Oct 7, 2011 | Uncategorized

By Jay Kaeppel

No single indicator will accurately forecast or coincide with every market top or bottom. Here, two indicators have been combined to form one indicator that can increase your chances of identifying buy or sell points.

As a student of the market, I have crunched a few numbers over the years. At the same time I have tried, and cautioned others also, to avoid the temptation to divide one number by another or multiply one number by another simply because we can.

Not every calculation involving market indicators enjoys any real purpose. In addition, many indicators react in a manner similar to other indicators. Almost all overbought/oversold indicators tend to get more oversold as the market declines and more overbought as the market rallies. So stringing together more than a handful of similar indicators does not necessarily provide any additional benefit.

The AIQ EDS code for Jay Kaeppel’s Jkhl indicator discussed in his article in this issue, “The JK HiLo Index,” can be downloaded from www.TradersEdgeSystems.com/traderstips.htm.

AIQ SYSTEMS, THE JK HILO INDEX. This chart shows the JKHL indicator on a chart of the S&P 500 index together with a 200-bar moving average.

! THE JK HILO INDEX

! Author: Jay Kaeppel, TASC October 2011

! Coded by: Richard Denning 8/12/2011

! www.TradersEdgeSystems.com

! HIGH-LOW INDICATORS:

! JKlogic:

NewH is TickerUDF(“OCEXCH”,[New Highs]).

NewL is TickerUDF(“OCEXCH”,[New Lows]).

Adv is TickerUDF(“OCEXCH”,[Adv Issues]).

Dec is TickerUDF(“OCEXCH”,[Dec Issues]).

Unch is TickerUDF(“OCEXCH”,[Unch Issues]).

Tot is Adv + Dec + Unch.

PctNH is (NewH / Tot) * 100.

PctNL is (NewL / Tot) * 100.

HLidx is min(PctNH,PctNL).

avgHLidx is simpleavg(HLidx,10).

! JK VERSION OF HIGH LOW LOGIC INDICATOR:

JKlogic is iff(avgHLidx > 2.15 or avgHLidx < 0.40,avgHLidx,1).

! JK NEW HIGH PERCENT:

JKnH is simpleavg(NewH / (NewH + NewL),10).

! COMBINED TWO JK INDICATORS:

!Plot as single line with upper 90 lower 20 support

JKHL is JKlogic * JKnH * 100.

—Richard Denning

info@TradersEdgeSystems.comThis e-mail address is being protected from spambots. You need JavaScript enabled to view it.

for AIQ Systems

Sep 12, 2011 | Uncategorized

Steve Palmquist.

Author of ‘The Timely Trades Letter’. ‘How to Take Money from the Markets’, and Money-Making Candlestick Patterns.

Serious traders will go through a learning curve as they study market behavior and how their trading systems function. They will have times when they run into situations that have not been experienced or researched and they may be unsure of what to do. This is normal, it is the price of admission to the trading business. My general rule is that when I am unsure I close the position. It is hard to go broke taking profits so my focus is on needing a clear reason to stay in a position, not wondering whether or not I should get out. If there is no clear reason to hold I take profits and move on to another trade.

When trading I am not holding out for the perfect trade, there is no such thing. Trading is about managing risks and I use the current market conditions to determine how many trades to be taking and the appropriate position sizing to use. Setups with more room to run are prioritized above ones with little room to run. Setups triggering on stronger volume compared to the previous days volume are prioritized above ones with lower trigger day volume. Setups with shallower pullbacks are prioritized above ones with deeper pullbacks. I then look at the setups that are triggering and start from the top of the prioritized list and work down until I run out of setups or fill the number of positions I am interested in.

The successful trader has a tool box with a variety of trading tools for use in different market conditions. The trader, like the carpenter, must go beyond just acquiring the tools. Traders must understand which tool to use for a specific task, and have a clear understanding of how the tool works, and what can and cannot be done with it. I have extensively tested several trading systems, the results of this testing on specific trading trading tools are outlined in ‘How to Take Money from the Markets’, and Money-Making Candlestick Patterns. The testing process helps us understand how stocks usually behave after forming a specific pattern such as being outside the Bollinger Bands, showing strong distribution or accumulation, or pulling back or retracing during a trend. Understanding what a stock is most likely to do forms the beginning of a trading strategy. Trading without this information is taking unknown risks.

