Jun 17, 2011 | Uncategorized

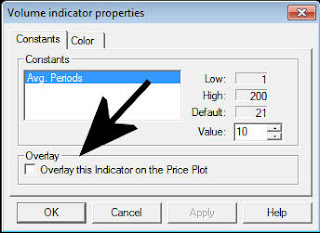

We heard you! One of the most common new feature request we’ve received this year is the ability to overlay indicators like MACD and Stocjastics on the price chart. TradingExpert Pro 9.4 upgrade now incorporates this feature.

Overlay indicators on Price Chart

Available only in AIQ Charts (rollout into RTalerts is on a future release). You can now display an indicator like MACD, Volume, Stochastic etc directly to the price chart, both real-time and end of day. Simply bring up a chart, right click on the indicator of your choosing in the Control Panel and select ‘Overlay this indicator on price plot’.

Currently this feature does not allow you to permanently save the seting for all charts and has to be applied individually. Here’s MSFT with 1 minute price bars and the MACD overlaid on the price plot.

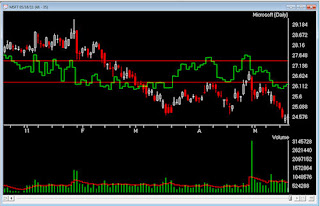

Here’s MSFT daily price bars and Volume overlaid on the price plot.

Here’s MSFT Candlestick chart overlaid with Stochastic indicator.

Candlestick color selector

Hollow and solid candles can now be assigned their own colors. Under Chart, Settings, Colors.

Here’s MSFT with hollow candles in green and solid candles in red.

This upgrade is FREE OF CHARGE for clients of the TradingExpert Pro on the monthly lease plan, all other TradingExpert or TradingExpert Pro clients please contact AIQ at 1-800-332-2999 for details. If you are not on the monthly plan and install the upgrade your key number may be invalidated.

Download now through the AIQ store

registration details are required for this upgrade

Jun 14, 2011 | Uncategorized

Here is the Aiq code based on Edgar Kraut’s article in this issue, “A Color-Based System For Short-Term Trading.” The code is also provided at the websites noted below. I coded the color indicators and three systems that use the indicators. Two of the three systems are discussed here.

I ran backtests using the AIQ Portfolio Manager module from 1/1/1998 to 5/13/2011 trading the Nasdaq 100 list of stocks. In Figure 10, I show the test results of simulated trading using the system that was proposed in Kraut’s article for trading the SPY with the following capitalization parameters:

- Maximum positions per day = 3

- Maximum total positions allowed = 10

- Choose candidates using highest volume on the day of the signal

- Size each position at 10% of total account equity recomputed every day

Figure 10: AIQ SYSTEMS, Kraut’s Color-Based System. Here is a sample equity curve for Edgar Kraut’s system trading the NASDAQ 100 list of stocks compared to the S&P 500 index over the test period 1/1/98 to 5/13/11. This original system uses a 1% trailing stop as the only exit.SPX in red.

For the test period, the original system using the 1% trailing stop as the only exit showed an average annual return of 4.95% with a maximum drawdown of 78.52% on 10/9/2002.

Since the drawdown of 78.52% on the original system was more than most traders could tolerate, I added trend and market trend filters and also changed the buy rules and exit rules as follows:

Buy if there is a green or blue bar today and if yesterday there were six consecutive bars of orange or red color and the 200-bar simple moving average of both the stock and the S&P 500 index are higher than they were 10 bars ago.

Exit if there are four consecutive bars of orange or red.

All trades for both systems are executed at the next open after a trade signal occurs. A commission of $0.01 per share round-turn was used. The same capitalization parameters were used in testing both the modified system and the original system.

In Figure 11, I show the test results of simulated trading on the Nasdaq 100 list of stocks using this modified system. For the test period, this modified system showed an average annual return of 20.24% with a maximum drawdown of 31.55% on 5/25/2000.

