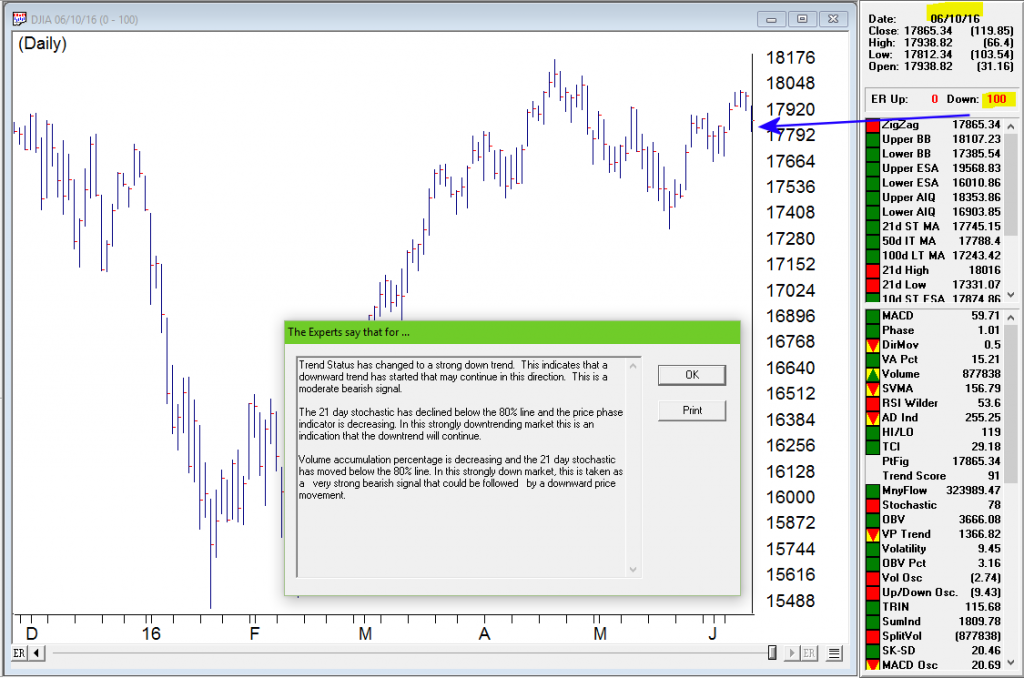

Artificial Intelligence Market Signal issues a 0-100 to the downside on June 10, 2016

WinWay TradingExpert AI signals are designed to anticipate changes in the direction of price movement. Some are accurate and some are not. However, more often than not, the Expert Rating signals are accurate. The strongest level of confirmation for market timing signals like this 0-100 down on June 10, 2016 can be found by examining one of TradingExpert’s other market indication components.

One possible confirmation of market timing signals (Expert Ratings of 95 or greater) is the the Up/Down Signal Ratio, on the Weighted Action List (WAL), an AIQ report. A Signal Ratio of 85 or greater in the direction of the signal could be viewed as significant, as the AI system used for stocks is completely separate in terms of expert system knowledge base and data, and share no information or expert rules with the market timing system.

