Sep 13, 2017 | Charts

“The WinWay Charts Candlestick Piercing bullish buy signal on Sept 6, 2017, worked out well so far on Southwest Airlines”

Steve Hill, founder WinWay Charts

Ready to take your apprentice training and put it into action in WinWay Charts?

Join me October 12, 2017 – Central London

It’s the final piece in your stock trading armoury

Steve Hill, is the founder and President of WinWay Charts, Darren Winters preferred trading software.

A native Londoner, Steve has over 25 years experience as both a trading analysis software developer and trading educator. He has trained countless clients in the disciplined analysis and trading mindset necessary to successfully trade in today’s markets.

Using WinWay Charts, he’ll take you through the entire process from analysis, stock selection, trade execution and trade management. With this traders blueprint, you’ll have the tools you need to take your trading efficiency to a new level.

Market insights only available WinWay Charts

The Dow and NASDAQ are at or near the highs but the broader market indicators are signaling something else. Steve will show you how to use the built-in market analysis tools in WinWay Charts to gain in-depth analysis,

Rare opportunity to spend the day with WinWay Charts founder

|

| Those of you have had an opportunity to spend time with Steve at sessions in Wealth Training offices in Bermondsey or at apprentice sessions in Guernsey will will appreciate his broad and in-depth knowledge and experience in trading analysis. You’ll need to be on your toes for this seminar. Every session is designed to enhance your current trading skill and take you to the next logical step as a trader. |

|

|

Topics covered in this action-packed day include:

|

|

– Trading psychology

– Top down analysis incorporating reports, chart analysis and trade selection

– Using Darren’s candlestick and other scans

– Establishing positions, portfolio management of established positions, exiting positions

– Using a trade log to evaluate your trades

– Live examples of trades in action

.

|

|

This opportunity won’t be available again this year!

Seats are limited and are filling up fast. Don’t hesitate, fast track your way to trading success PLUS special Autumn pricing now applies, if you reserve your seat in the next 10 days you’ll get the early bird price locked in.

Book your seat before September 20, 2017 and you’ll pay

ONLY $499 a $150 saving

PLUS your seminar comes with the entire course manual in PDF format.

Sep 8, 2017 | indexes, jay kaeppel, stock market

First the Good News:

*The market averages are still in an up trend

*The Fed has yet to “remove the punch bowl”

Now the bad news

Market Bellwethers Flashing Warnings

In this article I wrote about four tickers I follow for signs of early warnings of trouble. At the moment, all four are flashing warnings.

Stocks are Extremely Overvalued

Something important to note: valuation indicators are NOT good timing indicators. The overall market can be over or undervalued for years. However, overvalued valuation readings are extremely reliable at telling us what will come next once the top is in (whenever that may be). Figure 4 displays the Schiller CAPE model which measures adjusted P/E ratio.

Figure 4 – Schiller Adjusted PE (Courtesy:

Schiller Data Library)

1901: Dow -37% in 32 months

1929: Dow -89% in 3 years

1932: Dow -49% in 13 months

1965: Dow sideways to 40% lower for 17 years

2000: Nasdaq 100 -87%

2007: Dow -55% in 17 months

2017: ??

When will the exact top form? Don’t know

What will likely follow? Don’t Ask

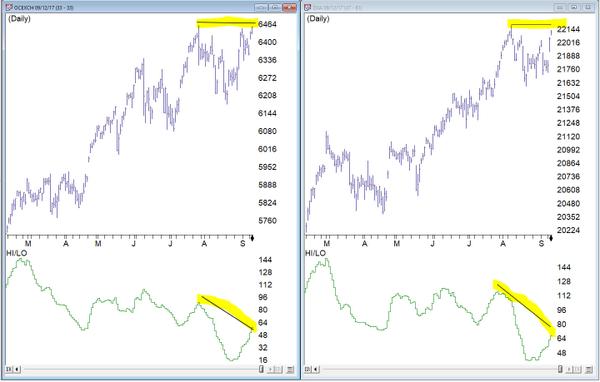

The Decennial Pattern

As I wrote about here and as you can see in Figures 5 and 6, the Year 7 into Year 8 period has historically witnesses significant market weakness. That does not mean that that is what will happen this time around. But it is reason for caution.

