Jul 11, 2014 | EDS code, trading strategies

The AIQ code based on Perry Kaufman’s article in the June 2014 Stocks & Commodities magazine, “Slope Divergence: Capitalizing On Uncertainty,” is provided at

www.TradersEdgeSystems.com/traderstips.htm.

I have modified the implementation somewhat from the author’s descriptions. I did not find that the system was exiting in an average of six days but was holding for a longer period. My exits might be the issue so I added a time exit that can be used to force an exit after the “maxBars” input number of bars. I liked the results when my time exit was set to hold for a maximum of nine bars.

Figure 7 shows the AIQ EDS summary long-only backtest report using the NASDAQ 100 list of stocks over the prior four years ending 4/10/2014. Neither commission nor slippage have been subtracted from these results. To get the short side of the system to show a profit, I added slope filters on the NASDAQ 100 index. Note that my parameter settings differ from those suggested by the author.

FIGURE 7: AIQ, SAMPLE RESULTS. Here is a sample AIQ EDS summary long-only backtest report using the NASDAQ 100 list of stocks over the prior four years ending 4/10/2014.

The code and EDS file can be downloaded from www.TradersEdgeSystems.com/traderstips.htm. The code is also shown here:

!SLOPE DIVERGENCE: CAPITALIZING ON UNCERTAINTY

!Author: Perry Kaufman, TASC June 2014

!Coded by: Richard Denning 4/7/2014

!www.TradersEdgeSystems.com

!INPUTS:

momLen is 10.

dvgLen1 is 5.

dvgLen2 is 7.

dvgLen3 is 10.

entryNum is 3.

maxDiverg is 3.

minPrice is 10.

maxBars is 3.

!USER DEFINED FORMULAS:

C is [close].

L is [low].

H is [high].

HH is highresult(H,momLen).

LL is lowresult(L,momLen).

stoch is (C - LL) / (HH - LL).

momSlope1 is slope2(stoch,dvgLen1).

momSlope2 is slope2(stoch,dvgLen2).

momSlope3 is slope2(stoch,dvgLen3).

priceSlope1 is slope2(C,dvgLen1).

priceSlope2 is slope2(C,dvgLen2).

priceSlope3 is slope2(C,dvgLen3).

dvgBuy1 if priceSlope1 > 0 and momslope1 < 0.

dvgBuy2 if priceSlope1 > 0 and momslope2 < 0.

dvgBuy3 if priceSlope1 > 0 and momslope3 < 0.

dvgSell1 if priceSlope1 < 0 and momslope1 > 0.

dvgSell2 if priceSlope1 < 0 and momslope2 > 0.

dvgSell3 if priceSlope1 < 0 and momslope3 > 0.

nPriceSUp is priceSlope1 > 0 + priceSlope2 > 0 + priceSlope3 > 0.

nMomSUp is momSlope1 > 0 + momSlope2 > 0 + momSlope3 > 0.

nPriceSDown is priceSlope1 < 0 + priceSlope2 < 0 + priceSlope3 < 0.

nMomSDown is momSlope1 < 0 + momSlope2 < 0 + momSlope3 < 0.

dvgBuySum is dvgBuy1 + dvgBuy2 + dvgBuy3.

dvgSellSum is dvgSell1 + dvgSell2 +dvgSell3.

Buy if dvgBuySum >= entryNum and C > minPrice.

AllComboExit if (nPriceSDown = maxDiverg and nMomSDown = maxDiverg)

or (nPriceSUp = maxDiverg and nMomSUp = maxDiverg).

Time if {position days} >= maxBars.

ExitBuy if AllComboExit or Sell or Time.

Sell if dvgSellSum >= entryNum.

ExitSell if AllComboExit or Buy or Time.

Jul 8, 2014 | chart patterns, group sector rotation, Seasonality, trading strategies

While looking through the seasonal trends in stocks and currencies, we decided to start running the seasonality scans on the S & P 500 groups. As a reminder here are the criteria we consider when running this.

Our study looks at 7 years of historical data and looks at the returns for all groups in the S & P 500 for the month of July from 2006 to 2013.

We do make an assumption that the month is 21 trading days and work our way back from the last day of the month. July also has the July 4th holiday and a half day trading on July 3rd. if the last day of the month falls on a weekend, then we use the first trading day prior to that date.

We make no assumptions for drawdown, nor do we look at the fundamentals behind such a pattern. We do compare the group to the market during the same period and look at the average SPY gain/loss vs. the average group gain/loss. This helps filter out market influence.