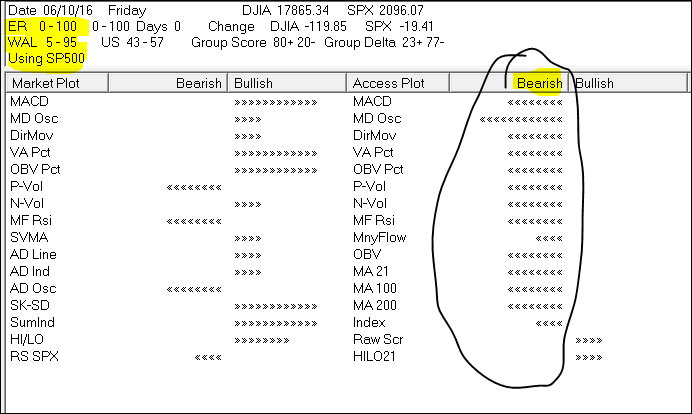

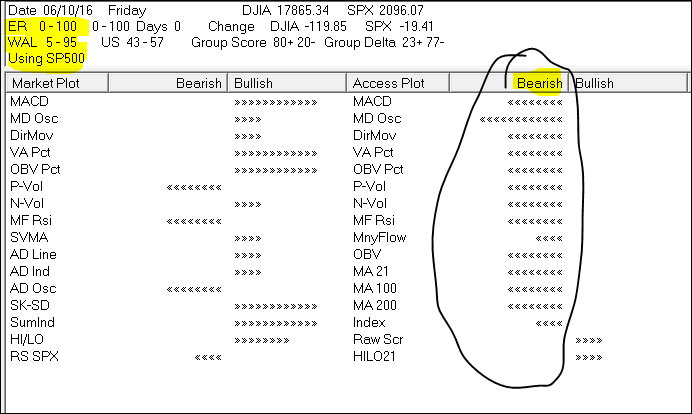

The image below is taken from the WinWay Reports Daily Market Log. This report pulls elements from various parts of TradingExpert. You’ll notice the 0-100 down signal on DJIA on 6/10/2016. Just below that is WAL 5-95. This is the Up/Down Signal Ratio from the Weighted Action List (WAL) in this case using SP500 stocks. This 5-95 confirms that 95% of the SP500 stocks have down signals according to the stock expert system.

The Access Plot area on the right gives a bullish/bearish consensus for the SP 500 stocks using 16 technical indicators.

The two independent components of TradingExpert are in agreement calling for the market to move in the same direction. This is a very powerful type of validation, both the equity and market timing systems have signaled a change in market direction at the same time.

While no system is perfect, it is interesting to note the previous 0-100 market timing signal occurred December 8, 2015 prior to the correction at the start of 2016.

Nov 26, 2014 | Uncategorized

It is not a little known fact that historically the action of the stock market has been relatively favorable both around holidays and towards the end of the year. But some question remains as to just how favorable things have been during these periods and how often. So let’s address it.

The Year-End (or “Santa Claus”) Rally

Different analysts will look at historical data and draw different conclusions. This is actually a good thing, otherwise everyone would be trying to buy or sell at the same time.

But in the opinion one analyst (“Hi, my name is Jay”) the “year-end rally” period (or as I like to call it the “Santa Claus Rally”):

*Starts on the Monday before Thanksgiving

*Ends at the close of the third trading day of the following January

Have I mentioned lately that this stuff doesn’t need to be rocket science?

So how has this period performed? We will start our test at the close of trading on Saturday (yes, Saturday) November 19, 1949 and examine what would have happened to a hypothetical $1,000 investment in the Dow Jones Industrials Average that was in the market only during the bullish year-end period described above (in other words, the trader would buy the Dow Industrials Average at the close on the last trading day prior to the Monday before Thanksgiving and would hold through the close of the third trading day of the following January. The rest of the time the “system” is out of the market. For our purposes, no interest is earned so as to reflect only the gains made during the bullish year-end period).

The results appear in chart form in Figure 1.

Figure 1 – Growth of $1,000 invested in the Dow Industrial Average only during the bullish year-end period described in text

Figure 2 displays the annual year-by-year results in table form.

|

Exit Date

|

% +(-)

|

|

1/5/50

|

3.6

|

|

1/4/51

|

4.0

|

|

1/4/52

|

3.9

|

|

1/6/53

|

4.6

|

|

1/6/54

|

2.9

|

|

1/5/55

|

5.1

|

|

1/5/56

|

0.2

|

|

1/4/57

|

3.7

|

|

1/6/58

|

(0.0)

|

|

1/6/59

|

5.7

|

|

1/6/60

|

5.8

|

|

1/5/61

|

3.2

|

|

1/4/62

|

(1.0)

|

|

1/4/63

|

5.0

|

|

1/6/64

|

8.2

|

|

1/6/65

|

(1.2)

|

|

1/5/66

|

3.0

|

|

1/5/67

|

(0.5)

|

|

1/4/68

|

4.3

|

|

1/6/69

|

(3.1)

|

|

1/6/70

|

(2.4)

|

|

1/6/71

|

10.0

|

|

1/5/72

|

11.6

|

|

1/4/73

|

3.4

|

|

1/4/74

|

(1.2)

|

|

1/6/75

|

3.6

|

|

1/6/76

|

6.0

|

|

1/5/77

|

3.1

|

|

1/5/78

|

(3.7)

