Oct 26, 2014 | Uncategorized

Seems like I have used this title before. That’s probably because I have. It’s also because every once in awhile I lift my head up from “crunching numbers” – in pursuit of that “one great market timing method” – and remember that there really is no such thing and that having a general sense of the overall trend of the markets and adding a touch of common sense can get you pretty far as an investor and trader.

Of course, that’s been easier said than done of late. At times its seems that common sense would dictate doning a Hazmat suit and curling up in the fetal position in a corner until – you know, whatever – passes. With an election coming up we have been informed by both sides that if the other side wins then that will pretty much be the end of humanity as we know it. Which leaves us exactly where? But I need to watch my blood pressure so I will steer clear of politics.

My Writing (or Lack Thereof) of Late

I have been writing very little of late. The good news for me is that JayOnTheMarkets.com is not a paid site and there are no deadlines and no one is waiting for me to tell them what to do next in the markets. Which is probably a good thing since the truth is that I have never been more unsure of exactly what the h?$% is going on in the markets (or the world around us, come to think of it) than I have been of late. Hence the lack of more frequent updates. As the saying goes, “If you don’t have something intelligent to say, don’t…” – well come to think of it I have never really adhered to that rule in the past. Never to late to start, I guess. In any event, thank goodness I am a systematic trader.

In trying to make sense of things, on one hand a perusal of the evidence in recent months led me to think that a major top was forming. On the other hand, the trend (except for a recent short-lived dip by some of the major averages below their 200-day moving averages) has remained “up” and we are now in what has historically been a very bullish seasonal period (also the standard most bullish 6 months of the year starts on November 1st).

So the bottom line is that if you want to be bullish you can make a pretty good case. On the other hand, if you want to be bearish you can also make a pretty good case.

What’s a guy or gal to do?

Well hopefully your answer is the same as mine: Continue to follow your objective, well thought out trading plan – one that incorporates some risk controls in case things don’t go the way you planned.

Sounds so simply when its put that way, doesn’t it? Towards that end, let me offer a simple “Non Rocket Science” method for identifying the long-term trend of the stock market.

Jay’s Non-Rocket Science Stock Market Trend Identification Method (JTIM)

Notice that this ridiculously long title (hence JTIM for short) includes the phrase “Trend Identification” and not the phrase “Market Timing”. If I were truly interested in full disclosure the title would actually be something like “Jay’s Non-Rocket Science Let’s Not Ride the Bear Market All the Way to the Bottom for Crying Out Loud” Method. But that one was really long winded.

The purpose of this method is simply this, nothing more, nothing less: to avoid riding an extended bear market all the way to the bottom all the while hoping that one day it will bounce back. When this method gives a sell signal it simply means that it “may be” time to play defense. That might mean selling a few stock market related holdings, that might mean selling everything related to the stock market, or it might mean hedging and existing portfolio.

It also means that there is a chance that you may take defensive action and later end up wishing that you had not. Sorry folks, that just kind of the nature of trend following. But one thing I have learned since, well, the time I had a lot of hair until now, is that selling now and buying back in at a slightly higher price is typically preferable to riding a 20%, 30% or 40% or more drawdown.

Now some people may respectfully disagree with that opinion. But these types of drawdowns can scar an investor’s psyche – and adversely affect their judgment in the future – for a long time – even after their portfolio eventually bounces back. In addition, riding a massive drawdown like DiCaprio and Winslet riding the final plunge of the Titanic opens an investor to one of the most devastating mistakes of all – i.e., selling at or near the bottom (Though fortunately not to hypothermia like DiCaprio – and just for the record, seriously, couldn’t Winslet have just schooched over a little bit and made enough room for both on that door or whatever it was she was floating on? But I digress).

This reminds me to remind you of:

Jay’s Trading Maxim #78: Drawdowns make people act stupid (the more the drawdown, the more the stupid).