Finally we look at the median gain/loss and look for statistical anomalies, like meteoric gains/loss in one year. Here are top 5 performing groups based on average return.

Average return alone is misleading. In the seasonal analysis we need consistent patterns in the price action throughout the periods we are testing, in this case 7 years. While The S & P 500 Motorcycle manufacturers group (MTRCYCLE) looks good on average, it includes one stellar July of 37.50% back in 2010, and has 2 July’s that were negative returns. NOTE: there’s only one stock in the group (guess which one that is!).

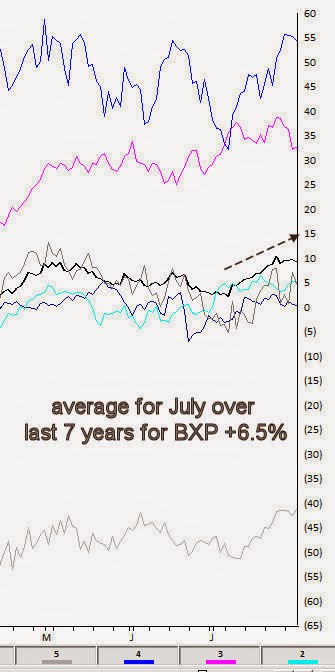

The office REITs group (REITOFC) is more consistent. It has an average return for the last 7 years in July of 6.50%, with the last 6 years Julys all positive. There are no stellar months skewing the average. The group also contains only one stock, Boston Properties [BXP].

Here’s the seasonal chart for BXP

Interestingly the other consistent group in July is another REIT, the Diversified REITs (REITDIV). It has an average return for the last 7 years in July of 6.06%, with the last 6 years Julys all positive. There are no stellar months skewing the average. The group also contains only one stock, Vonando Realty Trust [VNO].

A quick check on what the market did during the same period reveals an average return of 1.83% with 4 gaining Julys and 3 losing Julys.

The Oil & gas Equipment group (OILGASEQ) also had a decent average, but is more volatile over the past years, however the last 5 years have all been gainers.

Remember, we don’t draw conclusions here, just mine for information.

Jul 1, 2014 | chart patterns, trading strategies

It’s the beginning of the month and time to check the seasonal patterns for July. First off some background.

Our study looks at 7 years of historical data and looks at the returns for all optionable stocks for the month of July from 2006 to 2013.

We filter to find two sets of criteria

– Stocks with gains in all 7 years during July

– Stocks with losses in all 7 years in July

We do make an assumption that the month is 21 trading days and work our way back from the last day of the month. July also has the July 4th holiday and a half day trading on July 3rd. if the last day of the month falls on a weekend, then we use the first trading day prior to that date.

We make no assumptions for drawdown, nor do we look at the fundamentals behind such a pattern. We do compare the stock to the market during the same period and look at the average SPY gain/loss vs. the average stock gain/loss. This helps filter out market influence.

Finally we look at the median gain/loss and look for statistical anomalies, like meteoric gains/loss in one year.

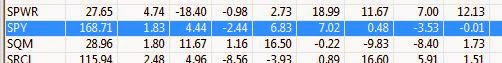

So here are the tickers that met the scan on the gain side, There was only 1 stock on the loss side. So we’ll look at the gainers only.

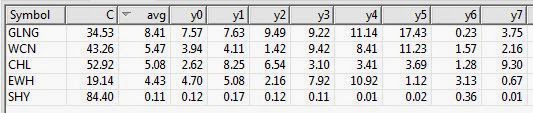

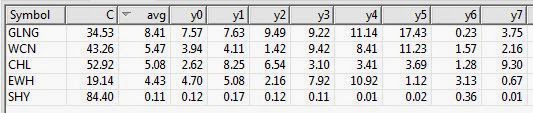

Figure 1 shows the stocks that have had gains in July, 7 years in row.

GLNG is a decent looking ticker, it’s in the LNG business. The average for July is 8.41% gain. The median is 7.63% and there’s no extreme values to skew the average. During the same test period the SPY gained an average of 1.83% with 3 losses and 4 gains.

Figure 2 shows SPY for the same period.

Figure 3 is a chart of GLNG seasonal pattern for the last 7 years in July. The solid black line is the average for the 7 years, these are percentage change day to day. Each line represents a prior year of GLNG.

