Jul 18, 2014 | chart patterns, indicators, trading strategies

I have been a little “quiet” lately. Kind of unusual for me, granted. But what can I say really that’s new? The stock market’s moving higher – blah, blah, blah. The bond market keeps trying to creep higher – sure, interest rates are basically 0%, so why not? Gold stocks keep trying to grind their way higher after putting in an apparent base. But who the heck ever knows about something as flighty as gold stocks?

So like I said, not much new to report.

So for the record – one more time – let me repeat where I am at:

- As a trend-follower there isn’t much choice but to say that the trend of the stock market is still “up”. So as a result, I have continued to grit my teeth and “ride”. And let’s give trend-following its due – it’s been a good ride.

- As a market “veteran” I have to say that this entire multi-year rally has just never felt “right”. In my “early years” in the market (also known as the “Hair Era” of my life) when the stock market would start to rally in the face of bad economic times I would think, “Ha, stupid market, that can’t be right.” Eventually I came to learn that the stock market knows way more than I do. And so for many years I forced myself to accept that if the stock market is moving higher in a meaningful way, then a pickup in the economy is 6 to 12 months off. As difficult as that was at times to accept, it sure worked.

Today, things seem “different”. By my calculation the stock market has now been advancing for roughly 5 years and 4 months. And the economy? Well, depending on your political leanings it is somewhere between “awful” and “doing just fine.” But in no way has the “old calculus” of “high market, booming economy 6-12 months later” applied.

Again depending on your politics leanings the reason for this lies somewhere between “it is entirely Barack Obama’s fault” to “it is entirely George Bush’s fault.” (I warned you there was nothing new to report).

From my perspective, I think that the charts below – the second one of which I first saw presented by Tom McClellan, Editor of “The McClellan Oscillator” (which he presciently labeled at the time, “The only chart that matters right now”) – explains just about everything we need to know about the stock market actions vis a vis any economic numbers.

So take a look at the two charts below and see if anything at all jumps out at you.

Figure 1 – S&P 500 Monthly (Source: AIQ TradingExpert)

Figure 2 – Fed Pumping (Quantitiatve Easing “to Infinity and Beyond”) propelling the stock market

I am not a fan of using the word “manipulation” when it comes to the stock market. But I am a strong believer in the phrase “money moves the market.” The unprecedented printing of – I don’t know, is it billions of trillions of dollars – has clearly (at least in my mind) overwhelmed any “economic realities” and allowed the stock market to march endlessly – if not necessarily happily – to higher ground.

Thus my rhetorical questions for the day are:

“What would the stock market have looked like the past 5 years without this orgy of money?”

“What happens to the stock market when the Fed cannot or will not print money in this fashion?”

Because this is all unprecedented in my lifetime (as far as I can tell) I don’t have any pat answers to these questions. But I some pretty strong hunches.

My bottom line: Err on the side of caution at this time.

Jay Kaeppel

Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Jul 8, 2014 | chart patterns, group sector rotation, Seasonality, trading strategies

While looking through the seasonal trends in stocks and currencies, we decided to start running the seasonality scans on the S & P 500 groups. As a reminder here are the criteria we consider when running this.

Our study looks at 7 years of historical data and looks at the returns for all groups in the S & P 500 for the month of July from 2006 to 2013.

We do make an assumption that the month is 21 trading days and work our way back from the last day of the month. July also has the July 4th holiday and a half day trading on July 3rd. if the last day of the month falls on a weekend, then we use the first trading day prior to that date.

We make no assumptions for drawdown, nor do we look at the fundamentals behind such a pattern. We do compare the group to the market during the same period and look at the average SPY gain/loss vs. the average group gain/loss. This helps filter out market influence.

Finally we look at the median gain/loss and look for statistical anomalies, like meteoric gains/loss in one year. Here are top 5 performing groups based on average return.

