Sep 2, 2016 | educational newsletters, ETFs, jay kaeppel, seasonal

Recently Jay Kaeppel of Jay On The Markets posted an update on the Seasonal Bonds Strategy using TMF. The gist of the strategy is straightforward, “Long TMF on the last 5 day of each month”

I’ve posted the article below.

Here’s a seasonal chart of the last 3 years with the average of the 3 years (black line). I colored the last 5 trading days of the average line in yellow to see what Jay was referring to. 8 of the 12 months were positive, 2 flat and 2 negative. Looks pretty good. At the bottom of the page you can see the returns this strategy yields.

BTW this Chart type, known as a seasonality chart will be included in the next AIQ TradingExpert Pro release this fall (OK marketing bit over)

So of course the bond market

rewarded my “brilliance” with a swift kick in the you know where in the months of March and April 2015 and especially in August 2015.

This would typically be enough to cause many people to go, “Well that guy’s and idiot” and to move on. But fortunately in this case, the market is a marathon and not a sprint.

Update

Figure 1 displays the results generated by:

*Holding long 1 t-bond futures contract ONLY for the last 5 days of each month since 12/30/1983

*Holding long 1 t-bond futures contract during all other days since 12/30/1983

Figure 1 – Long 1 t-bond futures contract ONLY during last 5 trading days of month (blue) versus long 1 t-bond futures contract on all other days (red); 12/31/1983-8/12/2016

The results sort of speak for themselves.

After I wrote about my aggressive TMF strategy, TMF (of course)

got hit very hard (as triple leveraged ETFs will do from time to time, hence the use of the words “aggressive” and “risky”), in March 2015 (-4.5%), April 2015 (-5.3%) and especially in August 2015 (-11.5%).

Still, as you can see in Figure 2, things have rebounded nicely since (hmmm, maybe I should be worried).

Figure 2– Growth of $1,000 Long ETF ticker TMF ONLY during last 5 trading days of month (blue) versus long TMF all other days; (red); 12/9/2009-8/12/2016

So far the “Long TMF on the last 5 day of each month” strategy is up +31.8% for the year in 2016.

| Year |

Last 5 TDM Long TMF |

| 2009* |

+12.9% |

| 2010 |

+33.4% |

| 2011 |

+15.2% |

| 2012 |

+35.7% |

| 2013 |

+6.7% |

| 2014 |

+45.7% |

| 2015 |

+6.8% |

| 2016** |

+31.8% |

*-Starting 4/16/2009 when TMF started trading

**-Through 8/12/2016

Summary

So did this odd little strategy “weather the storm” and “take the market’s best shot” in 2015 and now it is “smooth sailing”? Probably not. Make no mistake – this is a strategy that entails a great deal of risk. Still, for aggressive traders looking for an “edge”, it might be worth a closer look.

Jay Kaeppel

Aug 23, 2016 | educational newsletters, jay kaeppel, seasonal, trading strategy

Some days are just better than others – am I right or am I right? As a corollary, some days are worse than others. Wouldn’t it be nice to know in advance which days were going to be which?

Well, when it comes to the stock market, maybe you can.

The 3 Days to Miss

For our purposes we will refer to the very last trading day of the month as TDM -1. The day before that will be TDM -2, the one before that TDM -3, etc. Now let’s focus specifically on TDMs -7, -6 and -5.

Let’s now assume that we will buy and hold the Dow Jones Industrials Average every day of every month EXCEPT for those three days – i.e., we will sell at the close of TDM -8 every single month and buy back in 3 days later. We will refer to this as Jay’s -765 Method. Granted some may not be comfortable trading this often, but before dismissing the idea please consider the results.

Figure 1 displays the growth of $1,000 invested in the Dow as described above versus the growth of $1,000 from buying and holding the Dow.

*The starting date for this test is 12/1/1933.

*For this test no interest is assumed on the 3 days a month spent out of the market.

Figure 1 – Growth of $1,000 invested in Dow Industrials during all days EXCEPT TDM -7,TDM -6 and TDM -5 (blue line) versus $1,000 invested in Dow Industrials using buy-and-hold (red line); 12/1/1933-8/15/2016

For the record:

*Jay’s -765 Method gained +94,190%

*The Dow buy-and-hold gained +18,745%

While these results are compelling, the real “Wow” comes from looking at would have happened if you had been long the Dow ONLY on TDMs -7,-6 and -5 every month since 1933. These results appear in Figure 2 (but you’d better brace yourself before taking a glance).