Figure 3 seasonal average for GLNG average line for last 7 years

With seasonality you have to figure out what timeframe you want to analyze before anything else. Logic would seem to dictate that one week; comparing this week to the same period over X years would be the smallest time period you might consider. However there are events that seem to be seasonally predictable that occur at the end of a month or the beginning of the month. We’ll look at some these in a future article

In June we looked for the same seasonal pattern and no candidates were found on the gainers side. there were plenty on the losers side. Given that seasonally June is a bad month for the market it’s not too surprising.

Here are the July daily charts for the last 5 years for GLNG. We don’t draw conclusions here, just mine for information.

Jun 26, 2014 | chart patterns, indicators, trading strategies

Well the stock market just seems to keep chugging along. Despite the shaky economy, the national debt, the political discord, the terrorists on the march and the price of – well, just about everything made in China. And as a dutiful trend-follower I continue to “ride the ride” all the while repeating the ever apt phrase, “What, me worry?”

Three things for the record:

1) The stock market is in a clearly established uptrend and who am I to say otherwise?

2) Personally I still expect a serious “something” between now and the end of September

3) Arguably the most important bullish seasonal trend of all kicks in at the close on September 30, 2014.

Huh?

Yes folks, as of the close on September 30th it will be time for “the Mid Decade Rally”

Defining the Mid-Decade Rally

For the purposes of this article we will break each decade into two periods:

*Period 1 (i.e., the “Bullish 18″) = the 18 months extending from the end of September of Year “4” (2014, 2004, 1994, etc.)

*Period 2 (i.e., the “Other 102″) = the other 102 months of every decade.

So in a nutshell, Period 1 comprises 15% of each decade while Period 2 comprises 85% of each decade. Given that Period 2 is 5.67 times as long as Period 1 it would seem likely that an investor would make more money being in the stock market during Period 2 than during Period 1.

I mean if you had to choose – particularly given the long-term overall upward bias of the stock market – would you choose to be in the market 85% of the time or only 15% of the time. Safe to say most investors would answer the former. But if you are among those who chose this answer, perhaps you should read a little further.

Period 1: The “Bullish 18 Months” of the Decade

In Figure 1 you see the growth of $1,000 invested in the Dow Jones Industrials Average only during the middle 18 months (Sep. 30, Year 4 through Mar. 31, Year 6) of every decade starting in 1900. See if anything at all jumps out at you from the chart.

Figure 1 – Growth of $1,000 invested in Dow only during “Bullish 18” months of each decade; 1900-present

Does the word “consistency” come to mind? For the record, $1,000 invested only during this 18-month period grew to $40,948, or +3,994%. Now this all looks and sounds pretty good, but surely an investor would have made a lot more money investing in the stock market during the other 102 months of each decade, right? Well, not exactly. In fact, a more accurate statement might be, “not at all.”

Period 2: The “Other 102” Months of the Decade

Figure 2 displays the growth of $1,000 invested in the Dow Jones Industrials Average only during the other 102 months of each decade. $1,000 invested in the market 85% of the time – but excluding the mid-decade bullish period – would have grown to $6,166, or +517%.

Figure 2 – Growth of $1,000 invested in the Dow only during the “Other 102” months of each decade; 1900-present

Now for the record, +517% is +517% and no one is saying that you should simply mechanically sit out the 102 “other” months. But the point is simply that the “Bullish 18” made 7.73 times as much money – while invested only 15% of the time – as the “Other 102” – which was invested in stocks 85% of the time.

The difference is even clearer when the two lines are drawn on the same chart as shown in Figure 3.

Figure 3 – Growth of $1,000 during “Bullish 18″ month (blue line) versus “Other 102″ months (red line); 1900-present

Mid Decade “Bullish 18” Performance

| Period |

% +(-) during “Bullish 18” |

| 9/30/1904-3/31/1906 |

+68.3% |

| 9/30/1914-3/31/1906 |

+30.6% |

| 9/30/1924-3/31/1906 |

+36.2% |

| 9/30/1934-3/31/1906 |

+68.8% |

| 9/30/1944-3/31/1906 |

+36.1% |

| 9/30/1954-3/31/1906 |

+42.0% |

| 9/30/1964-3/31/1906 |

+5.6% |

| 9/30/1974-3/31/1906 |

+64.4% |

| 9/30/1984-3/31/1906 |

+50.7% |

| 9/30/1994-3/31/1906 |

+45.4% |

| 9/30/2004-3/31/1906 |

+10.2% |

Figure 3 – “Bullish 18″ month performance

For the record:

*The average % gain for the Bullish 18 was +41.7%

*The median % gain for the Bullish 18 was +42.5%

On the other hand:

*The average % gain for the Other 102 was +34.3%

*The median % gain for the Bullish 18 was -2.2%

So you see why I am marking September 30, 2014 on my calendar.