Figure 11: AIQ SYSTEMS, MODIFIED System equity curve. Here is a sample equity curve for my modified system trading the NASDAQ 100 list of stocks over the test period 1/1/98 to 5/31/11 compared to the S&P 500 index.

In Figure 12, I show the color-based indicators applied to both the price and volume on a chart of Adsk. The arrows on the chart also show a sample trade from the modified system.

Figure 12: AIQ SYSTEMS, MODIFIED System example. Shown here is a chart of ADSK with color studies and arrows showing sample trades from the modified system.

The code and Eds file can be downloaded from www.TradersEdgeSystems.com/traderstips.htm.

AIQ code:

! A COLOR-BASED SYSTEM FOR SHORT-TERM TRADING

! Author: Edgar Kraut, TASC July 2011

! Coded by: Richard Denning 5/14/11

! www.TradersEdgeSystems.com

! ABBREVIATIONS:

C is [close].

C10 is valresult(C,10).

V is [volume].

V10 is valresult(V,10).

! FOR COLOR BARS:

Green if C > C10 and V > V10.

Blue if C > C10 and V < V10.

Orange if C < C10 and V < V10.

Red if C < C10 and V > V10.

! FOR UDF IN REPORT COLUMN:

Signal is iff(Green,”Green”,iff(Blue,”Blue”,

iff(Orange,”Orange”,iff(Red,”Red”,””)))).

! TRADING SYSTEMS:

! ORIGINAL SYSTEM:

Buy if (Green or Blue) .

! Use built-in trailing stop set to 99 for exits

! FIRST MODIFICATION (NOT USED):

Buy2 if (Green or Blue)

and countof((Red or Orange),6,1)=6.

! SECOND MODIFICATION (FINAL SYSTEM):

SMA is simpleavg(C,200).

SPXsma is TickerUDF(“SPX”,SMA).

Buy3 if (Green or Blue)

and countof((Red or Orange),6,1)=6

and SMA > valresult(SMA,10)

and SPXsma > valresult(SPXsma,10).

Sell2 if countof((Red or Orange),4)=4.

Richard Denning for AIQ Systems

mailto:info@TradersEdgeSystems.com

Jun 14, 2011 | Uncategorized

Here is the Aiq code based on Edgar Kraut’s article in this issue, “A Color-Based System For Short-Term Trading.” The code is also provided at the websites noted below. I coded the color indicators and three systems that use the indicators. Two of the three systems are discussed here.

I ran backtests using the AIQ Portfolio Manager module from 1/1/1998 to 5/13/2011 trading the Nasdaq 100 list of stocks. In Figure 10, I show the test results of simulated trading using the system that was proposed in Kraut’s article for trading the SPY with the following capitalization parameters:

- Maximum positions per day = 3

- Maximum total positions allowed = 10

- Choose candidates using highest volume on the day of the signal

- Size each position at 10% of total account equity recomputed every day

Figure 10: AIQ SYSTEMS, Kraut’s Color-Based System. Here is a sample equity curve for Edgar Kraut’s system trading the NASDAQ 100 list of stocks compared to the S&P 500 index over the test period 1/1/98 to 5/13/11. This original system uses a 1% trailing stop as the only exit.SPX in red.

For the test period, the original system using the 1% trailing stop as the only exit showed an average annual return of 4.95% with a maximum drawdown of 78.52% on 10/9/2002.

Since the drawdown of 78.52% on the original system was more than most traders could tolerate, I added trend and market trend filters and also changed the buy rules and exit rules as follows:

Buy if there is a green or blue bar today and if yesterday there were six consecutive bars of orange or red color and the 200-bar simple moving average of both the stock and the S&P 500 index are higher than they were 10 bars ago.

Exit if there are four consecutive bars of orange or red.

All trades for both systems are executed at the next open after a trade signal occurs. A commission of $0.01 per share round-turn was used. The same capitalization parameters were used in testing both the modified system and the original system.

