AI Market Timing Signals – how to confirm

The WinWay TradingExpert Pro Market Timing signals are not a perfect system. If they were no doubt the founders would have kept it secret and traded the signals themselves.

The signals that give us early waring of a change in direction of the market are proprietary. The 400 rules that are used by the Artificial Intelligence inference engine to determine change of market direction use many of the widely known technical tools, read review here.

The rating calculation and the indicators contributing to the ratings have not been changed for many years. A decision was made some years ago to avoid constantly moving the goalposts as the constant optimizing or back fitting erodes the validity of the system.

High ratings to the upside or downside of notice have to be 95 or greater (the maximum is 100). the ratings are considered confirmed when the Phase indicator that is outside of the AI system, changes in the direction of the high rating.

So ratings have fired in the last few months how do we confirm them?

We look for the Phase indicator ( a derivative of MACD) to change in the direction of the signal. This needs to occur within a 3 day window before or after the rating.

The last 2 market timing signals illustrate this nicely.

August 18, 2022 97-2 up signal on the market

The up signal occurred during a a 3 day down period on the uptrend, however the Phase indicator did not change direction (it would need to turn up after going down) within the window for confirmation. This signal is therefore unconfirmed by Phase.

August 22, 2022 down signal on the market

The down signal occurred on 8-22-22. 100 down is the strongest signal the market timing generates. In this case the Phase turned down after a prolonged upward move, on the day before the signal. This is considered a confirmed down signal on the market.

The rules that contributed to 0-100 down on the market

The 100 down signal is the strongest signal the AI system generates. Here are the major technical events that contribute to this rating.

Trend Status has changed to a strong down trend. This indicates that a downward trend has started that may continue in this direction. This is a moderate bearish signal.

The 21 day stochastic has declined below the 80% line and the price phase indicator is decreasing. In this strongly downtrending market this is an indication that the downtrend will continue.

Volume accumulation percentage is decreasing and the 21 day stochastic has moved below the 80% line. In this strongly down market, this is taken as a very strong bearish signal that could be followed by a downward price movement.

The exponentially smoothed advance/decline line has turned negative when the up/down volume oscillator and the advance/decline oscillator are already negative. In this market, this is viewed as a bearish signal that could precede a downward price movement.

The up/down volume oscillator has turned negative when the exponentially smoothed advance/decline line and the advance/decline oscillator are already negative. In this market, this is viewed as a bearish signal that could precede a downward price movement.

The new high/new low indicator has reversed to the downside. This is a reliable bearish signal that is often followed by an downward price movement. In this market a continued strong downtrend can be expected.