Average return alone is misleading. In the seasonal analysis we need consistent patterns in the price action throughout the periods we are testing, in this case 7 years. While The S & P 500 Motorcycle manufacturers group (MTRCYCLE) looks good on average, it includes one stellar July of 37.50% back in 2010, and has 2 July’s that were negative returns. NOTE: there’s only one stock in the group (guess which one that is!).

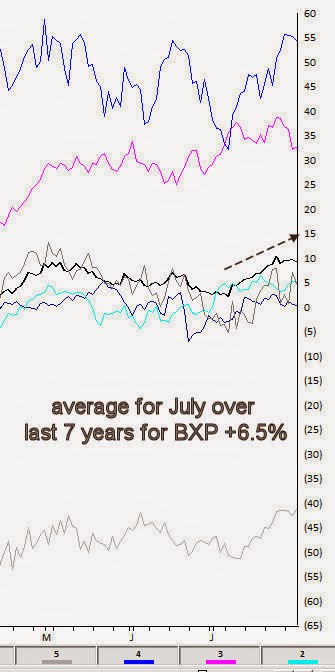

The office REITs group (REITOFC) is more consistent. It has an average return for the last 7 years in July of 6.50%, with the last 6 years Julys all positive. There are no stellar months skewing the average. The group also contains only one stock, Boston Properties [BXP].

Here’s the seasonal chart for BXP

Interestingly the other consistent group in July is another REIT, the Diversified REITs (REITDIV). It has an average return for the last 7 years in July of 6.06%, with the last 6 years Julys all positive. There are no stellar months skewing the average. The group also contains only one stock, Vonando Realty Trust [VNO].

A quick check on what the market did during the same period reveals an average return of 1.83% with 4 gaining Julys and 3 losing Julys.

The Oil & gas Equipment group (OILGASEQ) also had a decent average, but is more volatile over the past years, however the last 5 years have all been gainers.

Remember, we don’t draw conclusions here, just mine for information.

Jul 1, 2014 | chart patterns, trading strategies

It’s the beginning of the month and time to check the seasonal patterns for July. First off some background.

Our study looks at 7 years of historical data and looks at the returns for all optionable stocks for the month of July from 2006 to 2013.

We filter to find two sets of criteria

– Stocks with gains in all 7 years during July

– Stocks with losses in all 7 years in July

We do make an assumption that the month is 21 trading days and work our way back from the last day of the month. July also has the July 4th holiday and a half day trading on July 3rd. if the last day of the month falls on a weekend, then we use the first trading day prior to that date.

We make no assumptions for drawdown, nor do we look at the fundamentals behind such a pattern. We do compare the stock to the market during the same period and look at the average SPY gain/loss vs. the average stock gain/loss. This helps filter out market influence.

Finally we look at the median gain/loss and look for statistical anomalies, like meteoric gains/loss in one year.

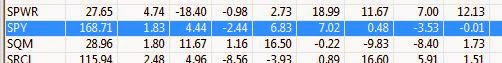

So here are the tickers that met the scan on the gain side, There was only 1 stock on the loss side. So we’ll look at the gainers only.

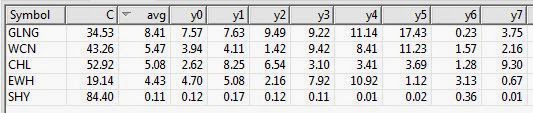

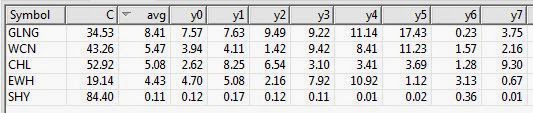

Figure 1 shows the stocks that have had gains in July, 7 years in row.

GLNG is a decent looking ticker, it’s in the LNG business. The average for July is 8.41% gain. The median is 7.63% and there’s no extreme values to skew the average. During the same test period the SPY gained an average of 1.83% with 3 losses and 4 gains.

Figure 2 shows SPY for the same period.