Figure 2 – Growth of $1,000 invested in the Dow ONLY on the 7th to last, 6th to last and 5th to last trading days of every month since 12/1/1933

The net result is an almost unrelenting 83 year decline of -80%.

Summary

I would guess that some readers would like me to offer a detailed and logical reason as to why this works. Unfortunately, I will have to go with my stock answer of “It beats me.” Of course, as a proud graduate of “The School of Whatever Works” (Team Cheer: “Whatever!”) I am not as interested in the “Why” of things as I am the “How Much.”

Sorry, it’s just my nature.

Jay Kaeppel

Jul 29, 2016 | educational newsletters, ETFs, jay kaeppel, trading strategy

It pains me to say that I don’t know where the stock market is going next. You would think that after being in the markets for so long and following a bunch of indicators and systems etc., that by now I would have developed some ability to divine what is coming next.

Alas, I have not.

But I do know three things:

*My trend-following stuff is bullish so I need to give the bullish case the benefit of the doubt (no matter how nervous or cynical I may be).

*Based on a variety of indicators the market is certainly getting overbought

So, a thought today for those who might be wishing to hedge away some of their market risk.

Ticker TZA

Ticker TZA is not necessarily one of my favorites. It is an ETF that tracks 3 times the inverse of the Russell 2000 small-cap index. In other words, if ticker RUT falls 1% today then TZA should rise 3%. There are two primary concerns to keep in mind before considering buying shares of TZA are:

*The shares are extremely volatile

*The shares have experienced a serious downside bias – even when RUT is headed sideways (See Figure 1).

Figure 1 – Ticker TZA (black bars) versus Ticker RUT (Russell 2000) (Courtesy

AIQ TradingExpert)

So if you are going to buy TZA you’d better pick your spots. As I discussed here we are entering an “interesting” time for the market. So let’s explore the possibility of buying a call option on ticker TZA as a hedge against a potential market decline.

Call Option on TZA

Remember, TZA should increase in value if the Russell 2000 declines. Therefore, a call option on TZA should also increase in value if the Russell 2000 declines.

As you can see in Figure 2, the “implied volatility” (which generally tells you whether there is a lot of time premium built into the price of the options for a given security) for options on TZA is near the low end of the historical range. This tells us that there is relatively little time premium built into TZA options, therefore they are “cheap”.

Figure 2 – Implied option volatility for options on TA near the low end of the historical range (Courtesy

www.OptionsAnalysis.com)

Next I ran the “Percent to Double” routine in

www.OptionsAnalysis.com (see output in Figure 3. The phrase “percent to double” tells us what percentage the underlying stock must rise in order for the call option to double in price.

Figure 3 – Percent to Double routine suggests buying Sep30 TZA call which will double in price if TZA rises 12.56% (i.e., if RUT declines by roughly -4.19%) (Courtesy

www.OptionsAnalysis.com)

Figures 4 and 5 display the particulars and risk curves for buying 10 TZA Sep 30 calls.

A few things to note:

*The cost to buy 10 is $2,550.

*TZA is trading at $30.25/share.

*The breakeven price for this trade is $32.25 (if TZA is below $32.25 at expiration and we still hold this position then we will lose -$2,250)

*There are 50 days left until September expiration

*The trade has unlimited profit potential

Regarding potential, in Figure 6 we see that if TZA rallies back to its June low of $33.77 this trade will generate a profit of between $1,500 and $2,400 depending on how soon that price is reached

Summary

Is this a good trade? I can’t say for sure that it is. In fact, the only way this trade makes money is if the broader market suffers a hit, so a good part of me would prefer to see this trade “not work out”.

But the point of all of this is simply to point out that it is possible to hedge against a significant market decline by buying call options on an inverse leveraged ETF.

Mr. Market, you take it from here.

Jay Kaeppel

Jul 28, 2016 | educational newsletters, jay kaeppel, seasonal

We are entering an “interesting” time of year for investors (Unfortunately, that’s “Interesting” as in the ancient Chinese curse stating “May you live in interesting times”).

Now I personally I have no idea if the stock market is going to break out to the upside and rally to further new highs or if this latest lull will be followed by a painful reversal of fortune. I am willing to play the long side as long as things are holding up/moving in the right direction. But investors should be aware that the August/September timeframe is the “Danger Zone” for the stock market historically.