|

|

1/4/79

|

3.6

|

|

1/4/80

|

1.6

|

|

1/6/81

|

1.5

|

|

1/6/82

|

0.9

|

|

1/5/83

|

2.3

|

|

1/5/84

|

2.5

|

|

1/4/85

|

(0.3)

|

|

1/6/86

|

5.7

|

|

1/6/87

|

4.3

|

|

1/6/88

|

6.5

|

|

1/5/89

|

6.2

|

|

1/4/90

|

5.4

|

|

1/4/91

|

0.6

|

|

1/6/92

|

13.9

|

|

1/6/93

|

2.4

|

|

1/5/94

|

2.8

|

|

1/5/95

|

0.9

|

|

1/4/96

|

3.7

|

|

1/6/97

|

1.5

|

|

1/6/98

|

0.3

|

|

1/6/99

|

4.2

|

|

1/5/00

|

1.1

|

|

1/4/01

|

2.7

|

|

1/4/02

|

4.0

|

|

1/6/03

|

(0.4)

|

|

1/6/04

|

9.5

|

|

1/5/05

|

1.3

|

|

1/5/06

|

1.1

|

|

1/5/07

|

0.4

|

|

1/4/08

|

(2.9)

|

|

1/6/09

|

12.0

|

|

1/6/10

|

2.5

|

|

1/5/11

|

4.6

|

|

1/5/12

|

5.3

|

|

1/4/13

|

6.7

|

|

1/6/14

|

1.6

|

Figure 2 – Year-by-Year “Santa Claus Rally” % +(-)

A few performance notes:

# times UP = 54 (83% of the time)

# times DOWN = 11 (17% of the time)

Average% +(-) = +3.19%

Median % +(-) = +3.08%

Largest % Gain = +13.87% (1991-92)

Largest % Loss = (-3.69%) (1977-78)

It is also worth noting that the year-end rally period has witnessed a gain for the Dow in 27 of the last 29 years and 33 of the last 36 years.

Summary

So do the results displayed in Figures 1 and 2 guarantee that the stock market is destined to rally in the near future? Ah there’s the rub. For the answer is “not necessarily”. Still, investing is in many ways a game of odds and probabilities. While one always needs to be prepared to act defensively if things start to go south, history suggests that traders and investors might do well to give the bullish case the benefit of the doubt between Thanksgiving Week and early January 2015.

Or to put it more succinctly:

Jay’s Trading Maxim #215: Santa Claus is real (approximately 83% of the time).

Jay Kaeppel

Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

http://jayonthemarkets.com/

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Nov 26, 2014 | Uncategorized

this is dynamite

Holiday Sale up to 75% off selected Books, DVDs and Courses

New Money-Making Trading Systems: Advanced Results from 6 Simple, Proven Strategies

One of the more important questions that traders face periodically is to determine when a stock or a market is reversing.

Over the past 20 years, Steve Palmquist has done just that – backtested countless market adaptive trading techniques. In this brand-new, six-hour DVD course, Steve reveals the results of his tests on Bollinger bands, declining volume pullbacks and retracements, as well as volume accumulation and distribution to bring you six proven trading strategies.

Each system was developed, tested, and analyzed for maximum profits

Steve will provide you with complete rules and exit strategies that have been back tested in various market conditions and time frames. Steve will also show you how to analyze the current market conditions and select the trading strategy that will make you the most money in a bear, bull, or trading range market. As Steve guides you through his six proven strategies, you will learn:

- How to use time stops, price targets, and money management techniques to improve results,

- Specific techniques for selecting among multiple trading candidates based on extensive testing and analysis, and

- To understand market behavior and to position yourself to profit from different market characteristics.

Don’t make costly mistakes by following the latest trading system blindly. Let Steve’s experience and expertise work for you. In this DVD course, he will not only provide you with six new powerful trading strategies, but he will show you exactly how to use each one to maximize profits.