In Figure 11, I show the test results of simulated trading on the Nasdaq 100 list of stocks using this modified system. For the test period, this modified system showed an average annual return of 20.24% with a maximum drawdown of 31.55% on 5/25/2000.

Figure 11: AIQ SYSTEMS, MODIFIED System equity curve. Here is a sample equity curve for my modified system trading the NASDAQ 100 list of stocks over the test period 1/1/98 to 5/31/11 compared to the S&P 500 index.

In Figure 12, I show the color-based indicators applied to both the price and volume on a chart of Adsk. The arrows on the chart also show a sample trade from the modified system.

Figure 12: AIQ SYSTEMS, MODIFIED System example. Shown here is a chart of ADSK with color studies and arrows showing sample trades from the modified system.

The code and Eds file can be downloaded from www.TradersEdgeSystems.com/traderstips.htm.

AIQ code:

! A COLOR-BASED SYSTEM FOR SHORT-TERM TRADING

! Author: Edgar Kraut, TASC July 2011

! Coded by: Richard Denning 5/14/11

! www.TradersEdgeSystems.com

! ABBREVIATIONS:

C is [close].

C10 is valresult(C,10).

V is [volume].

V10 is valresult(V,10).

! FOR COLOR BARS:

Green if C > C10 and V > V10.

Blue if C > C10 and V < V10.

Orange if C < C10 and V < V10.

Red if C < C10 and V > V10.

! FOR UDF IN REPORT COLUMN:

Signal is iff(Green,”Green”,iff(Blue,”Blue”,

iff(Orange,”Orange”,iff(Red,”Red”,””)))).

! TRADING SYSTEMS:

! ORIGINAL SYSTEM:

Buy if (Green or Blue) .

! Use built-in trailing stop set to 99 for exits

! FIRST MODIFICATION (NOT USED):

Buy2 if (Green or Blue)

and countof((Red or Orange),6,1)=6.

! SECOND MODIFICATION (FINAL SYSTEM):

SMA is simpleavg(C,200).

SPXsma is TickerUDF(“SPX”,SMA).

Buy3 if (Green or Blue)

and countof((Red or Orange),6,1)=6

and SMA > valresult(SMA,10)

and SPXsma > valresult(SPXsma,10).

Sell2 if countof((Red or Orange),4)=4.

Richard Denning for AIQ Systems

mailto:info@TradersEdgeSystems.com

Jun 12, 2011 | Uncategorized

Steve Palmquist.

Author of ‘The Timely Trades Letter’. ‘How to Take Money from the Markets’, and Money-Making Candlestick Patterns.

During 20 years of active trading experience I have researched, tested, and analyzed a number of trading systems and techniques. Some have shown promising results, some do not. I add tools to my trading toolbox based on their effectiveness. Trading systems are not effective because Aunt Millie or uncle Bob told you about them, they are effective because they work. Most trading systems are affected by market conditions, volume patterns, and other factors. Successful traders know how these parameters affect trading results, so they know when to trade a particular pattern, and when to use another tool in their toolbox.

Making money in the stock market requires knowledge of what to trade, when to trade, and a variety of trading tools designed for different market conditions. Just as a carpenter will use several different tools when building a house, traders will use different tools to build their account. Using the same trading tool in all situations is like trying to build a house with just a hammer. Carpenters have tools designed for specific jobs, and so should traders. Testing and analyzing potential trading systems allows traders to select the ones most appropriate for the current market environment.

The successful trader has a tool box with a variety of trading tools for use in different market conditions. The trader, like the carpenter, must go beyond just acquiring the tools. Traders must understand which tool to use for a specific task, and have a clear understanding of how the tool works, and what can and cannot be done with it. I have extensively tested several trading systems, the results of this testing on specific trading trading tools are outlined in ‘How to Take Money from the Markets’, and Money-Making Candlestick Patterns. The testing process helps us understand how stocks usually behave after forming a specific pattern such as being outside the Bollinger Bands, showing strong distribution or accumulation, or pulling back or retracing during a trend. Understanding what a stock is most likely to do forms the beginning of a trading strategy. Trading without this information is taking unknown risks.