So here are the (granted, imperfect) JTIM rules:

*If the S&P 500 Index closes for two consecutive months below its 21-month moving average AND also closes below its 10-month moving average, the trend is deemed “Bearish”.

*While the trend is deemed “Bearish”, if the SPX 500 Index closes one month above its 10-month moving average then the trend is deemed “Bullish.”

That’s it.

JTIM Results

The results must be measured based on what the method is trying to achieve – i.e., avoiding massive, long term drawdowns – so as to avoid “acting stupid” (and to avoid ending up like DiCaprio, but I repeat myself). Over the course of time the results look pretty good. Of course, it also depends to some extent on how you define “good”, because from time to time – and over certain extended periods of time between the beginning and end – the results don’t look so good. Allow me to explain.

In general terms, it goes like this:

Good: This method avoided most of the 1973-1974 bear market.

Not So Good: Between 1977 and 1991 there were 5 “sell” signals. In all 5 cases an investor who “sold everything” based on these signals would have bought back in at a higher price. An investor would have missed drawdowns of -9.6% in 1977-78 and -12.7% in 1981-82. But all other sell signals during the great bull market of the 80’s and 90’s witnessed drawdowns of no more than -4.0%.

Good: The last three sell signals (2000, 2002, and 2008) were followed by drawdowns of -28%, -29% and -50%, respectively.

Figure 1 displays the results in tabular form:

Figure 1 – Jay’s Trend Identification Method Signals

The key thing to note is that over the past 40+ years this method outperformed buy-and-hold (by almost 2-to-1 if interest earned while out of the market is added in; See Figure 6).

Figures 2 through 5 display the signals on SPX monthly bar charts.

Figure 2 – SPX with JTIM Signals 1970-1984 (Courtesy: AIQ TradingExpert)

Figure 3 – SPX with JTIM Signals 1984-1994 (Courtesy: AIQ TradingExpert)

Figure 4 – SPX with JTIM Signals 1994-2004 (Courtesy: AIQ TradingExpert)

Figure 5 – SPX with JTIM Signals 2004-2014 (Courtesy: AIQ TradingExpert)

Figure 6 displays the growth of $1,000 using JTIM (adding 1% of interest per year while out of the market) versus buy-and-hold since 1970.

Figure 6 – Growth of $1,000 using JTIM (blue line) versus buy-and-hold (red line) since 1970

And just to complete the picture Figure 7 displays the growth of $1,000 invested in SPX only when the system is bearish.

Figure 7 – Growth of $1,000 when JTIM is bearish (1970-present)

For the record, had an investor bought an held the S&P 500 only during those period when JITM was bearish since 1970, an intitial $1,000 investment would now be worth only $540 (i.e., a loss of -46%). Or as we “professional market analysts” refer to it – Not So Good.

Summary

So is this the “be all, end all” of market timing? Clearly not. During most of the 80′s and 90′s, getting out of the market for any length of time typically cost you money. Still, since nothing of the “be all, end all” variety actually exists some investors may find it useful to note the status of this simple model, at the very least as an alert that:

a) a lot of bad news can typically be ignored if the model says the trend is “up”, and,

b) some defensive action may be wise if the model says the trend is “down.”

Alright, excuse me, I have to get back into my Hazmat suit.

Jay Kaeppel

Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

http://jayonthemarkets.com/

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Oct 15, 2014 | Uncategorized

The Dow rose 140 points early in the yesterday’s session only to give it all back by the close. It finished down 6 points at 16,315.

Volume was on the heavy side, coming in at 123 percent of its 10-day average. There were 38 new highs and… 378 new lows.

In yesterday’s comments I talked about how the market would likely stair-step its way lower and how rallies would likely turn into shorting opportunities. We saw this occur yesterday.

FREE Weekend strategy review delivered to inbox every week

If you were paying attention to the 2-period RSI Wilder during the day, you saw that when the Dow was up 140 points, it was extremely overbought. Inverse positions established during that time were big winners by the end of the day.