Six-hour DVD course

List Price: $995.00

Our Price: $795.00

NOW $89

11/26 thru 12/5 while supplies last

“Someone has finally determined which candlesticks are the most effective”

Proven Candlestick Patterns

By: Steve Palmquist

Currently one of the the most widely used chart types, candles have the potential to be an effective tool for extracting profits from the market. But with all of the information out now about candles, how can you tell which ones work and which don’t? After testing every known candlestick pattern, Steve Palmquist has determined which candlesticks are the most effective and gives you extensive data and techniques for how to best incorporate them into your trading strategy. Palmquist’s extensive back testing has revealed :

- How effective popular candlestick patterns such as Bullish Engulfing, Bearish Engulfing, Hammers, Hanging Man, Evening Star, and Morning Star really are.

- Actual data on these popular candlestick patterns in different market environments to confirm when they are most effective at predicting winning trades.

- Which of the three major market environments to successfully use specific candlestick patterns — and which environments to avoid.

- How to use the massive information collected to truly confirm various candle patterns and eliminate the guess work.Steve Palmquist’s new 90-minute course arms you with what you need to know about candlestick patterns and shows you the candlesticks you should be using and which ones you should avoid. Don’t spend years collecting this powerful information and definitely don’t let another day go by without using the proven power of these candlestick patterns!

Our Price: $89.00

NOW $49

11/26 thru 12/5 while supplies last

|

Nov 11, 2014 | Uncategorized

As I mentioned last time around, when it comes to analyzing the financial markets, I am a proud graduate of “The School of Whatever Works”. In my youth I “wrote down” a lot of interesting analysis ideas (that’s how we did it back then, sadly).

Whenever I would hear or read of a new market analysis or market timing idea, rather than passing judgment one way or the other based solely on my own “youthful wisdom” (har, good one), I would agnostically write it down and “track it for awhile”. OK, “quantitative” is not a word that most “youths” get around to using until, well, whatever it is that comes after youth (which I believe most people refer to as “Mid-20’s and broke”, or alternatively, “Our parents have stopped feeding us, now what?” But I digress).

At lunch time I would take a break from my job in “Personnel” (which coincidentally is where I came to realize that I “hate people” and that I was going to have to do something that involved numbers instead) and go to the local library and peruse the available market newsletters, advisory services, etc. Anyway, I had quite the appetite for “market analysis” so I “wrote down” a lot of “stuff.”

Long story short, if I had a $1 for every idea/method I wrote down that did not stand the test of time, well, let’s just say I wouldn’t need to worry about analyzing the financial markets anymore. But I guess that shouldn’t really come as a surprise. What surprises me more is some of the ideas that I would likely have considered “arcane” (had I actually used that word in my youth) that actually did end up standing the test of time (at least so far). One of those is something I refer to as the “40-week cycle.“

Now I am certain that I personally did not “invent” the 40-week cycle. I must have read about it somewhere (OK, original thinking isn’t my strong suit, is that a crime?),written it down and followed it. But sadly, I don’t remember exactly when or where or from whom I first got the idea. But whoever you are, if by some strange twist of fate you are reading this article, let me just say “Thanks.”

The 40-Week Cycle

For the record there is the “Raw theory 40-week cycle” and the “Raw theory 40-week cycle with a stop-loss provision added because you know how that pesky stock market loves to crater even the best theories every once in a while” version (which I considered as the title for my next book but my editor emphatically said “No!” Guess the price of ink must be up these days).

The Rules are pretty simple:

*Starting at the close on 4/21/1967, the first 140 calendar days (20 weeks times 7 days) is considered the “Bullish Phase”

*The second 140 calendar days is considered the “Bearish Phase”

*During the Bullish Phase, if the Dow Jones Industrials Average losses 12.5% or more from its closing level at the end of the previous “Bearish Phase”, sell and remain in cash until the start of the next Bullish Phase.

Figure 1 displays this cycle going back a few years.

Figure 1 – Dow Industrials with 40-Week Cycle dates (Courtesy: ProfitSource by HUBB)

There are three critical things to know about the raw 40-week cycle:

1) The stock market DOES NOT always go UP during each bullish phase.

2) The stock market DOES NOT always go DOWN during each bearish phase (in fact, for the record, the “Bearish Phase” has seen the Dow advance more often than it declined. But when it does decline, it “really declines” – see Figure 3 below).

3) No one should rely on the 40-week cycle as their sole method of market analysis (even at the peak of “Youthful Wisdom”)

With those caveats in mind, let’s look at why it still may be useful to keep an eye on this cycle as a “weight of the evidence” tool.