Figure 7 from Tom McLellan illustrates this phenomenon even more clearly.

September

What a crummy time for September to roll around. Figure 8 displays the fact that the Dow has lost -80% during the month of September since 1897.

Figure 8 – Dow has lost -80% during September since 1897

Figure 9 displays the fact that since 1955 most of the “September Nasty” has occurred in that last 10 trading days of the month (after the close on 9/15 this year)

Figure 9 – Dow in September; 1st 3 days (blue); Last 10 days (green); in between (red); 1955-2016

Investor Complacency

Despite the fact that:

*We have experienced one of the longest bull markets in history

*Stock prices are extremely overvalued on an objective historical basis

*A number of warning signs are flashing

The investment world seems relatively untroubled (in the interest of full disclosure I have done only limited selling so far myself – more on this in a moment).

Figure 10 displays the AAII investor cash allocation reading from earlier this year. Low cash levels tend to signal complacency (and impending market trouble) while high cash levels tend to occur near market bottoms.

Figure 11 displays the amount of assets in the Rydex suite of “bearish” funds from earlier this year. As you can see, investors were not too concerned about the prospects for a bear market – a potential contrarian signal.

Figure 12 shows the level of margin debt versus stock prices. Historically when margin debt peaks and begins to decline the stock market suffers significantly. There is no way to predict when margin debt will top out and roll over but it did recently reach a new all-time high. Could it go higher? Absolutely. But if it rolls over – then look out below.

Figure 12 – If Margin Debt peaks trouble may follow (Courtesy:

dshort.com)

Figure 13 displays the stock market versus the number of “Hindenburg Omens” (a measure of “churning” in the stock market) that have occurred in the most recent 6-month period. Another warning sign is flashing.

Summary

Does any of the above guarantee that a significant stock market decline is imminent? The correct answer is “No.” The major market indexes all remain above their long-term moving averages. This can be considered the very definition of a bull market.

I personally have seen lots of warning signs flash along the way over the years. And I have found that it is important to pay attention to these and to “prepare for the worst” – i.e., to plan an exit/hedging strategy “just in case.” But trying to pick the exact top is an excellent way to end up looking stupid. Trust me on this one.

So here is my summary:

*I do not possess the ability to “call the top” nor to “predict what will happen next” in the stock market

*I do possess a reasonably good ability to identify the trend “right now”

*I also possess the ability to recognize gathering storms clouds (and, yes, they are forming) and the ability to formulate an “emergency plan” as well as the wherewithal to follow the plan “should this be an actual (market) emergency.”

The current level of market valuation – and the history of the stock market following previous similar such readings – suggests that the next bear market will surprise many investors by its severity.

The clouds are gathering. Please plan accordingly.

Jay Kaeppel Chief Market Analyst at JayOnTheMarkets.com and AIQ TradingExpert Pro client.

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Aug 18, 2017 | chart patterns, educational newsletters, jay kaeppel

If I were the type to make bold proclamations I would probably consider “taking my shot” right here and shout “This is the Top” and/or “The Market May Crash.” Unfortunately, on those occasions (well) in the past when I would make bold public predictions of what was about to happen in the financial markets I would almost invariably end up looking pretty stupid. So even if I did make a “bold proclamation” it wouldn’t necessarily mean that anyone should pay any attention.

Besides all that the last thing I want is for “the party to end”. Even if you do think the market is about to tank it’s a pretty crummy thing to have to root for. Even if you did manage to “call the top”, the ripple effect of the ramifications associated with a serious stock market decline can have pretty negative effect on just about everyone’s life.

So let’s put it this way: I am concerned – and prepared to act defensively if necessary – but still have money in the market and am still hoping for the best.

Reasons for Caution (Indexes)

Figure 1 displays four major indexes. The Dow keeps hitting new highs day after day while the others – at the moment – are failing to confirm. That doesn’t mean that they won’t in the days ahead. But the longer this trend persists the more negative the potential implications.

Figure 1 – Dow at new highs, small-caps, Nasdaq and S&P 500 not quite (Courtesy

TradingExpert)

Reasons for Caution (Bellwethers)

Figure 2 displays 4 “bellwethers” that I follow which may give some early warning signs.

Figure 2 – Market Bellwethers possibly flashing some warning signs (Courtesy

TradingExpert)

*SMH soared to a high in early June and has been floundering a bit since.