Aug 29, 2011 | Uncategorized

Steve Palmquist.

Author of ‘The Timely Trades Letter’. ‘How to Take Money from the Markets’, and Money-Making Candlestick Patterns.

At a recent trading conference several traders were talking about exit strategies at lunch and one noted that he ‘liked to hold positions for about a week’. When asked why, he had no reason for the decision; it just ‘felt right’ to him. Trading on tips, emotions, or what ‘just feels right’ is unlikely to produce good long term results. Trading should be based on the careful analysis and testing of each trading system that a trader uses. Testing does not eliminate risk or guarantee results, but it can help to give a good idea of how a system has actually performed.

In trading range market environments I generally exit a position if the stock approaches the upper Bollinger Band or a horizontal resistance point. I do not want to hold out for the last dime, I want to be taking profits as the stock approaches resistance. In a trading range market it is generally better to get out too early than too late. It is tough to go broke taking profits. By definition the market usually retraces at resistance. If the market usually retraces from resistance then I want to be out of the position before it does and use the funds for another trade that is just triggering and starting its run.

Eventually almost all resistance areas are broken, but if the stock usually retraces at resistance then I want to go with the odds and be positioned to profit if the stock does the normal thing and retraces. If it does retrace I have my profits and can use them in a new trade. If the stock breaks above resistance I still have my profits and can still take another trade. From a risk management standpoint I am better off to have taken the profits. I am always trying to position myself to profit if the market and my positions do the normal thing. When something unusual happens I may loose a few bucks, but by definition unusual things do not happen often. One of the keys to trading is learning what usually happens in a given situation and then being positioned to profit if it does.

The successful trader has a tool box with a variety of trading tools for use in different market conditions. The trader, like the carpenter, must go beyond just acquiring the tools. Traders must understand which tool to use for a specific task, and have a clear understanding of how the tool works, and what can and cannot be done with it. I have extensively tested several trading systems, the results of this testing on specific trading trading tools are outlined in ‘How to Take Money from the Markets’, and Money-Making Candlestick Patterns. The testing process helps us understand how stocks usually behave after forming a specific pattern such as being outside the Bollinger Bands, showing strong distribution or accumulation, or pulling back or retracing during a trend. Understanding what a stock is most likely to do forms the beginning of a trading strategy. Trading without this information is taking unknown risks.

Aug 1, 2011 | Uncategorized

The Fibonacci time zones discussed in “Automated Techniques For Intraday Traders” by Andrew Coles in this issue (August 2011 Stocks & Commodities) can be implemented using the Fibonacci time zone chart tool in AIQ with no additional programming required.

Thus, I am instead providing code for the “Three Black Crows” candle pattern that is discussed in Thomas Bulkowski’s June 2011 article, “Top 10 Candles That Work.”

Coding candlestick patterns requires quite a bit of interpretation, since these patterns are described in relative terms like a “tall” candle or “closes in the lower portion of the bar.” Depending on the interpretation given to these relative terms, we can get different results. In my code set, shown below, I provide inputs that allow for some of the adjustments. The three black crows pattern has the following rules:

- Must have three tall candles in a row

- Pattern occurs in an uptrend and the first candle is the highest high

- The last two candles must open in the real body range of the prior candle

- All three must close near the low

- The last two candles must have lows that are lower than the prior low.

“Tall” means that the bars’ high–low range is greater than the 10-day average range that occurs just prior to the start of the pattern. An uptrend is defined as a linear regression slope of the closes greater than zero. “Closing near the low” is based on how many candle zones are input, which are then used to divide the range of the bar into zones. “Closing near the low” means that the close must fall in the lowest zone. In addition, the author suggests testing in a bull market. Bull market is defined here as when the 200-bar moving average of the Standard & Poor’s 500 is greater than it was 10 bars ago. A bear market occurs whenever it is not a bull market.

I tested the pattern by entering at the close on the day the pattern is complete and exiting at the close six days later. This provides a test with five overnights and five full bars held after the pattern completes. I used the Russell 3000 list of stocks and tested from 1/15/1970 to 6/13/2011. In the table in Figure 8, I show the comparative results of bull, bear, and combined bull and bear. It appears that this pattern works in both bull and bear markets, but there may not be enough signals to build a trading system from just this pattern alone.

This table shows the metrics for the three

black crows candle pattern for the test period

1/15/1970 to 6/13/2011 using the Russell 3000 list of stocks.