By the way, if you like this one, in the immortal words of Jimmy Durante, “I got a million of ‘em.”

Jay Kaeppel

Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Jun 16, 2014 | bonds, trading strategies

With the Fed “pumpin’” and the economy “thumpin’” (as in “thumping along like a flat tire”) it seems unlikely that interest rates would rise. Still, sometimes is makes sense to go against the grain if enough evidence presents itself. So let me show you what I am looking at in the bond market.

EWJ vs. T-Bonds

As I wrote about in a previous article (T-Bonds and Japanese Stocks, Inversely….), for whatever reason, t-bonds have long exhibited a strong inverse correlation to Japanese stocks (no, seriously). In Figure 1 we see EWJ (the ETF that tracks Japanese stocks) with a 5 week and 30 week moving average drawn in the top clip. In the bottom clip we see ticker TLT (the ETF that tracks the 30-year t-bond). You can see that – using highly technical terms that we quantitative analysts types like to use to impress others with how much we know about the markets – when EWJ “zigs”, TLT tends to “zag”, and vice versa.

Figure 1 – EWJ with 5-30 week moving averages versus TLT (Courtesy: AIQ TradingExpert)

This past weekend the 5-week moving average for EWJ once again rose back above the 30-week moving average for EWJ. If history is an accurate guide then this may be a negative sign for t-bonds. Although I would be remiss if I did not invoke:

Jay’s Trading Maxim #216: History is not always an accurate guide (but it beats flipping a coin).

Figure 2 displays the raw dollar gain or loss from:

a) Holding a long position in t-bond futures (1 point movement = $1,000) when EWJ 5-week is below EWJ 30-week (red line)

b) Holding a long position in t-bond futures (1 point movement = $1,000) when EWJ 5-week is above EWJ 30-week (blue line)

Figure 2 – $(-) from a long position in t-bonds futures when EWJ 5-week MA is BELOW EWJ 30-week MA (red line) and $(-) from a long position in t-bonds futures when EWJ 5-week MA is ABOVE EWJ 30-week MA (blue line) (12/31/1997 to present)

Obviously this indicator is not perfect, but equally obvious is the fact that bonds have typically performed better when the EWJ 5-week MA is below that EWJ 30-week MA. So let’s call this – if nothing else – a potentially negative sign.

TLT vs. Elliott Wave

I am not a true “ElliottHead” but I do tend to pay attention to the Elliott Wave count for a given market when the daily and weekly counts point in the same direction. Figures 3 and 4 present the latest daily and weekly Elliott Wave counts for TLT as figured by ProfitSource by HUBB.

The daily count just completed a bullish Wave 5 (i.e., implying that the latest rally has run its course) and the weekly count is signaling a potentially Bearish Wave 4 sell signal. For the record, I do not believe in the “magic” of Elliott Wave. But I do like when daily and weekly signs for just about any indicator appear to confirm one another.

Figure 3 – Daily Elliott Wave Count for TLT; Completed Wave 5 suggests rally is over (Courtesy: ProfitSource by HUBB)

Figure 4 – Weekly Elliott Wave Count for TLT; signaling potentially Bearish Wave 5 signal (Courtesy: ProfitSource by HUBB)

Ways to Play

So if a trader buys the idea that t-bonds will decline in price in the months ahead, there are lots of way to play. A trader could:

*Sell short 100 shares of ticker TLT. This would require roughly $5850 of margin money and would technically entail unlimited risk.

*Trader could buy 100 shares of ticker TBT, an inverse leveraged ETF that is designed to track t-bonds times minus 2 (In other words, if bonds decline -1%, then ticker TBT should rally roughly +2%). This would require roughly $6,200.

*Buy a put option on ticker TLT.

*Buy a call option on ticker TBT.

There are pros and cons to each, but the trade that I want to highlight is buying a call on ticker TBT.