The Dean’s List remains negative and the Tide continues to go out. Do not attempt to fight the Tide.

The reason I say this is because I’m seeing a lot of institutional selling now.

The Big Boys are dumping stock!

How do I know?

Well, there’s a dead giveaway. If you have been watching the market action for the past week, you have seen that most of the selling is taking place late in the day. That’s when the institutions sell stocks. Most of their selling usually takes place during the last hour of trading.

As a matter of fact, some technicians have even developed an indicator to monitor this selling. It’s called the Last Hour Indicator. It breaks breaks down the selling into hourly increments so institutional trading can be monitored. But you don’t need a fancy indicator to do this. Just watch the trading in the last hour. If the Dow is falling into the close, then you know the institutions are likely behind it.

And why is this important? Hmmm?

Well, it’s one thing if the retail investors are selling a declining market. This is what usually causes the ‘dips’ to form in a Bull Market. Retail selling usually creates buying opportunities for the Big Boys.

But when it’s the Big Boys who are selling stock in a declining market, it’s almost always a sign that there is BIG trouble ahead. The fact that they are selling and not buying now means the market will likely have trouble finding bids. And without bids, small declines can turn into BIG ones very quickly!

So we need to be extremely careful now.

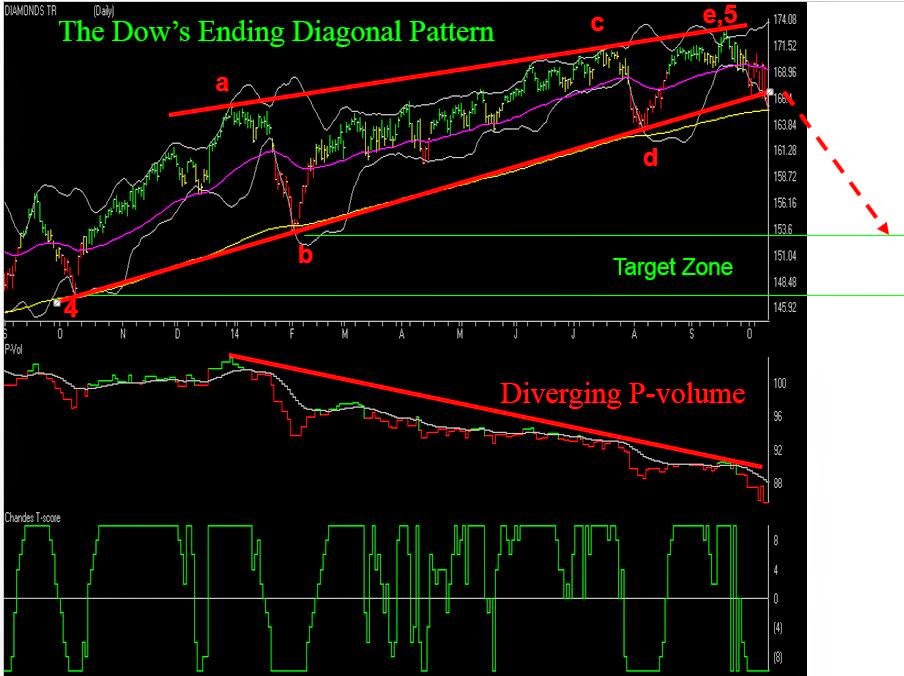

Now that prices have broken out of the Major Ending Diagonal Pattern, it is likely that the Dow will continue to decline into the end of October.

The next major support level for the Dow, which is the February 2014 low of 15,340, is still over 1,000 points away. You might want to look at the chart of the Dow I posted last weekend to review the ‘target zones’. The 15,340 level is the upper level of the zone. Prices could go a lot lower!

As long as the Dean and the Tide stay negative, the institutional selling will likely continue to drop the market to lower levels. The decline won’t be straight down, but the rallies will be brief…like the one we saw yesterday.

During yesterday’s rally, I bought an initial position in SKF, the inverse financial ETF. The ETF has a classic TLB pattern and is on the Dean’s List with positive PT indicators. It satisfies all of the elements of the SIGN.