Figure 3 is a chart of GLNG seasonal pattern for the last 7 years in July. The solid black line is the average for the 7 years, these are percentage change day to day. Each line represents a prior year of GLNG.

Figure 3 seasonal average for GLNG average line for last 7 years

With seasonality you have to figure out what timeframe you want to analyze before anything else. Logic would seem to dictate that one week; comparing this week to the same period over X years would be the smallest time period you might consider. However there are events that seem to be seasonally predictable that occur at the end of a month or the beginning of the month. We’ll look at some these in a future article

In June we looked for the same seasonal pattern and no candidates were found on the gainers side. there were plenty on the losers side. Given that seasonally June is a bad month for the market it’s not too surprising.

Here are the July daily charts for the last 5 years for GLNG. We don’t draw conclusions here, just mine for information.

Jun 26, 2014 | chart patterns, indicators, trading strategies

Well the stock market just seems to keep chugging along. Despite the shaky economy, the national debt, the political discord, the terrorists on the march and the price of – well, just about everything made in China. And as a dutiful trend-follower I continue to “ride the ride” all the while repeating the ever apt phrase, “What, me worry?”

Three things for the record:

1) The stock market is in a clearly established uptrend and who am I to say otherwise?

2) Personally I still expect a serious “something” between now and the end of September

3) Arguably the most important bullish seasonal trend of all kicks in at the close on September 30, 2014.

Huh?

Yes folks, as of the close on September 30th it will be time for “the Mid Decade Rally”

Defining the Mid-Decade Rally

For the purposes of this article we will break each decade into two periods:

*Period 1 (i.e., the “Bullish 18″) = the 18 months extending from the end of September of Year “4” (2014, 2004, 1994, etc.)

*Period 2 (i.e., the “Other 102″) = the other 102 months of every decade.

So in a nutshell, Period 1 comprises 15% of each decade while Period 2 comprises 85% of each decade. Given that Period 2 is 5.67 times as long as Period 1 it would seem likely that an investor would make more money being in the stock market during Period 2 than during Period 1.

I mean if you had to choose – particularly given the long-term overall upward bias of the stock market – would you choose to be in the market 85% of the time or only 15% of the time. Safe to say most investors would answer the former. But if you are among those who chose this answer, perhaps you should read a little further.

Period 1: The “Bullish 18 Months” of the Decade

In Figure 1 you see the growth of $1,000 invested in the Dow Jones Industrials Average only during the middle 18 months (Sep. 30, Year 4 through Mar. 31, Year 6) of every decade starting in 1900. See if anything at all jumps out at you from the chart.

Figure 1 – Growth of $1,000 invested in Dow only during “Bullish 18” months of each decade; 1900-present

Does the word “consistency” come to mind? For the record, $1,000 invested only during this 18-month period grew to $40,948, or +3,994%. Now this all looks and sounds pretty good, but surely an investor would have made a lot more money investing in the stock market during the other 102 months of each decade, right? Well, not exactly. In fact, a more accurate statement might be, “not at all.”

Period 2: The “Other 102” Months of the Decade

Figure 2 displays the growth of $1,000 invested in the Dow Jones Industrials Average only during the other 102 months of each decade. $1,000 invested in the market 85% of the time – but excluding the mid-decade bullish period – would have grown to $6,166, or +517%.

Figure 2 – Growth of $1,000 invested in the Dow only during the “Other 102” months of each decade; 1900-present

Now for the record, +517% is +517% and no one is saying that you should simply mechanically sit out the 102 “other” months. But the point is simply that the “Bullish 18” made 7.73 times as much money – while invested only 15% of the time – as the “Other 102” – which was invested in stocks 85% of the time.

The difference is even clearer when the two lines are drawn on the same chart as shown in Figure 3.