The AIQ code is shown here and the Eds file for this technique can be downloaded from www.TradersEdgeSystems.com/traderstips.htm.

AIQ code for three black crows pattern

!TOP 10 CANDLES THAT WORK: THREE BLACK CROWS

!Author: Thomas N. Bulkowski, TASC June 2011

!Coded by: Richard Denning 6/14/11

!INPUTS:

RangeLen is 10.

CandleZones is 4.

HHLen is 10.

UpTrendLen is 10.

! ABBREVIATIONS:

C is [close].

C1 is valresult(C,1).

C2 is valresult(C,2).

H is [high].

L is [low].

L1 is valresult(L,1).

O is [open].

O1 is valresult(O,1).

OSD is offSetToDate(month(),day(),year()).

!BULL / BEAR MARKET DETERMINATION:

SPXc is TickerUDF("SPX",C).

Bull if simpleavg(C,200) > simpleavg(C,200,10).

Bear if not Bull.

!FUNCTIONS AND RULES FOR THREE BLACK CROWS CANDLE PATTERN:

Range is H - L.

HHoffset is scanany(H = ∧highresult(H,HHLen),HHLen) then OSD.

AvgRng is simpleavg(Range,RangeLen,∧HHoffset).

LowerZoneC if C < L + (Range * 1/CandleZones).

Tall if Range > AvgRng.

BlackCrow1 if Tall

and LowerZoneC

and slope2(C,UpTrendLen) > 0

and H = highresult(H,HHLen).

BlackCrow2 if Tall

and LowerZoneC

and O <= O1

and O >= C1.

ThreeBlackCrows if valrule(BlackCrow1,2)

and countof(BlackCrow2,2)=2

and countof(L < L1,2)=2.

Bull3BlackCrows if Bull and ThreeBlackCrows.

Bear3BlackCrows if Bear and ThreeBlackCrows.

Jul 18, 2011 | Uncategorized

Steve Palmquist.

Author of ‘The Timely Trades Letter’. ‘How to Take Money from the Markets’, and Money-Making Candlestick Patterns.

The market has three basic modes. It can be going up, down, or sideways. Over time the markets movement is made up of combinations of these three different behaviors. None of these behaviors lasts for long, the market is always switching between them. This is one of the keys to trading. Traders need to recognize that the market moves between these three modes and have the ability to recognize then the change has arrived and be able to switch to trading tools suitable for the new environment. This is a process I call Market Adaptive Trading. The market will not adapt to us. It does not care what we want or think. Therefor we must adapt to it.

If I know how a trading system, or trading tool as I refer to them, performs in each of the three different market conditions; then I can watch the market to determine what type of condition we are currently experiencing and then use the tools that have shown good results in that type of market condition. This is the process of Market Adaptive Trading. It takes some practice to quickly recognize the current market conditions, but this is a lot easier that trying to predict where the market is going.

No one has consistently predicted where the market is going over the long run. Remember all those empty suits on the TV news shows telling us everything was fine just before the 2008 crash. They did the same thing before the 2000 crash. Not even (or perhaps especially) the experts can successfully predict market direction consistently. However you can learn to look at a chart and tell if the market is going up, down, or sideways. And that is actionable information, as opposed to someone’s guess of where the market is going to be in three months or a year.

The successful trader has a tool box with a variety of trading tools for use in different market conditions. The trader, like the carpenter, must go beyond just acquiring the tools. Traders must understand which tool to use for a specific task, and have a clear understanding of how the tool works, and what can and cannot be done with it. I have extensively tested several trading systems, the results of this testing on specific trading trading tools are outlined in ‘How to Take Money from the Markets’, and Money-Making Candlestick Patterns. The testing process helps us understand how stocks usually behave after forming a specific pattern such as being outside the Bollinger Bands, showing strong distribution or accumulation, or pulling back or retracing during a trend. Understanding what a stock is most likely to do forms the beginning of a trading strategy. Trading without this information is taking unknown risks.

Jul 14, 2011 | Uncategorized

As discussed in the free webinar on Thursday July 14, 2011. Recording is available at http://prowebinars.adobeconnect.com/p6efx0lc7kf/

To add the VIX with a 10-day average of the VIX to an AIQ Chart follow these instructions

- Click on this link below to download the EDS file required, save it to c:wintes32EDS Strategies folder http://aiqsystems.com/VIX_as_an_indicator.EDS

- Open AIQ Charts and chart the ticker SPY end of day.