Call on TBT

If t-bonds do decline, then TBT would be expected to advance, hence the reason for considering a call option on TBT. The reason I am looking at this trade is simply because it offers the most “bang for the buck.” Not only are TBT shares leveraged 2 to 1, but by buying a call option we can obtain even more leverage with limited risk. As you can see in Figure 5, TBT has support at roughly $56 and resistance at roughly $80.

Figure 5 – TBT; support near $56, resistance near $80 (Courtesy: AIQ TradingExpert)

So let’s look at buying the September 62 call for $281 (NOTE: the bid/ask is fairly wide at $2.62/$2.81. For illustrative purpose I am simply assuming a market order and a fill at $2.81. An astute trade might consider a limit order that splits the difference). Figure 6 displays the risk curves for buying the Sep TBT 62 call at $2.81.

As you can see, in the worst case the maximum loss is $281. In the best case – i.e., TBT rallies all the way back up to $80, the trade can generate a profit in excess of $1,500. Also there are three months for “something” to happen.

Summary

As always, I am not “recommending” this trade. I am simply pointing out some potentially bearish evidence that I have found in regards to t-bonds and have highlighted “one way” to play such a situation using the limited risk associated with options.

So will t-bonds take a tumble and in turn, will TBT soar, thus generating an excellent rate of return? As always, “It beats the heck out of me.” But from a trader’s perspective, the real question is, “Am I willing to risk $281 to find out?”

Jay Kaeppel

Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.

Jun 10, 2014 | chart patterns, indicators, trading strategies

For the record, I am now – and have for some time been – a “reluctant bull.” I can look at a dozen different things – including the fact that they economy still shows no signs of the robustness that would typically justify the run that the stock market has enjoyed in recent years – and make an argument that the stock market is way overdue to run out of steam.

But the timeless, well-worn phrase, “The Trend is Your Friend” didn’t become a timeless, well-worn phrase for nothing.

And so I continue to “ride the ride”. But as I have mentioned more frequently of late, I am keeping a close eye on the exit. Given my present “bad attitude” I tend to focus on and point out a lot more potentially bearish developments than bullish. But what the heck, I might as well let the sun shine through on occasion. So this time out, let’s highlight one development that suggests that “The End Is (Not Necessarily) Near!”

This is one of the things that has prompted me to “sit tight” and not listen to “those voices in my head” (No not those voices, the other ones…..), despite the fact that a meaningful correction could begin at any moment.

The Bullish Outside Month

Just as it takes a lot of “thrust” to get a rocket off of the ground, a large thrust upward in the stock market can be a sign that a particular rally is in the early stages rather than the late stages.

So here is a pattern to consider:

A) This month’s low is less than or equal to last month’s low

B) This month’s close is greater than last month’s high

That’s it. In Figure 1 we see the S&P 500 monthly bar chart from 1996 to the present with these “Bullish Outside Months” highlighted in green. The first one occurred in October 1998 and launched the final surge in great bull market of the 1990’s (or as most of us above a certain age refer to it – “The Good Old Days”).

Figure 1 – Bullish Outside Months for SPX since 1996 (courtesy AIQ TradingExpert Pro)

The most recent signal occurred at the end of February of this year. This was only the 19th signal since 1970. The action of the S&P 500 index following previous signals – looking out 3 months, 6 months and 12 months after each signal – appears in Figure 2.

Figure 2 – SPX Results 3, 6 and 12 months after Bullish Outside Months (1970-Present)

As you can see, on a 3-month, 6-month and 12-month basis, the S&P 500 has been higher at least 77% of the time following previous signals. Which creates something on a conundrum.

Summary

In my mind’s eye the stock market is ridiculously overbought and “due” for a good solid “whack” sometime between now and the end of September. But this particular indicator suggests that that “whack” may not come. So for now my own primary investment strategy remains to play the long side of the market unless and until the major averages (Dow, SPX, Nasdaq 100 and Russell 2000) drop below their respective 200-day moving averages. Fairly boring yes, but it pays to mind:

Jay’s Trading Maxim #72: Boring and effective is much better than exciting and AAAAAHHHHHH!!

Jay Kaeppel

Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro (http://www.aiq.com) client

Jay has published four books on futures, option and stock trading. He was Head Trader for a CTA from 1995 through 2003. As a computer programmer, he co-developed trading software that was voted “Best Option Trading System” six consecutive years by readers of Technical Analysis of Stocks and Commodities magazine. A featured speaker and instructor at live and on-line trading seminars, he has authored over 30 articles in Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, Futures & Options magazine and on-line at www.Investopedia.com.