Figure 3 – Growth of $1,000 during “Bullish 18″ month (blue line) versus “Other 102″ months (red line); 1900-present

Mid Decade “Bullish 18” Performance

| Period |

% +(-) during “Bullish 18” |

| 9/30/1904-3/31/1906 |

+68.3% |

| 9/30/1914-3/31/1906 |

+30.6% |

| 9/30/1924-3/31/1906 |

+36.2% |

| 9/30/1934-3/31/1906 |

+68.8% |

| 9/30/1944-3/31/1906 |

+36.1% |

| 9/30/1954-3/31/1906 |

+42.0% |

| 9/30/1964-3/31/1906 |

+5.6% |

| 9/30/1974-3/31/1906 |

+64.4% |

| 9/30/1984-3/31/1906 |

+50.7% |

| 9/30/1994-3/31/1906 |

+45.4% |

| 9/30/2004-3/31/1906 |

+10.2% |

Figure 3 – “Bullish 18″ month performance

For the record:

*The average % gain for the Bullish 18 was +41.7%

*The median % gain for the Bullish 18 was +42.5%

On the other hand:

*The average % gain for the Other 102 was +34.3%

*The median % gain for the Bullish 18 was -2.2%

So you see why I am marking September 30, 2014 on my calendar.

By the way, if you like this one, in the immortal words of Jimmy Durante, “I got a million of ‘em.”

Jay Kaeppel

Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Jun 10, 2014 | chart patterns, indicators, trading strategies

For the record, I am now – and have for some time been – a “reluctant bull.” I can look at a dozen different things – including the fact that they economy still shows no signs of the robustness that would typically justify the run that the stock market has enjoyed in recent years – and make an argument that the stock market is way overdue to run out of steam.

But the timeless, well-worn phrase, “The Trend is Your Friend” didn’t become a timeless, well-worn phrase for nothing.

And so I continue to “ride the ride”. But as I have mentioned more frequently of late, I am keeping a close eye on the exit. Given my present “bad attitude” I tend to focus on and point out a lot more potentially bearish developments than bullish. But what the heck, I might as well let the sun shine through on occasion. So this time out, let’s highlight one development that suggests that “The End Is (Not Necessarily) Near!”

This is one of the things that has prompted me to “sit tight” and not listen to “those voices in my head” (No not those voices, the other ones…..), despite the fact that a meaningful correction could begin at any moment.

The Bullish Outside Month

Just as it takes a lot of “thrust” to get a rocket off of the ground, a large thrust upward in the stock market can be a sign that a particular rally is in the early stages rather than the late stages.

So here is a pattern to consider:

A) This month’s low is less than or equal to last month’s low

B) This month’s close is greater than last month’s high

That’s it. In Figure 1 we see the S&P 500 monthly bar chart from 1996 to the present with these “Bullish Outside Months” highlighted in green. The first one occurred in October 1998 and launched the final surge in great bull market of the 1990’s (or as most of us above a certain age refer to it – “The Good Old Days”).

Figure 1 – Bullish Outside Months for SPX since 1996 (courtesy AIQ TradingExpert Pro)

The most recent signal occurred at the end of February of this year. This was only the 19th signal since 1970. The action of the S&P 500 index following previous signals – looking out 3 months, 6 months and 12 months after each signal – appears in Figure 2.

Figure 2 – SPX Results 3, 6 and 12 months after Bullish Outside Months (1970-Present)

As you can see, on a 3-month, 6-month and 12-month basis, the S&P 500 has been higher at least 77% of the time following previous signals. Which creates something on a conundrum.

Summary

In my mind’s eye the stock market is ridiculously overbought and “due” for a good solid “whack” sometime between now and the end of September. But this particular indicator suggests that that “whack” may not come. So for now my own primary investment strategy remains to play the long side of the market unless and until the major averages (Dow, SPX, Nasdaq 100 and Russell 2000) drop below their respective 200-day moving averages. Fairly boring yes, but it pays to mind:

Jay’s Trading Maxim #72: Boring and effective is much better than exciting and AAAAAHHHHHH!!