The Results

For measuring results during the “bullish” phase:

Buy the Dow at the close on the last day of the previous Bearish cycle.

Sell if either:

a) The Dow declines 12.5% or more on a closing basis from the buy price, or;

b) 140 calendar days go by if a) is not triggered

For our purposes, we will assume that interest is earned at a rate of 1% per year while out of the stock market. Starting on 4/21/67, $1,000 invested using the rules above would be worth $36,483 as of 10/31/14, as shown in Figure 2.

Figure 2 – Growth of $1,000 using 40-Week Bullish Phase Rules (blue line) versus Buy and Hold (red line)

On the flip side, had an investor skipped all of the “bullish” days and invested only during the “bearish” days (including after the 12.5% stop was hit), he or she would have done, ahem, worse. The growth of $1,000 invested only during the “non bullish” days appears in Figure 3.

Figure 3 – Growth of $1,000 invested only during “Non Bullish” 40-Week Bullish days

To be succinct:

*$1,000 invested only during the “Bullish” days grew to $36,483 (+3,548%)

*$1,000 invested only during the “Non Bullish” days shrank to $688 (-31%)

Summary

The latest bullish phase started at the close of trading on 10/31/2014 (and extends through 3/20/15). This nicely coincides with the “Bullish Six Months” period originally espoused by Yale Hirsch which (according to my own rules) extends from the close of trading on October 31st each year through the third trading day of the following May. So does this combination of bullish seasonal factors guarantee us that “Happy Day are Here Again?”

Sadly, no. Murphy and his d$%^ Law stand ever vigilant against complacent investors. But if history is a guide (and “sometimes” it is) we might continue to give the bullish case the benefit of the doubt.

Well, at least for another 139 days.

Jay Kaeppel

Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

http://jayonthemarkets.com/

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Nov 6, 2014 | Uncategorized

The AIQ code and EDS file based on Charlotte Hudgin’s article in the September 2014 Stocks & Commodities issue, “Finding The Golden Triangle,” is provided at www.TradersEdgeSystems.com/traderstips.htm, and is shown below.

I created an indicator I named the clear value indicator (“ClearValueSum” and “ClearValueAvg”) that might be used to rank signals. The “ClearValueSum” indicator sums the daily percentages that the close is above the simple moving average (SMA). The summing starts at the last cross up and goes to the current bar. If the close is below the SMA, then the value of the indicator is zero.

In Figure 7, I show a chart of Priceline (PCLN) with the ClearVauleSum indicator in the subgraph. In addition, I provide the code for the golden triangle setup and confirmation.

The author did not discuss exits, so I provided one based on a cross under the SMA or an exit after a maximum-bars-to-hold input (“maxBarsToHold”).

FIGURE 7: AIQ, sample trade. Here is a chart of Priceline (PCLN) with the ClearValueSum indicator and a sample trade marked with white up and down arrows.

FIGURE 8: AIQ, SAMPLE PERFORMANCE RESULTS. Here are the EDS summary results compared with varying the maxBarsToHold input trading the NASDAQ 100 list of stocks over the last six years.

I ran a short optimization on the “maxBarsToHold” input, the results of which are shown in the table in Figure 8. Most of the metrics are best at the 18-bar setting. In Figure 7, I also show a sample trade from the system from 2009 with the 18-bar setting.

!FINDING THE GOLDEN TRIANGLE

!Author: Charlotte Hudgin, TASC Sept 2014

!Coded by: Richard Denning 7/10/2014

!www.TradersEdgeSystems.com

!INPUTS:

smaLen is 50. !moving average length

periods is 252. !Total look back period

strength is 4. !Number of bars on each side of pivot

maxBarsToHold is 18. !max bars to hold position

!VARIABLES:

C is [close].

L is [low].

V is [volume].

OTD is offsettodate(month(),day(),year()).

!CLEAR VALUE INDICATOR:

SMA is simpleavg(C,smaLen).

Xup if C>SMA and (valrule(C<=SMA,1) or countof(L=1).

XupDte is scanany(Xup,periods).

XupOS is scanany(Xup,periods) then OTD.

ClearPct is (C/SMA -1) * 100.

ClearPctSum is iff(C>SMA,sum(ClearPct,^XupOS),0).