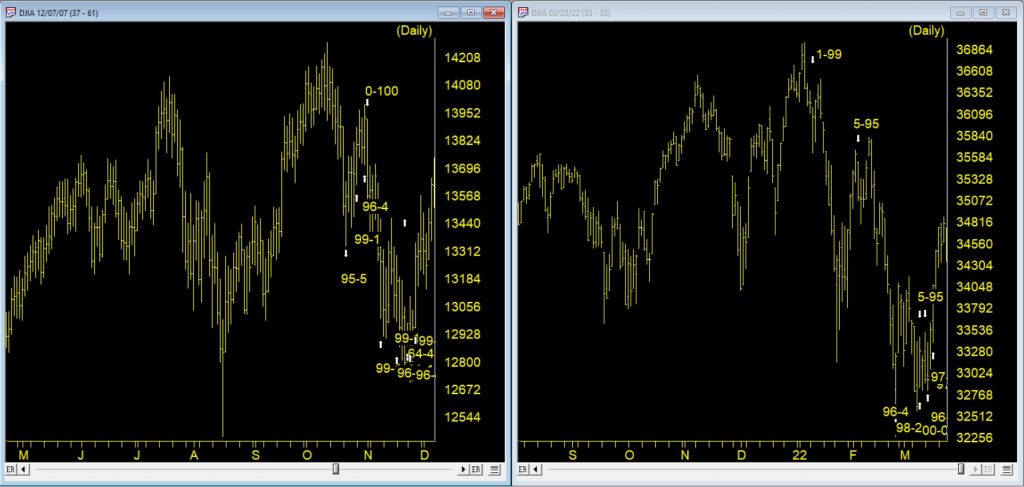

A plethora of market ERs – we’ve seen this before

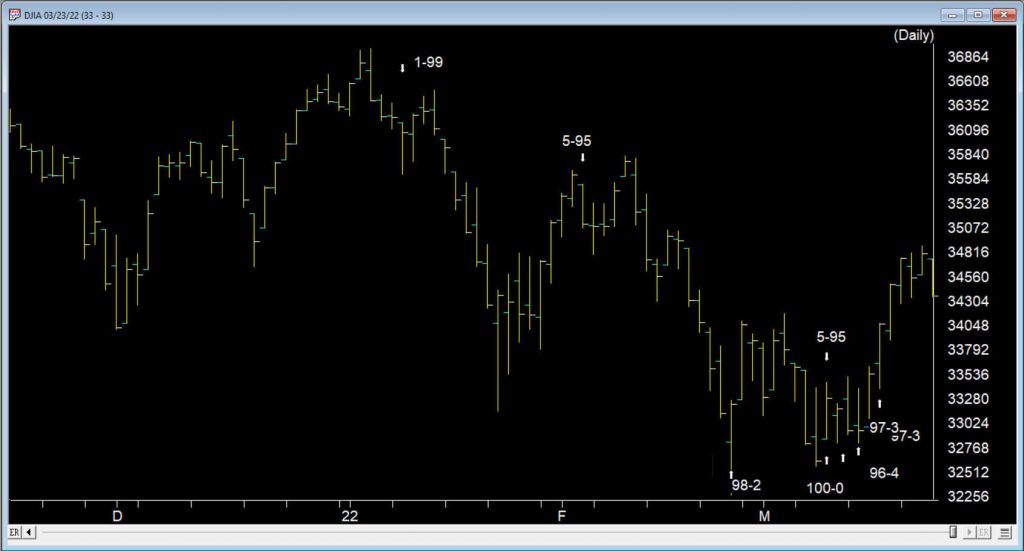

As we reach the end of March 2022, the volatility in the markets continues with large range days and varying volume levels.

When the market is in a trend, we might see 2 or 3 high Expert Ratings warning us of a potential change in direction. At the tail end of 2021 and the first 10 days of 2022, we had 3 down signals, the last of the 3 at 1-99 was on 1/10/22. The market moved down solidly to the 33280 level before rallying 2/3rds of the down move.

There was no up rating at the bottom as prices moved back up and one up rating early February that didn’t pan out. However, between 2/24 and 3/16 there was six signals, 5 of them up. That’s in only 14 trading days.

Between the 2/24 up signal and the 3/14 up signal there were 9 distinct bullish ER rules showing. There was also several that were duplicated bullish ER rules. Add to this 4 new distinct ER rules on the up signal 3/16, that adds up to the busiest ER cluster for a very long time.

Here are the first 9 distinct rules contributing the cluster of ratings

- The Money Flow Indicator has reversed and is now advancing. In this sideways market, this is read as a bullish indication that the market could move up from this point because of the inflow of funds.

- The 21 day stochastic has advanced and crossed the 20% line and the price phase indicator is also in- creasing. In this strongly downtrending market this is taken as a strong bullish signal suggesting an increase in prices.

- The price phase indicator is negative but volume accumulation has started to advance. This is a non-conformation that, regardless of the type of market, is a bullish signal which usually results in an upward movement of the market.

- The Money Flow Indicator has reversed and is now advancing. In this downtrending market, this is taken as a weak bullish signal that could indicate an upward movement in the market averages.

- The advance/decline oscillator has turned positive with volume accumulation already positive. In this strong downward trend this is read as a strong non- confirmation of the current trend which could be followed by a reverse in price direction to the upside.

- The new high/new low indicator has reversed to the upside. This is a reliable bullish signal that is often followed by an upward movement in prices. In this strong downtrending market a reverse in trend could start shortly.

- Volume accumulation percentage is increasing and the 21 day stochastic has moved above the 20% line. In this downtrending market, this is taken as a strong bullish signal that could be followed by an upward price movement.

- The new high/new low indicator has reversed to the upside. This is a reliable bullish signal that is often followed by an upward movement in prices. In this weak downtrending market an uptrend could start shortly.

- Intraday low prices of the market have declined to a 21 day low. But the volume accumulation percentage is positive. In this market, this is taken as a weak bullish signal that could be followed by an upward price movement.