August/September Historically

Figure 1 speaks for itself. The chart displays the growth of $1000 invested in the Dow Jones Industrials Average only during the months of August and September every year starting in1934.

Figure 1 – Growth of $1,000 invested in Dow Jones Industrials Average (using price data only) ONLY during August and September; 12/31/1933-present

Two key takeaways:

*The net result has been a loss of -53% or the past 82 year. Not exactly the kind of returns most of us are looking for.

HOWEVER

*Despite the negative net results, the fact is that the Aug/Sep period has showed a gain more often (45 times) than not (37 times).

So while caution appears to be in order, no one should assume that the next two months are doomed to show a loss.

Stocks versus Bonds

Figure 2 compares the performance of:

Ticker VFINX – Vanguard S&P 500 Index fund

*Ticker VFIIX – Vanguard Mortgage Bond Fund

(*VFIIX is used as a proxy for intermediate-term treasuries as it has a high correlation to IT treasuries and a longer data history. Any short-to-intermediate term treasury fund or ETF would likely produce similar results)

The test starts in 1980 (when VFIIX started trading) and shows the total return for buying and holding each fund ONLY during the months of August and September each year since.

Figure 2 – Growth of $1,000 invested in VFINX (stocks; blue line) versus VFIIX (bonds; red line); August 1980 to present

Summary

So what will it be this year? A breakout to new highs? Or something much worse? I wish I could tell you the answer. But at least now you have some information to help guide your “speculative” versus “conservative” instincts in the months ahead.

Jay Kaeppel

Jul 13, 2016 | educational newsletters, fundamental analysis

Dividends for U.S. companies continue to be under pressure as fewer issues are increasing payments and those issues that do increase do so at a lower rate. Within the S&P 500®, the average dividend increase for Q2 2016 was +10.56%, down from +10.62% in Q1 2016 and +13.08% for all of 2015. The pace of dividend cuts continues to rise, as Q2 saw a substantial increase in cuts from mid and small-cap energy issues, with the overall aggregate dollar 12-month cuts rising 157% over the prior 12-month period. Yet, the over-all dividend increases continue to outweigh the decreases. So the outlook remains positive.

Energy and Materials issues are expected to remain under pressure for 2016, potentially resulting in disappointing announcements for earnings, capital investments, buybacks and dividends. Assuming dividend policies remain unchanged, the U.S. equity market in 2016 is positioned to set another record in payments, especially in the S&P 500®, but the increase is seen as being in the mid-single digit range, not the double-digits seen over the past few years.

The good news for dividends is that, while things are difficult, the majority of issues continue to increase and have the resources to do so for the near future.

Large, Mid, Small Caps

Within the S&P 500®, 418 issues, or 82.8% currently pay a dividend. All 30 members of the Dow Jones Industrial Average® pay a dividend as well.

Within the S&P Mid Cap 400®, 69.3% of the issues within pay a cash dividend, a decrease from 70.3% in Q1 2016. Within the S&P Small Cap 600®, 51.4% of the issues pay a dividend, which is unchanged from Q1 2016.

Yields continued to vary among the various market indices.

Large-Caps at 2.17% (no change from the 2.17% in Q1 2016).

Mid-Caps at 1.68% (1.69% in Q1 2016).

Small-Caps at 1.38% (1.47% in Q1 2016).

The yields across dividend paying market-size classifications continue to be compatible, with large-caps coming in at 2.54% (the same as Q1 2016), mid-caps at 2.37% (2.36% in Q1 2016) and small-caps at 2.47% (2.50% in Q1 2016).

Contributed by Top Stock Analyzer

Stocks which received upward revisions to current year consensus earnings estimates and show a lower uncertainty of earnings tend to outperform over time…..LEARN MORE

Jul 11, 2016 | educational newsletters, market timing, one minute stock

The Dow rallied for 251 points on Friday, closing at 18,147. It was up 197 points for the week. The NASDAQ finished up 80 points on Friday and up 94 points for the week.

After the BLS said that 287K new jobs were created in June, the market shot up and tested the April 20 high. The Dow actually came within one point of making a new high before pulling back from overbought conditions.

This week I’m posting three charts that show where the Dow, Gold, and the Dollar are in their current patterns.