The thing that caused me to add SKF to the mix was the positive and diverging P-volume.

Once again, I’m not in love with SKF. It’s just a ‘date’. And when I buy something with a TLB pattern, I am now committed to hold it until one of two things happens. Either the ETF ‘Jumps the Ropes’ and starts the reversal process, or the PT indicators turn negative. One or the other. That’s it.

If the ETF makes a ‘Rope Jump’, I’ll start managing my money in anticipation of a wave 2 pullback. If the PT indicators turn negative, the ‘date’ is over.

BTW, I also bought back a few shares of TWM during yesterday’s rally. The P-volume continues to impress, but once again the ETF appears overbought. If the rally in TWM continues today, I’ll likely take a few bucks off the table. The 50 still has not crossed above the 200 and I never like to be holding a full position when the ETF is technically still in a down trend.

Holding inverse ETFs from the Dean’s List.

That’s what I’m doing.

Hank Swiencinski, aka The Professor, is founder of http://OneMinuteStock.com and teaches the One Minute Stock course at UNF in Jacksonville, FL. Hank uses TradingExpert Pro extensively in his analysis.

FREE Weekend strategy review delivered to inbox every week

All of the commentary expressed in this site and any attachments are opinions of the author, subject to change, and provided for educational purposes only. Nothing in this commentary or any attachments should be considered as trading advice. Trading any financial instrument is RISKY and may result in loss of capital including loss of principal. Past performance is not indicative of future results. Always understand the RISK before you trade.

Oct 10, 2014 | Uncategorized

The MACD indicator is a useful addition to any stock trading strategy. It is a good measure of momentum, trend direction and can also be a good guide to the relative strength of the market, indicating whether the market is overbought or oversold.

However, like all technical indicators there are a number of advantages and disadvantages that any trader should know before incorporating it into their strategy.

Disadvantages

The main disadvantage of the MACD indicator is that it is subjective to the user. Like many technical indicators, the MACD has settings that can be changed to give almost limitless numbers of variations which means results will always differ from person to person.

A trader must decide for example what moving averages to choose. The suggested settings are the 12 day moving average, 26 day and 9, however, these can easily be changed. Secondly, a trader must know what time frame the MACD works best on and there are no easy answers, since the MACD will tend to work differently across different markets. Generally, however, the MACD works best when it is confirmed across several different time frames – especially further out time frames such as the weekly chart.

Lagging indicator

Unless using the divergence strategy (more on this later) which seeks to pick tops and bottoms before they occur, the MACD has an inherent disadvantage that occurs with all technical indicators that concern price history such as moving averages. Since moving averages are lagging indicators, in that they measure the change in a stock price over a period of time (in the past), they tend to be late at giving signals. Often, when a fast moving average crosses over a slower one, the market will have already turned upwards some days ago. When the MACD crossover finally gives a buy signal, it will have already missed some of the gains, and in the worst case scenario it will get whipsawed when the market turns back the other way. The best way to get around this problem is to use longer term charts such as hourly or daily charts (since these tend to have fewer whipsaws). It is also a good idea to use other indicators or time frames to confirm the signals.

The chart below of the Spyders (SPY) clearly shows the lagging nature of the MACD.

Early signals

While the crossover strategy has the limitation of being a lagging indicator, the divergence strategy has the opposite problem. Namely, it can signal a reversal too early causing the trader to have a number of small losing trades before hitting the big one. The problem arises since a converging or diverging trend does not always lead to a reversal. Indeed, often a market will converge for just a bar or two catching its breath before it picks up momentum again and continues its trend.

MACD divergence and multiple time frames

Actually this is a useful feature of the MACD. Bear in mind the lagging nature of the indicator, looking for divergences between price action and the indicator over multiple time frames makes more sense. In the chart of the SPY above the multiple daily MACD divergences are evident, but prices kept moving higher nevertheless. Prices didn’t break down until 07/25/14 and then corrected for about 5%.