ClearPctAvg is iff(C>SMA and ^XupOS>1,simpleavg(ClearPct,^XupOS),iff(ClearPct>0,ClearPct,0)).

!CODE TO FIND PIVOTS:

LowR is LoVal([low],(2*strength)+1).

LowM is Val([low],strength).

LS if LowR = LowM.

HighR is HiVal([high],(2*strength)+1).

HighM is Val([high],strength).

HS if HighR = HighM.

!FIND FIRST PIVOT LOW

LT1 is scanany(LS,periods) then OTD .

LO1 is ^LT1 + Strength.

LO1dte is SetDate(LO1).

LowLO1 is val([low],^LO1).

!FIND FIRST PIVOT HIGH

HT1 is scanany(HS,periods,0) then OTD .

HO1 is ^HT1 + Strength.

HO1dte is SetDate(HO1).

HighHO1 is val([high],HO1).

!SYSTEM CODE:

Xdn if [low]=SMA,1).

XdnDte is scanany(Xdn,periods).

XdnOS is scanany(Xdn,periods) then OTD.

ShowValues if C > 5.

HHVpivot if HighHO1 = hival([high],smaLen) and C > 5.

Setup if Xdn and HHVpivot.

PriceCnf if C>SMA.

SetupOS is scanany(Setup,periods) then OTD.

PriceCnfOS is scanany(PriceCnf,periods) then OTD.

AvgV is simpleavg(V,smaLen).

VolumeCnf if ^SetupOS<15 and="" ricecnfos="" setupos="" v="">avgV and V=highresult(V,^PriceCnfOS).

!BUY & EXIT RULES (LONG ONLY):

Buy if VolumeCnf and countof(Setup,15)=1 and countof(PriceCnf,15)>=1

and countof(C>SMA,SetupOS+1)=SetupOS+1.

Exit if C=maxBarsToHold.

Oct 30, 2014 | Uncategorized

Typically, I don’t like to rain on other people’s parades – you know, karma being what it is and all. And when it comes to analyzing the financial markets and trading, I am a proud graduate of “The School of Whatever Works.” So if someone tells me that the key to their success comes from analyzing the ratio between the VIX Index and the price of arugula, I say “more power to ‘em.” (OK, this is a made up example. Please DO NOT email me and ask me if I have back data for the price of arugula. I do not. At least not that I am aware of. Maybe I do. I should look. Wait, no!).

So anyway, what follows is not meant to denigrate anybody else’s analysis. But one thing that has always bugged me is when people arbitrarily draw all kinds of things on a price bar chart and then say “Aha!” One notorious example is a guy I used to know who was a big believer in Gann and Fibonacci (not that there is anything wrong with that). So if we were to talk (assuming we were still talking) about the gold market he might send me a chart that sort of resembles the one that appears in Figure 1. This is a weekly bar chart for ticker GLD – an ETF that tracks the price of gold bullion – with a Gann fan and Fibonacci Retracement lines drawn.

Figure 1 – Ticker GLD with a Gann Fan and Fibonacci Retracements (Courtesy: ProfitSource by HUBB)

As you can see in Figure 1 there is in fact a point where the 61.8% “Fib line” (as we “professional market analysts” like to refer to them) will intersect with the, well, one of the Gann Fan lines. Is this actually significant in any way? [Insert your answer here]. But I would likely respond to him by saying something constructive like, “Interesting analysis. Hey what about the other 50 lines you’ve drawn on this chart?” To which he would likely respond by saying something equally constructive like “$%^ you.” (You kind of get the idea why we don’t talk much anymore).

For the record please note that at no time did I denigrate his analysis (well, maybe in a sneaky, snarky sort of way – sorry, it’s just my nature). But if it works for him, that’s great. But seriously, what about the other 50 lines? And please remember that for the sake of clarity I did not include the 4 to 6 “key” moving averages that he would normally include on a typical bar chart. Anyway, in the end it seems like an appropriate time to invoke:

Jay’s Trading Maxim #102: If you draw enough lines on a bar chart, price will eventually touch one. This may or may not signify diddly squat.

or the addendum:

Jay’s Trading Maxim #102a: The market may not care that you’ve drawn a particular line on a particular chart. Just saying.

So with this in mind, let’s turn to the price of gold and Elliott Wave Analysis.