- From the menu in Charts, click on Chart, Settings, Indicator Library, EDS Indicators

- In the Custom Indicators click on Add

- In Look in: locate c:wintes32EDS Strategies folder and select the file VIX_as_an_indicator.EDS. Click Open.

- In Plot Type, select Histogram with Plotted Line, click Next.

- In Histogram with Line Indicator, for Description I use VIX and 10-day. UDF to Plot: select Close_VIX from the pull down. UDF for Line: select VIX_10day from the pull down. Click Finish.

- Click on Done in the Custom Indicators screen. The indicator will be at the very bottom in your Indicator Control Panel, click on the indicator to add it to the SPY chart. Note: custom indicators do not have barometers

Jul 9, 2011 | Uncategorized

Steve Palmquist.

Author of ‘The Timely Trades Letter’. ‘How to Take Money from the Markets’, and Money-Making Candlestick Patterns.

When traders get together and discuss trading patterns or setups someone usually asks why a particular pattern works. To explain trading patterns the market is often described as a battle between the Bulls trying to drive prices up, and the Bears trying to drive prices down. The patterns are the result of this contest between the Bulls and Bears. Some traders will start using a pattern or trading system when they hear an explanation of why it works that makes sense to them. We all have a need to understand why something should work. However, for traders it is more important to know how often a pattern works than an explanation of why it works. Knowing why a pattern works is interesting. Knowing how often a trading pattern works can be profitable. Knowing in what specific market conditions a pattern works best can be very profitable.

In addition to knowing how often a particular trading pattern produces profitable trades, traders should understand if there are observable parameters that can strongly influence results. Some of the questions traders should address before using a trading pattern are: How long should a position be held? What are good profit target points? What type of orders should be used? Where should stop loss orders be entered? There are a number of effective tools for the trader’s tool box. However, like any other tool the user needs to understand exactly what it is designed for, and how to use it effectively. Carpenters can make beautiful things with a table saw; however they need to understand how to use it, and also know when another tool might be more appropriate for the task at hand. They also need to know the safety rules, how to avoid kickback, and the importance of using a push tool. At least the carpenters that still have all their fingers do.

Some traders gain a better understanding of trading patterns, and the environments in which to use them, though experience. After trading for a number of years they begin to understand what variations of a particular trading pattern work best, and which ones are more prone to failure. Experience often produces good results when we are listening closely, however it can be costly.

A less expensive way to develop an in depth understanding of how trading patterns work is by backtesting the pattern. Backtesting also allows us to test how simple variations or changes in the trading pattern effect results. Backtesting can be done over a variety of time periods and even in specific market conditions. The more traders understand exactly how and when their trading patterns work, the more effective use they will be able to make of each tool in the trading toolbox. The Timely Trades Letter provides additional information on trading tools and techniques on a weekly basis.

The successful trader has a tool box with a variety of trading tools for use in different market conditions. The trader, like the carpenter, must go beyond just acquiring the tools. Traders must understand which tool to use for a specific task, and have a clear understanding of how the tool works, and what can and cannot be done with it. I have extensively tested several trading systems, the results of this testing on specific trading trading tools are outlined in ‘How to Take Money from the Markets’, and Money-Making Candlestick Patterns. The testing process helps us understand how stocks usually behave after forming a specific pattern such as being outside the Bollinger Bands, showing strong distribution or accumulation, or pulling back or retracing during a trend. Understanding what a stock is most likely to do forms the beginning of a trading strategy. Trading without this information is taking unknown risks.

Jul 6, 2011 | Uncategorized

Join Steve Hill for this FREE webinar on how to use the 3 Vs as an indication of exhaustion in an up move or down move.

When: Thursday July 14th, 2011

Time: 4:30pm eastern

Please register for this event at http://aiqsystems.com/3vs.html

Even if you cant make the event that late at night, register, and you will get the link to the recording after the event.

Jul 2, 2011 | Uncategorized

Steve Palmquist.

Author of ‘The Timely Trades Letter’. ‘How to Take Money from the Markets’, and Money-Making Candlestick Patterns.