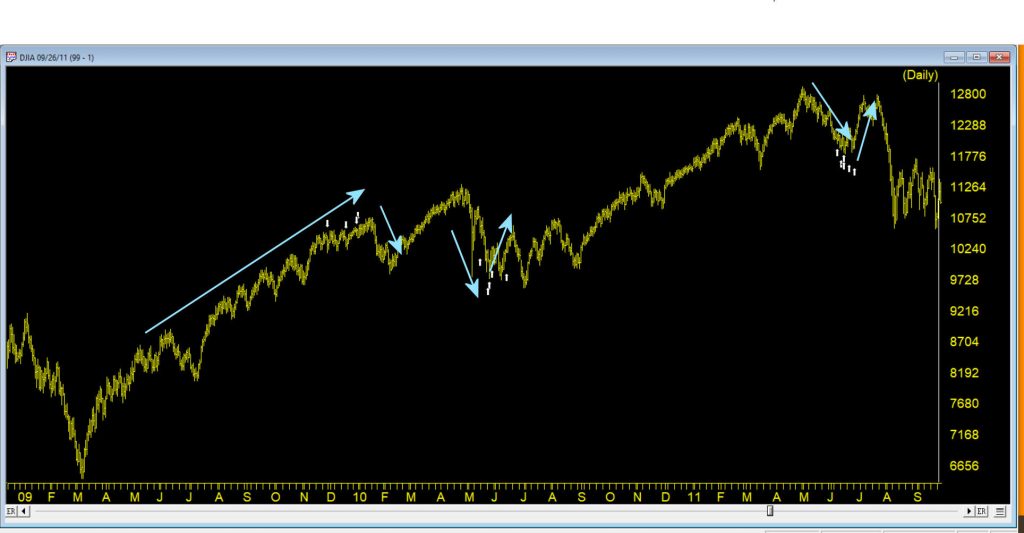

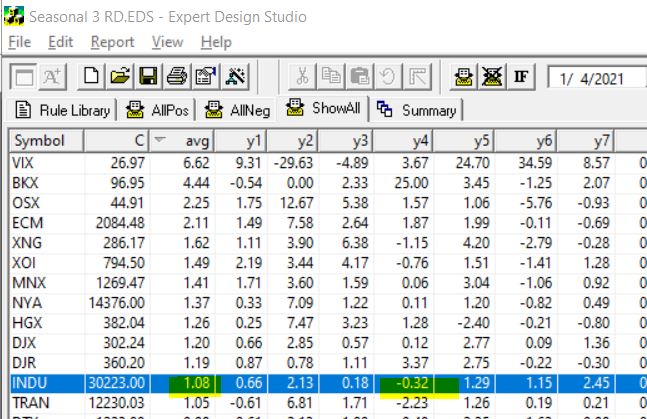

So when was the last time we saw this many ratings so close together?

It happens in clusters particularly in advance of a move against the current trend of the market. The ER system is inherently counter trend. This chart shows some cluster from 2009 – 2011.

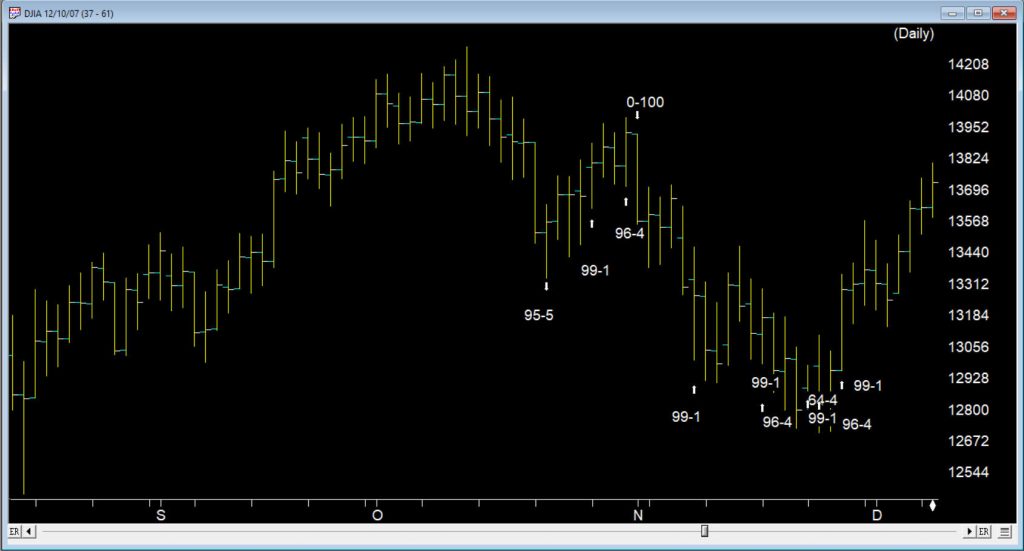

One example was way back at the tail end of 2007, when another cluster of buy signals occurred in a similar fashion. Following a 100 down on 11/01/07 the market gave ground until 11/08/07, the first of 6 buy signals in 13 trading days through to 11/28/07