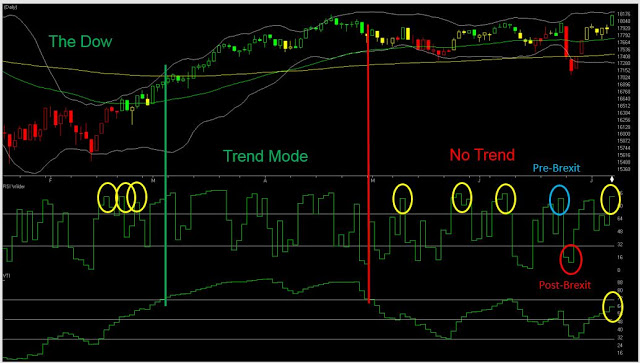

The first chart of the Dow shows that once again, the 2-period RSI Wilder is overbought with No Trend in place. So the Dow should start to pull back early next week.

Gold and the Dollar are another matter. As you can see from the second chart, GLD continues to remain in a strong uptrend. The VTI is above the 70 level and continues to move higher. GLD closed at 130.52 on Friday and appears to be right on track for a move to the 134+ level.

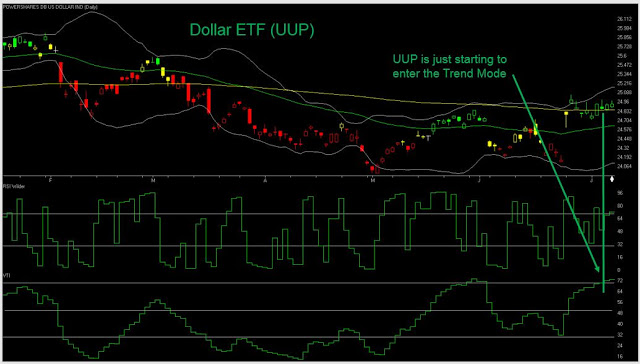

But the chart of the Dollar shows a fly in the ointment. For the past three days, the VTI on the chart of UUP is showing that it is also starting to enter the Trend Mode. This is a major concern, because it is extremely unusual for the Dollar and Gold to be rising at the same time. The only time this tends to happen is when there is major trouble in the world.

It happens because people are so concerned about their money that they are flocking to safe havens. And it’s not only happening with individual investors, it’s happening with companies too. We’re seeing this in a lot of European countries now where investors are willing to pay the banks money (negative interest) just so they can get their money back at some point in the future. It’s insane!

Prior to Brexit, I warned that this could happen. I said U.S stocks, gold and the Dollar could be perceived as safe havens, and all three could rise post-Brexit. But I don’t believe this condition will last. Something has to give. A strong dollar makes it extremely difficult for most U.S. companies to sell their products abroad. It will impact their earnings. There are no two ways about it. As long as the dollar continues to rise, large cap U.S. stocks will face strong headwinds.

And right now, most U.S. stocks are not cheap. The current P/E ratio for the S&P500 is a whopping 24.61! Compare this to its historic mean of 15.60 and you will quickly see that stocks are severely overvalued. The reason they are being priced so high now is because companies are buying back shares, and investors are being pushed into stocks because most other investments are paying diddly squat. This is a very dangerous situation.

The fact that most companies are buying back their own shares is really something you should think about. Usually the only time a company buys back its own shares is because they believe the stock price is too cheap! The stock price might have been reduced because of a temporary slip in earnings or some unusual one time event. In normal times, a company would not do this. In normal times, a company would use any excess cash it generates to expand. They would buy additional equipment or hire more people. After all, they’re in business to make money. But this is NOT happening now. The reason its not happening now is because companies are worried. They are not buying new equipment or hiring new workers despite the fact that the June Jobs Report was positive. Given May’s horrible report of only 34K new jobs and its subsequent downward revision to 11K, the June report MUST be considered suspect.

So think about this. If a company is worried about its future, doesn’t it seem strange to pay on average, 25 times earnings to buy back its stock? If they were buying back stock at 10-12 tries earnings, I could understand. But at 25 times earnings, buying back shares is not a strange strategy, it’s crazy!

It’s a strategy that can support the price of the stock for a while, but longer term, it’s not something that will lead to actual growth. I also believe it’s a very risky strategy. Share buyback programs and cost cutting measures are temporary accounting tricks. They make the price of a stock seem attractive to unsuspecting investors, especially seniors, who are being forced into the stock market because they need income (dividends). But eventually, if companies are going to keep their share price supported, they will have to show profits produced by real growth. With earnings season about to begin next week, and an overbought market, it should be interesting to watch what what happens as these companies report.

Protect yourself.

That’s what I’m doing,

The Professor