Harness your trading potential – using Darren Winters preferred trading software

Harness your trading potential April 26, 2018

Join us at Wealth Training offices for a full day seminar using WinWayCharts

Darren Winters preferred trading software

New to WinWayCharts or a veteran looking for a refresher, this seminar is for you. We’ll be covering in detail the application of Darren Winters indicators and strategies within the trading software and taking you through some of the powerful tools that will make your analysis easier and save you time.

Now more than ever, stock traders need an edge to successfully trade stocks

We really don’t care if the market goes up or down. With the right tools, used the right way, there are always opportunities to make money trading stocks.

In this full-day seminar, Steve Hill, founder of WInWayCharts, will start at the top with the powerful Market Analysis tools, Sector Rotation and Stock Selection, plus he’ll recap technical indicators that Darren uses and reveal additional confirming indicators that are essential for making good trading decisions, .

All of this will build up to developing a trading strategy that suits your trading style. Finally he’ll take you through trade execution and trade management with live market action and trades. With this traders blueprint, you’ll have the tools you need to take your trading efficiency to a new level.

Rare opportunity to spend the day with

WinWayCharts founder Steve Hill

Those of you have had an opportunity to spend time with Steve at sessions at Wealth Training will appreciate his broad and in-depth knowledge and experience in trading analysis. Darren and Steve have worked together to develop and improve the WinWayCharts software throughout the last 10 years. Today the WinWayCharts platform is one of the fastest and most comprehensive stock analysis tools in the world.

You’ll need to be on your toes for this seminar. Every session is designed to enhance your current trading skill and take you to the next logical step as a trader.

Topics covered in this action-packed day include:

– Market Timing – a thorough breakdown of WinWayCharts Market Timing and how to use it effectively

– Sector Rotation – Tools for identifying leading and lagging sectors and how to maximize your investments

– Technical indicators you have in WinWayCharts that every trader and investor must use

– Hidden tools in your WinWayCharts that can save you time and make you money

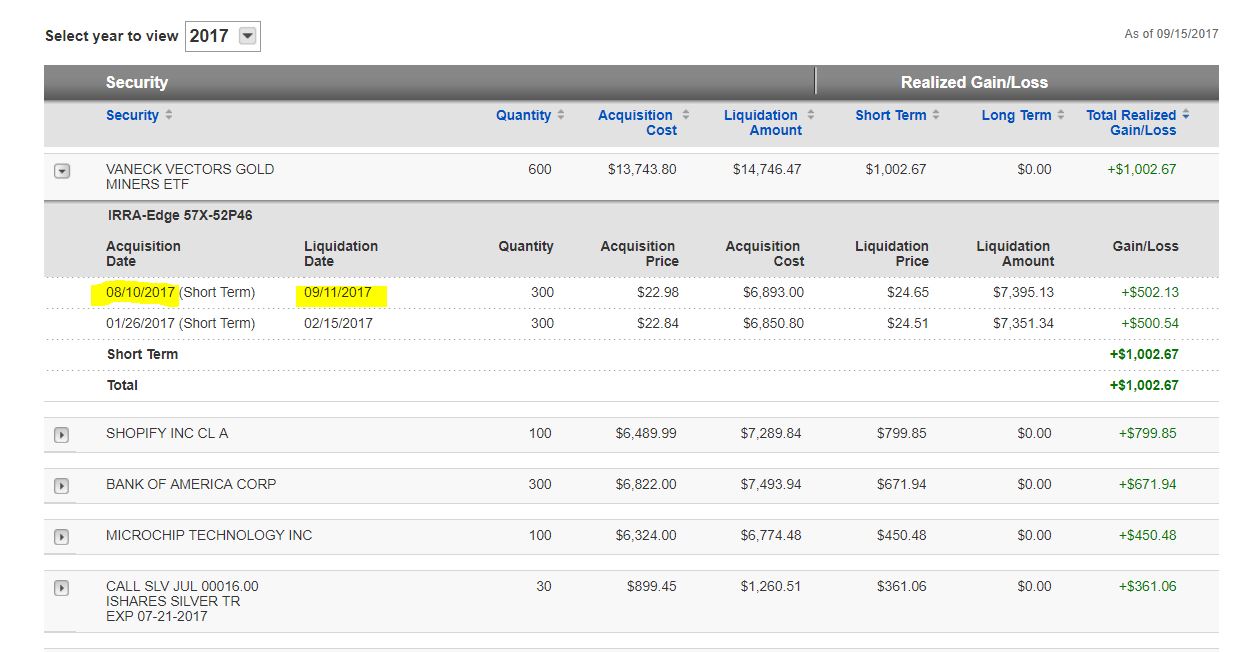

– Steve trading account, establishing positions, portfolio management of established positions, exiting positions and live trades in action

This opportunity won’t be available again this year!