The market ERs are not perfect but they provide us with key insights into the way the internals are performing.

Where does the market go from here?

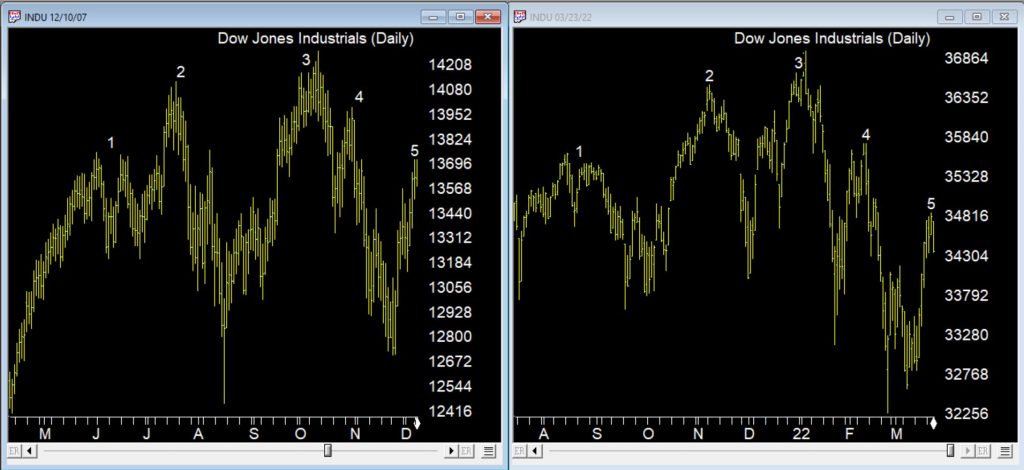

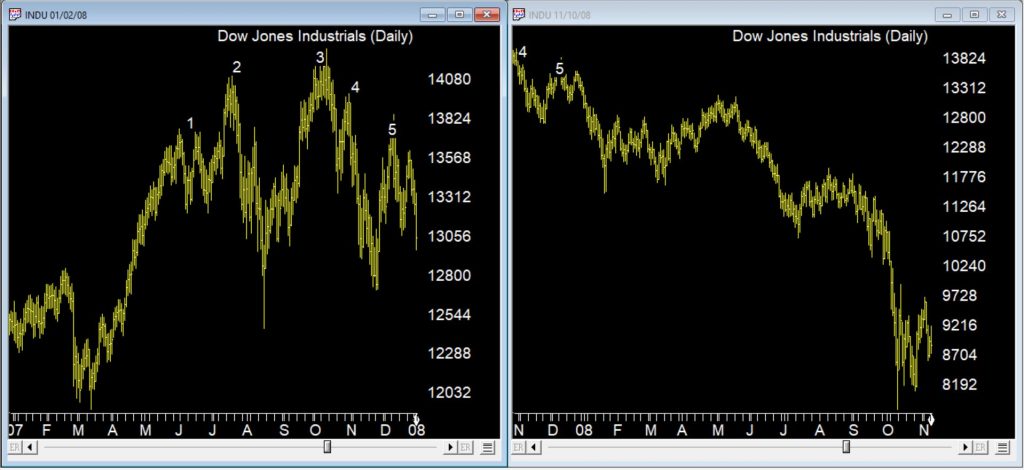

This chart above was back at the start of the 2007/8 bear market. So how do the chart patterns compare between 2022 and 2007/8? The chart below, on the left shows the 2007/8 market through early December 2007 following a strong move up after the cluster of up signals. The right charts shows current market with a strong up move following the cluster of up signals

There are some similarities between current price action and the topping pattern back in 2007, one being the measured way this pattern is emerging over several months. The chart below is the same time periods compared but with the ERs showing.