Gold and the Elliott Wave

I always feel compelled to point out that I am not now, nor have I ever been a true “Elliotthead.” But I know enough traders whom I respect who are serious users of Elliott Wave analysis that I do try to pay attention. So let’s take a look at a recent example, in this case using the ticker GLD.

The biggest problem I always had with Elliott Wave is figure out when one wave is – um, waving goodbye and another wave is about to crest. So I rely on ProfitSouce from HUBB to do the work for me. In Figure 2 you see a bar chart for ticker GLD with ProfitSource’s version of the latest Elliott Wave count drawn. As you can see in Figure 2, the indicated wave count just crossed down into a bearish Wave 5 (although most of the people I know who follow Elliott Wave refer to this as a “Wave 4 Sell”. Go figure).

Figure 2 – GLD and Elliott Wave w/Wave 4 Sell signal (Courtesy: ProfitSource by HUBB)

So let’s assume that a person wanted to play the short sort of gold based on this one signal (for now we will ignore the question of whether or not this is wise). One avenue would be to sell short 100 shares of GLD at $119.34. This transaction would involve putting up margin money of roughly $6,000 and assuming unlimited risk to the upside (Remember that if you sell short shares of GLD and gold decides for some reason to open $20 higher tomorrow your stop-loss to buy back your short GLD shares at $125 is not necessarily going to limit your risk).

My preferred play would be to use put options on ticker GLD. Of course, with options there is always “more than one way to play.” So let’s look at two.

Strategy #1: The “I Want to be Short Gold” Strategy (Buy a Deep-in-the-Money Put)

The objective with this strategy is to get as close to point-for-point movement with the underlying security (i.e., shares of GLD) as possible, at a fraction of the cost. In this example, the trade in Figures 3 and 4 involves buying the December 127 put at $8.40.

This trade costs $840 – which represents the maximum risk on the trade and has a delta of -79.77. This means that this trade will act roughly the same as if you had sold short 80 shares of ticker GLD (which would entail putting up margin money of roughly $4,800 and the assumption of unlimited risk.

If GLD falls to the upper price target range indicated in Figure 2 (112.20) this trade will generate a profit of roughly $700. As this is written, GLD has fallen from 119.34 to 115.76 a share and the December 127 put is up from $8.40 to $11.40 (+36%).

Strategy #2: The “I’m Willing to Risk a Couple of Bucks in Case the Bottom Drops Out of Gold” Strategy (buy an OTM Put Butterfly)

This strategy is for people who are willing to speculate and risk a few dollars here in there in hopes of a big payoff. Now that phraseology probably turns a few people off, but risking a few bucks in hopes of a big payoff is essentially the definition of intelligent speculation.

So for this I turn to www.OptionsAnalysis.com which helpfully has an OTM Butterfly Finder routine built in.

This trade involves:

Buying 1 December 118 put

Selling 2 December 108 puts

Buying 1 December 98 put

The cost of this trade is only $170.

As you can see, if GLD does fall into the price range projected by the Elliott Wave count shown in Figure 2, this trade can make anywhere from $250 to $700 or more based on $170 of risk.

As I write, GLD is trading at $115.76 and this open position shows a profit of $94 (+55%).

Summary

There sure are a lot of ways to analyze and play the financial markets. As a proud graduate of “The School of Whatever Works” (our school motto is “Whatever!”) I am not here to tell you what tools you should use (nor how many lines you should draw on a bar chart) or what type of trading strategies you should use to act on any particular trading strategies. My only purpose in this blog is to provide food for thought. Speaking of blogs, on a sidenote, I’m officially revamping my website. You can click here to get an idea of what kind of theme I will be laying out. I decided my blogs could do with a change.

Whether or not a single particular Elliott Wave count constitutes a valid trading signal is up to each trader to decide. But whatever the indicator, once a signal to play the short side is given, more choices arise. In this example, three choices are to:

1) Sell short shares of GLD (putting up margin money and assuming significant risk),

2) Buy an in-the-money put option to track the price of GLD without as much cost and with limited risk

3) Risk less than $200 to gain exposure to the downside in GLD

Food for thought. Feel free to “chew on that” for awhile.

Jay Kaeppel

Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

http://jayonthemarkets.com/

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.