Many traders are interested in knowing how a trading system did last year, or the year before. If they see these numbers it makes them happy, and they feel that is what they should expect going foreword. When some people evaluate mutual fund, or money manager, performance they want to know how the performance was in each of the last few years. While this seems to make people happy, it does not mean much, or give a realistic expectation of what to expect going foreword. The reason is that the market is not the same from one year to the next. How the market, or a trading system, performed last year may have little to do with how it will perform next year. Looking at annual returns may be interesting, but it does not tell you how and when to use a trading tool.

I know traders who took significant losses during 2008, using techniques that showed strong results over previous years. They had developed these systems by looking at annual results over several years. When 2008 came along, and the market did not look much like it had the previous few years they experienced losses that wiped out the profits of several years of trading. I have seen traders that are looking for the hot hand, and when they find someone with good results in the previous year, they want that person to manage all their money because they think the hot hand will perform again next year. Strong results in the past year or two may have no bearing on next year if the market conditions change.

Rather than look just at annual results, I want to know how a trading system performs in bull and bear markets. No one knows what the market will do next year. Even the ‘expert’ economists have predicted ten of the last three recessions; they usually all over the financial channels telling you we are in a recession, or a boom period, after they have started. Few, if any, consistently predict them in advance. Driving while looking in the rear view mirror can be problematic.

The market has just three basic modes. It can be trending up, a bullish period, it can be trending down, a bearish period, or it can be just moving sideways, a trading range period. During the testing and evaluation of numerous trading systems I have seen that the market conditions, bullish, bearish, or trading range, have a strong effect on most systems. Because of this I have developed different trading systems for each of the three market conditions and refer to the collection of trading techniques as my trading tool box. The markets overall movement is made up of a combination of bullish, bearish, and trading range periods. Years are convent for us to mark time, but the market does not care about them. It simply moves in combinations of bullish, bearish, and trading range periods. It is hard for it to do anything else.

The successful trader has a tool box with a variety of trading tools for use in different market conditions. The trader, like the carpenter, must go beyond just acquiring the tools. Traders must understand which tool to use for a specific task, and have a clear understanding of how the tool works, and what can and cannot be done with it. I have extensively tested several trading systems, the results of this testing on specific trading trading tools are outlined in ‘How to Take Money from the Markets’, and Money-Making Candlestick Patterns. The testing process helps us understand how stocks usually behave after forming a specific pattern such as being outside the Bollinger Bands, showing strong distribution or accumulation, or pulling back or retracing during a trend. Understanding what a stock is most likely to do forms the beginning of a trading strategy. Trading without this information is taking unknown risks.

Jun 17, 2011 | Uncategorized

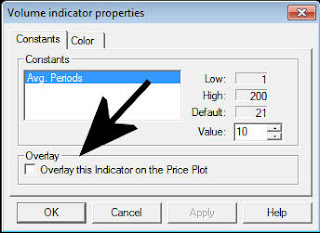

We heard you! One of the most common new feature request we’ve received this year is the ability to overlay indicators like MACD and Stocjastics on the price chart. TradingExpert Pro 9.4 upgrade now incorporates this feature.

Overlay indicators on Price Chart

Available only in AIQ Charts (rollout into RTalerts is on a future release). You can now display an indicator like MACD, Volume, Stochastic etc directly to the price chart, both real-time and end of day. Simply bring up a chart, right click on the indicator of your choosing in the Control Panel and select ‘Overlay this indicator on price plot’.

Currently this feature does not allow you to permanently save the seting for all charts and has to be applied individually. Here’s MSFT with 1 minute price bars and the MACD overlaid on the price plot.

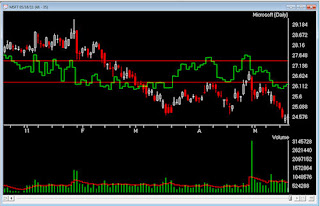

Here’s MSFT daily price bars and Volume overlaid on the price plot.

Here’s MSFT Candlestick chart overlaid with Stochastic indicator.

Candlestick color selector

Hollow and solid candles can now be assigned their own colors. Under Chart, Settings, Colors.

Here’s MSFT with hollow candles in green and solid candles in red.

This upgrade is FREE OF CHARGE for clients of the TradingExpert Pro on the monthly lease plan, all other TradingExpert or TradingExpert Pro clients please contact AIQ at 1-800-332-2999 for details. If you are not on the monthly plan and install the upgrade your key number may be invalidated.

Download now through the AIQ store

registration details are required for this upgrade