The bear market that followed in 2008 is in the Chart below.

The market moved down in a series of measured moves until we reached late September 2008 and the sharp downturn occurred. No guarantees we’re in the same market, but keep an eye out for those counter trend cluster ERs if we are, they may provide warning of rallies.

WinWay TradingExpert Pro is programmed with the knowledge and insight of respected technical analysts, experts who have developed technical analysis indicators and systems for the last 50 years. The up/down timing signals issued by TradingExpert Pro are based on this knowledge. Since TradingExpert Pro’s timing signals are generated on a scientific basis, free of bias or emotion, you get a disciplined, objective approach to stock market timing.

The timing signals produced by the WinWay expert system are in the form of Expert Ratings. Behind each Expert Rating is a set of rules that combine the sound principles of technical analysis with the experience of market professionals. Since no single technical indicator works all the time, using indicators in combination increases their reliability. For example, a rule is developed that combines the readings of two or more indicators.

This rule is then more reliable than the reading of a single indicator. Within TradingExpert Pro are two knowledge bases, one specifically designed to issue market timing signals and the other designed to issue stock timing signals. Each TradingExpert Pro knowledge base contains approximately 400 rules, but only a few “fire” on any given day.

In the language of expert systems, those rules that are found to be valid on a particular day are described as having “fired”. Rules can fire in opposite directions. When this happens, the bullish and bearish rules fight it out. It’s only when bullish rules dominate that the Expert Rating signal is bullish, or when bearish rules dominate that the Expert Rating signal is bearish.

Market Timing Expert System signals through 1-21-22

Your WinWayCharts includes the AIQ Market Timing AI rating system. In this short video we’ll discuss the last 4 AI ratings on the Dow Jones Industrial average and examine the rules that fired to generate these signals.

AIQ TradingExpert Pro is programmed with the knowledge and insight of respected technical analysts, experts who have developed technical analysis indicators and systems for the last 50 years. The up/down timing signals issued by TradingExpert Pro are based on this knowledge. Since TradingExpert Pro’s timing signals are generated on a scientific basis, free of bias or emotion, you get a disciplined, objective approach to stock market timing.

The timing signals produced by the AIQ expert system are in the form of Expert Ratings. Behind each Expert Rating is a set of rules that combine the sound principles of technical analysis with the experience of market professionals. Since no single technical indicator works all the time, using indicators in combination increases their reliability. For example, a rule is developed that combines the readings of two or more indicators. This

rule is then more reliable than the reading of a single indicator. Within TradingExpert Pro are two knowledge bases, one specifically designed to issue market timing signals and the other designed to issue stock timing signals. Each TradingExpert Pro knowledge base contains approximately 400 rules, but only a few “fire” on any given day.

In the language of expert systems, those rules that are found to be valid on a particular day are described as having “fired”. Rules can fire in opposite directions. When this happens, the bullish and bearish rules fight it out. It’s only when bullish rules dominate that the Expert Rating signal is bullish, or when bearish rules dominate that the Expert Rating signal is bearish.