ONLY a few more days left to lock in the early bird price

ONLY $649

$499

a $150 saving

A Simple Indicator for Traders

First the Bad News: There are no “magic bullets” when it comes to trading. There are people in this industry who have literally tested somewhere in the range of six bazillion “indicators” – give or take (“Hi. My name is Jay”). Every trend following indicator looks like a gold mine when it latches onto a huge trend and rides it (but not so much when it starts getting whipsawed). And every overbought/oversold indicator looks like a gift from heaven from time to time when it somehow manages to peak (or valley) and then reverses right at a high (or low). And then the next time the thing gets oversold the security in question just keeps plunging and the previously “amazingly accurate” indicator just gets more and more oversold.

Bottom line: what I am about to discuss is likely no better or worse than a lot of other indicators. And it is no holy grail. Still, I kinda like it – or whatever that is worth.

EDITORS NOTE an WinWay EDS file for this indicator with the 3 step rules outlined can be downloaded from here you will need to copy or save this file into your wintes32/eds strategies folder. Alternatively the code is available at the end of this article for copying and pasting into a new EDS file.

UpDays20

I call this indicator UpDays20 and I stole, er, learned it originally from Tom McClellan of McLellan Financial Publications. My calculation may be slightly different because I wanted an indicator that can go both positive and negative.

For a given security look at its trading gains and losses over the latest 20 trading days.

UPDays20 = (Total # of Up days over the last 20 trading days) – 10

So if 10 of the last 20 trading days showed a gain then UpDays20 would read exactly 0.

If only 6 of the last 20 trading days showed a gain then UpDays20 would read -4

You get the idea (and proving once again that it “doesn’t have to be rocket science”). As a “trading method” it is always advised that this indicator – like most all other indicators – NOT be used as a standalone approach to trading. That being said, the way I follow this indicator is as follows.

Step 1) UpDays20 drops to at least -2

Step 2) UpDays20 rises 2 points from a low

Step 3) The security in question then rises above its high for the previous 2 trading days

It is preferable to follow this setup hen the security in question is above its 200-day moving average, but that is up to the trader to decide (the danger to using this with a security below its 200-day moving average is that it might just be in the middle of a freefall. The upside is that counter trend rallies can be fast and furious – even if sometimes short-lived).

Again, there is nothing magic about these particular steps. They are simply designed to do the following:

1) Identify an oversold condition

2) Wait for some of the selling pressure to abate

3) Wait for the security to show some sign of reversing to the upside

Like just about every other indicator/method, sometimes it is uncannily accurate and sometimes it is embarrassingly wrong (hence the reason experienced traders understand that capital allocation and risk management are far more important than the actually method you use to enter trades).

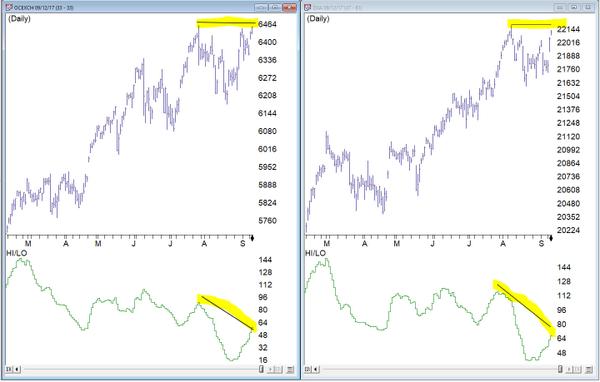

In this previous article (in Figures 3 and 4) I wrote about using this indicator with ticker TLT. Figure 1 and 2 display the “buy” signals generated using the rules above for tickers IYT and GLD.

Figure 1 – UpDays20 “Buy” Alerts for ticker IYT (Courtesy TradingExpert)

Figure 2 – UpDays20 “Buy” Alerts for ticker GLD (Courtesy TradingExpert)

Are these signals good or bad? That is in the eye of the beholder and not for me to say. One big unanswered question is “when do you exit”? That is beyond the scope of this “idea” article – however, “sell some at the first good profit and then use a trailing stop” looks like a decent approach to consider) but would have a profound effect on any actual trading results.