*Dow Transports tried to break out to the upside in July but failed miserably.

*XIV is comfortably in new high territory.

*BID tried to break out in July and then collapsed. It is presently about 12% off of its high.

In a nutshell – 3 of the 4 are presently flashing warning signs.

Reasons for Caution (Market Churn)

In this article I wrote about an indicator that I follow that can be useful in identify market “churn” – which can often be a precursor to market declines. Spikes above 100 by the blue line often signify impending market trouble

It should be noted that the indicators signals are often early and occasionally flat out wrong. Still, a churning market with the Dow making new highs has often served as a “classic” warning sign.

Figure 3 – JK HiLo Index (blue) versus Nasdaq Compsite / 20 (red); 12/31/2006-present

Summary

Again, and for the record, I do not possess the ability to “predict” the markets. But I have seen a few “warning signs” flash bright red at times in the past. As a general rule, it is best to at least pay attention – and maybe make a few “contingency plans” – you know, just in case.

Here’s hoping my gut is wrong – again.

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Aug 1, 2017 | jay kaeppel, market timing

It is hard to look at Figure 1 and argue that the trend of the stock market is anything but bullish. Major averages making new all-time highs is essentially the very definition of a bull market. And indeed the market may continue to push higher indefinitely.

Figure 1 – Four Major Averages all at or near all-time highs (Courtesy

AIQ TradingExpert)

Trying to “pick a top” usually ends with an embarrassed prognosticator. Particularly when the major market averages are posting new highs. Still, there comes a time when it can pay to pay close attention for signs of “Trouble in Paradise”. That time may be now.

Four Bellwethers

In this article I wrote about 4 “bellwethers” that I follow for potential “early warning signals”. So far no “run for cover” signals have appeared. Two of the four have confirmed the new highs in the market averages and the other two have not. If and when 3 or 4 of them fail to confirm that may signal trouble ahead.

Figure 2 – XIV and BID confirm news highs; SMH and TRAN so far have not (Courtesy

AIQ TradingExpert)

XIV and BID have confirmed new highs in the major averages (although the parabolic nature of XIV’s run is somewhat troubling to me) while SMH and the Dow Transports have not.

Post-Election/Year “7” Bermuda Triangle

I

have written about this a few times but it bears repeating here. Post-Election Years and Years ending in “7” (1907, 1917, etc.) have typically witnessed “trouble” in the second half of the year. Figures 3 and 4 are posted courtesy of a Twitter post from Larry McMillan of the

Option Strategist.

Figure 3 highlights the fact that the 2nd half of “Years 7” have often witnessed “trouble.”

Figure 4 show that each “7” year posted a high during the 2nd half of the year (or in June) and then suffered a decline. This does not guarantee a repeat this year but it is a warning sign.

Figure 3 – Decade Pattern for the Dow Jones Industrials Average (Courtesy:

Options Strategist)

Also, during years that are both “post-election” years AND “Years ending in 7”, the August through October results have been brutal- as depicted in Figure 5 – with an average 3-month decline of -15%.

Figure 5 – August/September/October of Post-Election Years that also End in “7”

Nothing in Figures 3 through 5 “guarantee” an imminent market decline. They do however, constitute the reason the word “Beware” appears in the headline.

Valuation

Last week I witnessed a presentation where a quite knowledgeable gentleman posted a chart of the Schiller PE Ratio. He made note of the fact that the Schiller PE Ratio has only been higher twice in modern history – 1929 and 2000. The 1929 peak was followed by an 89% decline by the Dow and the 2000 peak was followed by an 83% decline by the Nasdaq. So are we doomed to experience a devastating decline? Not necessarily. At least not necessarily anytime soon. The stock market became “overvalued” in 1995 and then continued to rally sharply higher for another 4+ years. Likewise, the market as theoretically been “overvalued” since 2013 – and so far so good.

Figure 6 shows the price action of the Dow Jones Industrials Average since 1901 in blue and the movements of the Schiller PE Ratio in green.

The peaks in the Schiller PE ratio in:

1901

1929

1937

1965

1995-2000

2003-2008

Were all followed by “something bad”.

While the exact timing is unknowable, as you can see in Figure 6, history does suggest that ultimately a “happy ending” is unlikely.