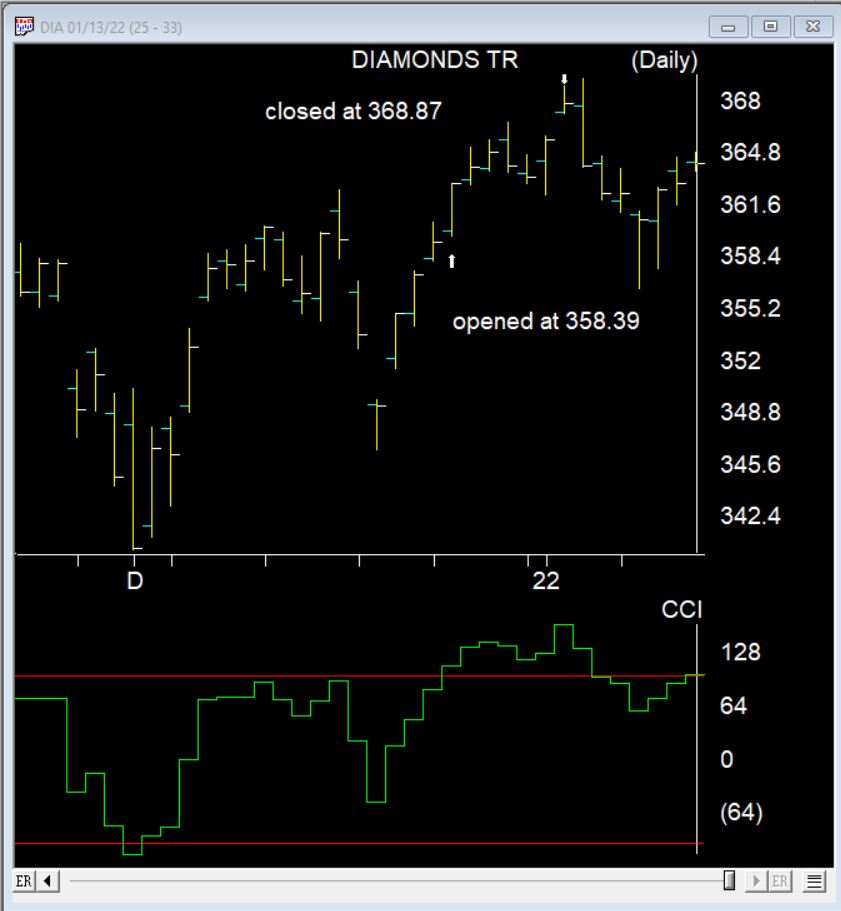

How’d the Santa Claus rally go?

December 20, 2021 we published this seasonality article on the Santa Claus rally https://winwaycharts.com/wordpress/tis-the-season-to-be-cautious/ In a nutshell we looked at the last 5 trading days of the year and the first 2 trading days of the next year. We looked back over the last 7 years to see if the rally holds up.

The Dow clearly did show an average rally of over 1% during those 7 trading days.

So how did things go this Santa Claus rally?

Here’s the DIA the ETF that follows the Dow during the 7 day Santa Claus rally. It made a nice gain of 2.9%. 2 days later things turned down.

Keeping a Wary Eye on the “Scary Stuff”

In many ways the markets imitate life. For example, the trend is your friend. You may enjoy your friendship with the trend for an indefinite length of time. But the moment you ignore it – or just simply take it for granted that this friendship is permanent, with no additional effort required on your part – that’s when the trouble starts.

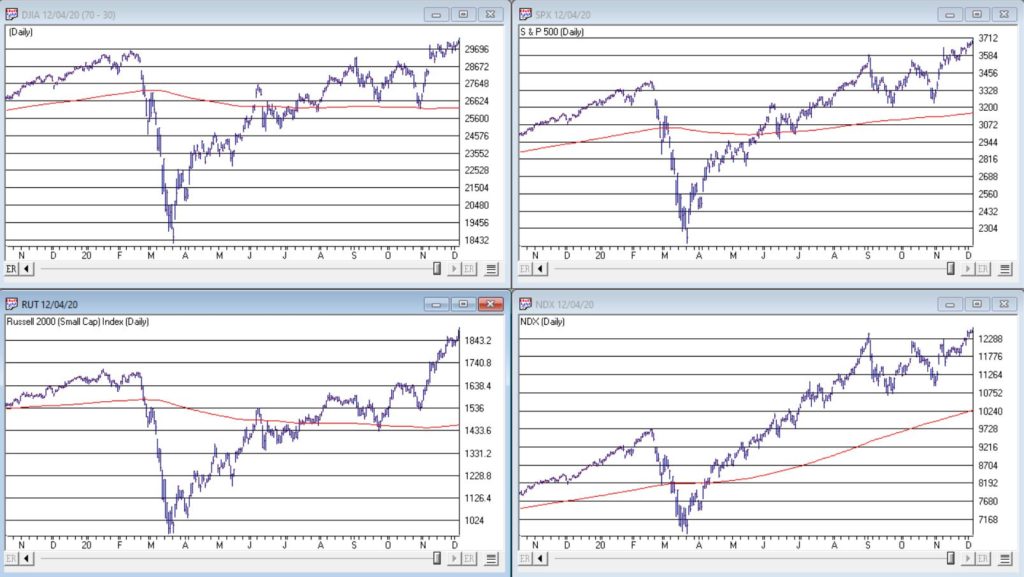

For the stock market right now, the bullish trend is our friend. Figure 1 displays the 4 major indexes all above their respective – and rising – long-term moving averages. This is essentially the definition of a “bull market.”