Some of the signals displayed in Figures 1 and 2 are obviously great, others are maybe not so hot. Interestingly, some of the signals in Figure 1 and 2 that don’t look to timely at first blush actually offered a profitable opportunity to a trader who was inclined to take a quick profit. Again, how you allocate capital and when you exit with a profit and when you exit with a loss would likely have as much impact on results as the raw “buy” signals themselves.

Summary

No one should go out and start trying to trade tomorrow based on UpDays20. No claim is being made that the steps detailed herein will result in profits nor even that this is a good way to trade.

But, hey, it’s one way.

Jay Kaeppel Chief Market Analyst at JayOnTheMarkets.com and TradingExpert Pro client.

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

EDITORS NOTE an WinWay EDS file for this indicator with the 3 step rules outlined can be downloaded from here you will need to copy or save this file into your wintes32/eds strategies folder. Alternatively the code is available at the end of this article for copying and pasting into a new EDS file.

! UpDays20 – I call this indicator UpDays20. For a given security look at its trading gains and losses over the latest 20 trading days.

! UPDays20 = (Total # of Up days over the last 20 trading days) – 10!

So if 10 of the last 20 trading days showed a gain then UpDays20 would read exactly 0.

! If only 6 of the last 20 trading days showed a gain then UpDays20 would read -4

Upday if [close]>val([close],1).

totalupdayslast20days is CountOf(upday,20).

updayindicator is totalupdayslast20days – 10.

! How to follow this indicator

! Step 1) UpDays20 drops to at least -2

! Step 2) UpDays20 rises 2 points from a low

! Step 3) The security in question then rises above its high for the previous 2 trading days

UpDays20rises2points if updayindicator>valresult(updayindicator,1) and valresult(updayindicator,1)>valresult(updayindicator,2).

updays20atminus2orlower if valresult(updayindicator,2)<=-2.

closesabovehighof2priordays if [close]>val([high],1) and [close]>val([high],2).

Upsignal if UpDays20rises2points and updays20atminus2orlower and closesabovehighof2priordays.

A message from WinWay Charts founder – Steve Hill

Successful Trading: Developing a Mindset and Process

Reserve your seat now for this full-day seminar

It’s the final piece in your stock trading armoury

Steve Hill, is the founder and President of WinWay Charts, Darren Winters preferred trading software.

A native Londoner, Steve has over 25 years experience as both a trading analysis software developer and trading educator. He has trained countless clients in the disciplined analysis and trading mindset necessary to successfully trade in today’s markets.

Using WinWay Charts, he’ll take you through the entire process from analysis, stock selection, trade execution and trade management. With this traders blueprint, you’ll have the tools you need to take your trading efficiency to a new level.

The Dow and NASDAQ are at or near the highs but the broader market indicators are signaling something else. Steve will show you how to use the built-in market analysis tools in WinWay Charts to gain in-depth analysis,

|

Rare opportunity to spend the day with WinWay Charts founder

|

||

|

||

|

Topics covered in this action-packed day include:

|

|

|

|

This opportunity won’t be available again this year!

WinWay Charts Shortcut keys

Action keys

A Toggle vertical date cursor line to a diamond and back

D Quick-change the date

G Toggle grid lines on or off

F Display fundamental information

W Toggle between daily and weekly data

M Toggle trendline drawing on or off (also crosshairs)

S Process a stock split or mutual fund distribution

T Add ticker to a tag list

U Untag ticker from tag list

O Overlay feature

P Print active chart

L Toggle Log Scales on or off

V Set tag list

Z Toggle Zoom feature on or off (temporarily hide current indicators)

Function keys

F1 Help

F5 Close all open charts

F10 Toggle Control Panel on or off

Ctrl+O Display Chart Ticker dialog box

Esc Display Chart Ticker dialog box

Enter Toggle between Indicator and Explore panels

Ctrl+M Display Market Charts

Ctrl+Enter Display Indicator Constants box

Ctrl+left/right arrow Quick search for Expert Ratings

Alt+N Display ticker Notes

? Display ER rules

+ Explore right

– Explore left

* Explore up

/ Explore down

Left/right arrows Move date one period

Up/down arrows Select indicators or scroll through a list