Looking at a weekly chart over the same period, the MACD divergence is evident but only one occurrence is apparent and that occurs at the week ending 07/25/14.

MACD divergence and double tops and bottoms

The multiple timeframe divergence does alleviate some of the whipsaws when using MACD. If we then look at only double tops or bottoms with MACD divergence and multiple time frames, we are effectively using multiple confirmation techniques.

Take the recent top in the market 09/18/14. Prices had reached a new high 09/4/14 then retraced for 7 days before reaching the same peak on 09/18/14. A double top. The chart below shows the MACD indicator clearly diverging as the double top occurs. Prices have corrected over 5% from the peak.

No indicator is foolproof, but combining multiple techniques and time frames does provide greater insight.

Oct 8, 2014 | Uncategorized

Wow, does Murphy hate my guts, or what?

So I write an article all about how the stock market gets all bullish during the middle 18 months of the decade (September 30th – Mark Your Calendar) – i.e., starting at the close on September 30th of the mid-term election year – and what does Murphy go and do? He (She? Hmmm, that might explain a few things) invokes his (her?) dreaded Law and the market gets hammered right out of the box in early October.

Fortunately for me I have made enough mistakes in the market over the years that I don’t even bother to feel stupid anymore when things go exactly the opposite of what I might have anticipated. This leads me to invoke a maxim I adopted (after a long, painful process) a long time ago:

Jay’s Trading Maxim #412: Murphy hates you. Plan accordingly.

To put it into other terms, it essential for any trader or investor to give some thought as to what might go wrong before taking any particular action and to come up with an answer to the following question:

“What is my worst case scenario and what specific action will I take to mitigate the damage should this scenario unfold?”

Sounds like such an obvious question to ask and answer doesn’t it? But here is another question that will likely make a lot of readers squirm:

“Do you have an answer to the question above? Every time you make a trade?”

OK granted that’s two questions, but you get my drift.

Where to From Here?

So here is the part of the article where most “highly trained professional market analysts” tell you why the market is almost certain to rise (or fall) from here. Unfortunately, the bad news for me is that I am not very good at predicting the future (plus let’s face it, I can’t risk pissing Murphy off again). So while it “feels” like the market could melt down at any moment, I have little choice but to simply follow my plan and give the bullish case the benefit of the doubt. So two things to note:

#1. October through December in Mid-Term Election Years

In Figure 1 you can see the growth of $1,000 invested in the Dow Jones Industrials Average only during the months of October, November and December during mid-term election years, starting in 1934 (i.e., 1934, 1938, 1942, etc.)

Figure 1 – Growth of $1,000 invested in DJIA Oct-Nov-Dec of Mid-Term Election Year (1934-present)

Figure 1 – Growth of $1,000 invested in DJIA Oct-Nov-Dec of Mid-Term Election Year (1934-present)

Figure 2 shows the year-by-year results

Figure 2 – DJIA performance Oct through Dec of Mid-Term Election Years

As you can see, this period has showed a gain 90% of the time. Granted a few were pretty miniscule, still the median gain was in excess of 8% and the worst previous performance was -7%.

#2. Short-Term Oversold

Well I could hardly refer to myself as a highly trained professional market analyst if I didn’t have my own proprietary overbought/oversold indicator, so, voila, surprise, surprise, my own proprietary overbought/oversold indicator (cleverly named JKOBOS) appears in Figure 3.

Figure 3 – Jay’s Overbought/Oversold Indicator is flashing an oversold (i.e., theoretically bullish) signal at the moment (Chart courtesy of AIQ TradingExpert)

Figure 3 – Jay’s Overbought/Oversold Indicator is flashing an oversold (i.e., theoretically bullish) signal at the moment (Chart courtesy of AIQ TradingExpert)A close look at the chart in Figure 3 reveals that JKOBOS readings below 25 tend to highlight decent buying opportunities. With the indicator presently standing at 21.8, this qualifies as at least a “bullish alert”.