Figure 6 – A History Lesson in High Shiller PE Ratio Readings: Dow Jones Industrials Average (blue line) and Schiller PE Ratio (green line); 1901-present

Summary

I absolutely, positively DO NOT possess the ability to “predict” what is going to happen in the financial markets. I have gotten pretty good however, at identifying when risk is unusually high or low.

Current Status: Risk High

Because I don’t offer investment advice on this blog – and because my track record of “market calls” is so bad, no one should interpret anything in this article as a call to “Sell Everything”, especially since I haven’t even done that myself – us “trend-followers” usually take awhile to give up the ghost. In reality, I hope that stocks continue to rally and that this article ends up making me looking stupid, er, I mean “overly cautious”.

But the real point is simply that having plans, mechanisms, etc. to reduce risk in your portfolio makes sense.

Jay Kaeppel Chief Market Analyst at JayOnTheMarkets.com and TradingExpert Pro client.

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Jul 5, 2017 | bonds, educational newsletters, ETFs, indexes, jay kaeppel, market timing

In the end it is not so much about “predicting” what will happen next in the financial markets, but rather recognizing – and being prepared for – the potential risks, that makes the most difference in the long run. So let’s start by looking at current trends.

Stocks

Let’s start with a most simple trend-following model that works like this:

-A sell signal occurs when the S&P 500 Index (SPX) registers two consecutive monthly closes below its 21-month moving average

-After a sell signal, a buy signal occurs when SPX register a single monthly close above its 10-month moving average.

Figure 1 displays recent activity.

Figure 1 – SPX Trend-Following signals (Courtesy

WinWayCharts)

The good news is that this model does a good job of being out of stocks during long bear markets (1973-74, 2000-2002, 2008-2009). The bad news is that – like any trend-following model – it gets “whipsawed” from time to time. In fact the two most recent signals resulted in missing out on the October 2015 and March 2016 rallies.

But note the use of the phrase “simple trend-following model” and the lack of phrases such as “precision market timing” and “you can’t lose trading the stock market”, etc.

For now the trend is up. A few things to keep an eye on appear in Figures 2 and 3. Figure 2 displays four major averages. Keep an eye to see if these averages break out to the upside (see here) or if they move sideways to lower.

Figure 2 – Four Major Market Averages (Courtesy

WinWayCharts)

In addition, I suggest following

the 4 tickers in Figure 3 for potential “early warnings” – i.e., if the major averages hit new highs that are not confirmed by the majority of the tickers in Figure 3

.

Figure 3 – Four potential “Early Warning” tickers (Courtesy

WinWayCharts)

Bonds

My main “simple bond trend-following model” remains bearish. As you can see in Figure 4, a buy signal for bonds occurs when the 5-week moving average for ticker EWJ (Japanese stocks) drops below its 30-week moving average and vice versa.

Figure 4 – Ticker EWJ 5-week and 30-week moving average versus ticker TLT (Courtesy

WinWayCharts)

A 2nd model using metals to trade bonds has been bullish of late but is close to dropping back into bearish territory. Figure 5 displays the P/L from holding a long position of 1 t-bond futures contract ONLY when both the EWJ AND Metals models are bearish (red line) versus when EITHER model is bullish (blue line)

Figure 5 – T-bond futures $ gain/loss when EWJ OR Metals Models are Bullish (blue line) versus when EWJ AND Metals Models are both Bearish (red line); August 1990-present

Gold

My most basic gold trend-following model is still bearish. This model uses my “Anti-Gold Index” (comprised of tickers GLL, SPX, UUP and YCS). It is bullish for gold when a Front-Weighted Moving Average (detailed here) is below the 55-week exponential moving average and vice versa.

Figure 6 – Jay’s “Anti-Gold Index” versus ticker GLD (Courtesy

WinWayCharts)

Summary

So at the moment the stock model is bullish and the bond and gold models are bearish. Are these trends certain to persist ad infinitum into the future? Definitely not. Will the models detailed here provide timely signals regarding when to get in or out the next time around? Sorry, but it doesn’t always work that way with trend-following.

But as for me I prefer “riding the trend” to “predicting the future.”

Some painful lessons just stick with you I guess.

Jay Kaeppel Chief Market Analyst at JayOnTheMarkets.com and TradingExpert Pro client.

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.