Figure 1 – 4 Major Indexes in Bullish Trends (Courtesy WinWayCharts)

In addition, a number of indicators that I follow have given bullish signals in the last 1 to 8 months. These often remain bullish for up to a year. So, for the record, with my trusted trend-following, oversold/thrust and seasonal indicators mostly all bullish I really have no choice but to be in the bullish camp.

Not that I am complaining mind you. But like everyone else, I try to keep my eyes open for potential signs of trouble. And of course, there are always some. One of the keys to long-term success in the stock market is determining when is the proper time to actually pay attention to the “scary stuff.” Because scary stuff can be way early or in other cases can turn out to be not that scary at all when you look a little closer.

So, let’s take a closer look at some of the scary stuff.

Valuations

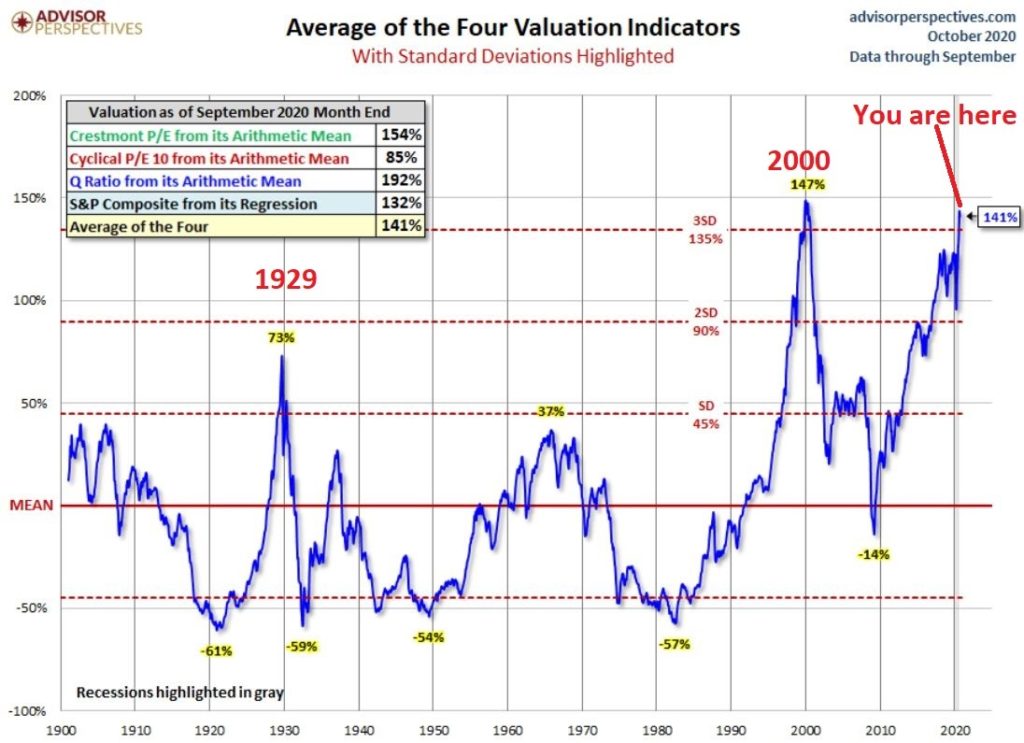

Figure 2 displays an aggregate model of four separate measures of valuation. The intent is to gain some perspective as to whether stocks are overvalued, undervalued or somewhere in between.

Figure 2 – Stock Market valuation at 2nd highest level ever (Courtesy: www.advisorperspectives.com)

Clearly the stock market is “overvalued” if looked at from a historical perspective. The only two higher readings preceded the tops in 1929 (the Dow subsequently lost -89% of its value during the Great Depression) and 2000 (the Nasdaq 100 subsequently lost -83% of its value).

Does this one matter? Absolutely. But here is what you need to know:

*Valuation IS NOT a timing indicator. Since breaking out to a new high in 1995 the stock market has spent most of the past 25 years in “overvalued” territory. During this time the Dow Industrials have increased 700%. So, the proper response at the first sign of overvaluation should NOT be “SELL.”

*However, ultimately valuation DOES matter.

Which leads directly to:

Jay’s Trading Maxim #44: If you are walking down the street and you trip and fall that’s one thing. If you are climbing a mountain and you trip and fall that is something else. And if you are gazing at the stars and don’t even realize that you are climbing a mountain and trip and fall – the only applicable phrase is “Look Out Below”.