Jun 2, 2011 | Uncategorized

It so happens that the doji is able to teach much of candlestick theory. If an undecided market contemplates retracement or pauses a while to reconsider the trend upon which it has embarked, this of itself will demand no alteration in price. When the market tests various levels and yet returns to its original price the premise is even more securely made. Here it is found that the greater the extension of the shadows on either side of the real body of the doji, the more pronounced the market’s reassessment. That the market has tested vast levels to the upside or to the downside as well is of great relevance to the issue of price discovery. When it has rejected these extremes to return not to a new found level of value but its original opening price, it is not merely a coincidence but an indication that momentum has come to an abrupt halt. For swing traders the doji must be understood in all its forms, for it provides one of the clearest signals for entry into the market or exit thereof.

When the market has tested the downside thoroughly and shows a doji at the peak of the candlestick with a long shadow extending downward, the contention goes to market strength rather than weakness; it has convincingly rejected lower prices and recovered to close at its highs – at its open. Still, the doji is an indication of indecision and needs further confirmation before entering the market. However, while the fact that an upper range has not been pursued balances out any bullish optimism, it may well be that the downside has been preoccupying the market however, and so the Dragon Fly Doji depicted below is inherently a bullish signal. When it occurs after sustained retracement it suggests a reversal is imminent, and when after an upward trending market, the suggestion that the trend has played out its natural course and has come to an end is patent.

Dragon Fly Doji

Similarly, the Gravestone Doji below mirrors the Dragon Fly already discussed. Here the market has given extensive airing to the upside and has yet concentrated price discovery upon not only its lows, but its opening price. That the downside has not been more thoroughly explored is valid, but hardly able to dilute the bearish signal exuded. When at the end of an uptrend it clearly indicates a reversal is likely; when at the bottom of the market – indecision is rife, but any short positions ought to be covered.

Gravestone Doji

May 26, 2011 | Uncategorized

Original article by Walid Khalil and David Steckler in Stocks & Commodities

AIQ Code by Richard Denning

The AIQ code for Walid Khalil and David Steckler’s article, “Entering The Price Zone”, is shown below. I coded both the Price Zone Oscillator (PZO) and Volume Zone Oscillator Indicator (VZO) (from the prior month’s article by the same authors) along with the system that uses the PZO or VZO indicator. There is an input at the top of the code called “usePZO”. When this input is set equal to “1” then the indicator and system use the PZO. If set to any other value, then the indicator and system use the VZO oscillator. I had to use my own interpretation of what the divergence sell/cover rules of their system mean since the exact code for this part of the system is not given in the article. Also note that the non-trending case is provided with this code but tests of the rule “BuyNoTrnd” showed that trading only when the market is trending was the better choice. As a result, my tests below were of only the trending portion of the system as I had done in last month’s tests.

I ran a back test using the Portfolio Manager module from 1/1/98 to 4/8/11 using the NASDAQ 100 list of stocks. In Figure 1, I show the test results of simulating trading the NASDAQ 100 list of stocks, using the following parameters for capitalization:

1) Maximum positions per day = 3

2) Maximum total positions allowed = 10

3) Choose candidates using ADX values in descending order

4) Size each position at 10% of total account equity recomputed every day

For the test period, the average annual return was 11.3% with a maximum drawdown of 67.7% on 02/07/03.

In last month’s issue, I ran a similar test using the VZO indicator and the results were slightly better than using the PZO indicator with this system.

The short side test was unsuccessful as the system lost all its capital during the early years of the test. These results are not shown in any figures. I tried adding an index trend filter but this did not save the short side from total loss.

Captions:

Figure 1 – PZO system equity curve trading longs only using the NASDAQ 100 list of stocks compared to the SPX index for the test period 1/1/98 to 4/8/11.

EDS Code for Entering the Price Zone:

EnterPriceZone.EDS

(right click and choose Save As)