Jay Kaeppel

Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

May 3, 2014 | chart patterns, Risk management, Seasonality, trading strategies

I have to admit I am a little surprised. It is the last day of April and so far I have only seen a couple hundred thousand “Sell in May and Go Away” related articles, as opposed to the usual several hundred bazillion such articles that usually make their appearance about his time each year. Still, what with May due to pop up at midnight tonight it seems like as good a time as any to chime in.

What You Probably Already Know

Historically the stock market has performed much better between the end of October and the third trading day of May that it has between the third trading day of May and the end of October. To wit, sees Figure 1 and 2.

.

Figure 1 – $1,000 in the Dow from October 31st through 3rd trading day of May (1960-present)

Figure 2 – $1,000 in the Dow from 3rd trading day of May to October 31st (1960-present)

Starting on 10/31/60:

* $1,000 invested in the Dow Industrials each year at the close of trading on the last trading day of October and held through the close of the third trading day of May grew to $47,280.

* $1,000 invested in the Dow Industrials each year at the close of trading on the third trading day of May and held through the close of the last trading day of October decreased to $599.

So to put it in blunt terms:

October to May = +4,628%

May to October = (-40%)

So clearly there is something to the “Sell in May” thing. There is a caveat, however. As you can see from a perusal of Figure 2 it is not as though the stock market declines each and every year during the May to October period. So during many years selling in May and getting back in at the end of October would cause your returns to trail that of the overall market (and we can’t have that now can we?).

So that explains why roughly half of the bazillion annual “Sell in May” related articles warn against blindly selling in May.

What You Probably Don’t Know

Like they always say, sometimes it’s not what you know but who you know that counts. Or in this case, not even someone I have personally met but do associate with. Rob Hanna is the head of Hannah Capital Management (www.QuantifiableEdges.com) and is a colleague of mine in AAPTA (American Association of Professional Technical Analysts). Rob revealed in some of his work the following “guide” for determining whether to “sell in May” or not:

-If the S&P 500 experiences a drawdown of 5% or more between December 31st and April 30th, then sell in May.

-If the S&P 500 DOES NOT experience a drawdown of 5% or more between December 31st and April 30th, then DO NOT sell in May.

Doesn’t get much simpler than that. Since 1960 there have been 14 years during which the S&P 500 did not experience a 5% drawdown and an investor would have simply remained in the market. The results appear in Figures 3 and 4.

Figure 3 – $1,000 in the Dow during bullish periods applying Hanna Sell in May Filter (1960-present)

Figure 4 – $1,000 in the Dow during bearish periods applying Hanna Sell in May Filter (1960-present)

In cold hard numbers:

* $1,000 invested in the Dow Industrials each year durung the “bullish” periods described grew to $70,244.

* $1,000 invested in the Dow Industrials each year duirng the “beairsh” periods describeed decreased to $403.

So to put it in blunt terms, applying Rob Hanna’s Sell in May Filter:

*October to May (plus May to October when no Sell in May IS NOT triggered) = +6,924%

*May to October (only during years when Sell in May IS triggered) = (-59.7%)

Here’s The Bad News

As you can see in Figure 5, the S&P 500 experienced a drawdown of -5.76% between the end of December and the end of April. And -5.76% is greater than -5% (OK, mathematically speaking -5.76 is technically LESS than 5%, but you get my drift – there was a drawdown in excess of 5%).

Figure 5 – S&P 500 for 2014

So by that rule, the Sell in May model that I prefer says to sell at the close on the third trading day of May and to buy back in at the end of October (although for the record, buying at the end of September is typically better in a mid-term election year, but that’s a topic for another article).

Summary

So because the S&P 500 experienced a -5.76% drawdown is the stock market absolutely, positively doomed to decline between May and the end of October? Of course not. But the historical odds seem to suggest that caution may be in order.

Jay Kaeppel Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.