So, the proper response is this: instead of walking along and staring at the stars, keep a close eye on the terrain directly in front of you. And watch out for cliffs.

Top 5 companies as a % of S&P 500 Index

At times through history certain stocks or groups of stocks catch “lightning in a bottle.” And when they do the advances are spectacular, enriching anyone who gets on board – unless they happen to get on board too late. Figure 3 displays the percentage of the S&P 500 Index market capitalization made up by JUST the 5 largest cap companies in the index at any given point in time.

Figure 3 – Top 5 stocks as a % of S&P 500 Index market cap (Courtesy: www.Bloomberg.com)

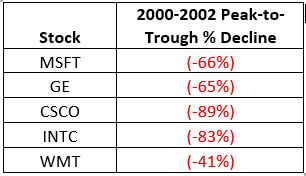

The anecdotal suggestion is pretty obvious. Following the market peak in 2000, the five stocks listed each took a pretty significant whack as shown in Figure 4.

Figure 4 – Top Stocks after the 2000 Peak

Then when we look at how far the line in Figure 3 has soared in 2020 the obvious inference is that the 5 stocks listed for 2020 are due to take a similar hit. And here is where it gets interesting. Are MSFT, AAPL, AMZN, GOOGL and FB due to lose a significant portion of their value in the years directly ahead?

Two thoughts:

*There is no way to know for sure until it happens

*That being said, my own personal option is “yes, of course they are”

But here is where the rubber meets the road: Am I presently playing the bearish side of these stocks? Nope. The trend is still bullish. Conversely, am I keeping a close eye and am I willing to play the bearish side of these stocks? Yup. But not until they – and the overall market – actually starts showing some actual cracks.

One Perspective on AAPL

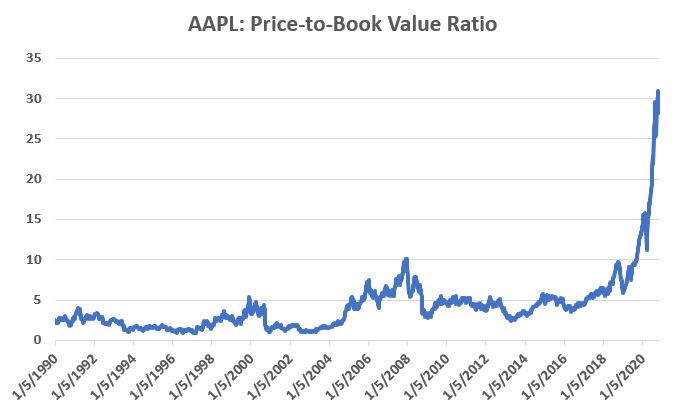

Apple has been a dominant company for many years, since its inception really. Will it continue to be? I certainly would not bet against the ability of the company to innovate and grow its earnings and sales in the years ahead. Still timing – as they say – is everything. For what it is worth, Figure 5 displays the price-to-book value ratio for AAPL since January 1990.

Figure 5 – AAPL price-to-book value ratio (Data courtesy of Sentimentrader.com)

Anything jump out at you?

Now one can argue pretty compellingly that price-to-book value is not the way to value a leading technology company. And I probably agree – to a point. But I can’t help but look at Figure 5 and wonder if that point has possibly been exceeded.

Summary

Nothing in this piece is meant to make you “bearish” or feel compelled to sell stocks. For the record, I am still in the bullish camp. But while this information DOES NOT constitute a “call to action”, IT DOES constitute a “call to pay close attention.”

Bottom line: enjoy the bull market but DO NOT fall in love with it.

Jay Kaeppel

Disclaimer: The information, opinions and ideas expressed herein are for informational and educational purposes only and are based on research conducted and presented solely by the author. The information presented represents the views of the author only and does not constitute a complete description of any investment service. In addition, nothing presented herein should be construed as investment advice, as an advertisement or offering of investment advisory services, or as an offer to sell or a solicitation to buy any security. The data presented herein were obtained from various third-party sources. While the data is believed to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. International investments are subject to additional risks such as currency fluctuations, political instability and the potential for illiquid markets. Past performance is no guarantee of future results. There is risk of loss in all trading. Back tested performance does not represent actual performance and should not be interpreted as an indication of such performance. Also, back tested performance results have certain inherent limitations and differs from actual performance because it is achieved with the benefit of hindsight.