Summary

So is the combination of a bullish seasonal trend (i.e., October through December of Mid-Term election years) and an oversold market (based on a reading from my own overbought/oversold indicator) telling us that another rally is in the near future?

The honest answer is “not necessarily”. The optimistic answer however, is that despite the fear and loathing that seems to permeate the market these day (or maybe partly because of it), there is a chance that the market could surprise to the upside. As a dutiful trend follower I personally have little choice but to continue to give the bullish case the benefit of the doubt

Just don’t anyone tell Murphy I said that………sssshhhh!

Jay Kaeppel

Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

http://jayonthemarkets.com/

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Sep 29, 2014 | Uncategorized

With the beginning of October a couple of days away, here’s our seasonal analysis for the month. We’ve also embedded a table with the scan results that will make it easier to see the results.

A refresher on this scan and some notes about changes.

We have noted on several occasions that we are using 7 years of historical data in the Comparison charts and that is true, however the scan actually looks at 8 years, so in future charts we’ll add the eighth year.

Our study looks at 8 years of historical data and looks at the returns for all optionable stocks 2006 to 2013.

We filter to find two sets of criteria

– Stocks with gains in all 8 years during October

– Stocks with losses in all 8 years in October

We do make an assumption that the month is 21 trading days and work our way back from the last day of the month. If the last day of the month falls on a weekend, then we use the first trading day prior to that date.

We make no assumptions for drawdown, nor do we look at the fundamentals behind such a pattern. We do compare the stock to the market during the same period and look at the average SPY gain/loss vs. the average stock gain/loss. This helps filter out market influence. We are now including group information to identify particular segments that might display a seasonal bias.

Finally we look at the median gain/loss and look for statistical anomalies, like meteoric gains/loss in one year.

WLT – Walter Energy seasonality through October 2013 – 7 year average in black

SWN – Swan Energy seasonality through October 2013

DV – Devry seasonality through October 2013

Sep 23, 2014 | Uncategorized

At the beginning of September I ran the seasonality scan as usual and was disappointed to find very little that looked attractive. 2 stocks met the scan to the upside, but with very poor consistency. September can be a tough month. It was only later in the month I realized I’d made an error and had scanned only the S&P500 stocks! Live and learn.

So, rather than do the September analysis as an exercise now we’re at the 23rd, instead here’s an update on how the scan on August seasonal players panned out. At the end of this week we’ll do the October run.

First a refresher on this scan

First off some background.

Our study looks at 7 years of historical data and looks at the returns for all optionable stocks for the month of August from 2006 to 2013.

We filter to find two sets of criteria

– Stocks with gains in all 7 years during August

– Stocks with losses in all 7 years in August

We do make an assumption that the month is 21 trading days and work our way back from the last day of the month. If the last day of the month falls on a weekend, then we use the first trading day prior to that date.

We make no assumptions for drawdown, nor do we look at the fundamentals behind such a pattern. We do compare the stock to the market during the same period and look at the average SPY gain/loss vs. the average stock gain/loss. This helps filter out market influence. We are now including group information to identify particular segments that might display a seasonal bias.

Finally we look at the median gain/loss and look for statistical anomalies, like meteoric gains/loss in one year.

there were 2 stocks that had the most consistent patterns. They were UPL and DNR

DNR is Denbury Resources and it opened at $16.89 before dropping to around $16.13 into the middle of August. By the last trading day in August DNR closed at $17.22 for a modest gain of 1.95%.

UPL is Ultra Pete Corp and it opened at $22.97 and was relatively unchanged for the first half of August before rallying to close the month at $26.53 for a gain of 15.5%.

Before we leap off the cliff, I must point out that the market return in August over the 7 years is a paltry average of -0.06, as measured by SPY. However this August SPY gained 4.2%.

Here’s the charts for the 2 stocks.

See you again later this week with October’s seasonals.