Feb 15, 2010 | Uncategorized

Three Black Crows consists of three consecutive long black real bodies occurring in an uptrend, each one uccessively lower than the candle prior. The first black candle typically opens above the prior day’s close. The two candles that follow are characterized by an open within the prior day’s real body and a close at or near the prior day’s low, creating a downward stairstep pattern. The Three Black Crows also translate into one very long black candle, sending a message of trend reversal.

Friday February 12, 2010 saw this classic bearish pattern on SBB, ProShares Short Small Cap 6000

Feb 8, 2010 | Uncategorized

When the market is falling and the charts look terrible, your emotions want you to sell. Conversely, when the market is rallying and the news is good, your emotions want you to buy. Unfortunately, this can lead to selling at the low or buying at the high. One way of controlling your emotions is to set some market timing rules based on AIQ’s US score, a unique indicator that can be found on the Market Log report.While the Expert Ratings on an individual stock can be suspect, the Expert Ratings taken from a large database (in this case the SP500) of stocks are effective in classifying the health of the market.

That is, when a lot of stocks are giving AIQ Expert Rating buy signals, a market rally may be near. Conversely, when a large number of stocks are giving AIQ sell signals, a market decline may be approaching.

Expert Ratings are either “confirmed” or “unconfirmed.” A confirmed buy signal occurs when a stock has a recent Expert Rating up signal of 95 or greater along with an increasing Phase indicator. The opposite is true for confirmed sell signals. Unconfirmed signals, however, occur when there is an Expert Rating of 95 or greater but the Phase indicator fails to move in the direction of the signal. It is the unconfirmed signals that you should be interested in.

AIQ’s Market Log report lists the percentage of stocks giving unconfirmed signals (US). The US score is found near the top of the report. The percentage of stocks giving unconfirmed AIQ buy signals appears to the left of the hyphen and the percentage of stocks giving unconfirmed AIQ sell signals appears on the right side of the hyphen. As of Friday February 5th, 2010, of the stocks giving unconfirmed signals, 93% are on the buy side and 7% are on the sell side.

To open the Market Log report, go to Reports and double-click Summary Reports and then Market Log. It is important to keep in mind that AIQ Expert Ratings fire against the trend. As the market declines, the percentage of stocks giving unconfirmed AIQ buy signals increases. As the market rallies, few stocks give buy signals and more stocks register sell signals. The US score serves as an overbought/oversold indicator for the market. That is, when the US score shows 85% or more on the buy side, then that implies the market has recently experienced a sharp decline, is oversold, and due for a rally. Conversely, when the US score shows 85% or more on the sell side, then the market has rallied and is overbought.

Some AIQ users immediately enter the market when the US score moves to 85% or more on the buy side. They exit anytime the US score is 85% or more on the sell side. I don’t recommend this approach because the market can stay overbought or oversold for quite some time. Instead, it may be best to wait for a trend-following indicator such as the Directional Movement Index to confirm the new trend direction.

Rather than using the US score as a strict market timing model, use it as a simple tool to keep your emotions in check. It helps you avoid buying high or selling low. Here is the rule: Don’t turn bearish on the market and sell positions when the US score shows 85% or more buy signals. Similarly, never turn bullish or add positions when the US score shows 85% or more sell signals.

The rule sounds simple but your emotions will tell you otherwise. When the US score has a high percentage of buy signals, the market has fallen and news reports are gloomy. That’s when your emotions tell you to bail. You may be selling right at a low, however. You either should have already sold or you should wait until the market rallies enough to where the US score is no longer giving a bullish reading.

When the market rallies it gets easier to buy. News reports are better and you think you may miss a big rally if you don’t immediately buy. Your emotions tell you to buy more but the US score can counteract your emotions. Don’t buy until the market pulls back enough to bring the US score out of bearish territory. Preferably, wait until the US score turns bullish.

Feb 5, 2010 | Uncategorized

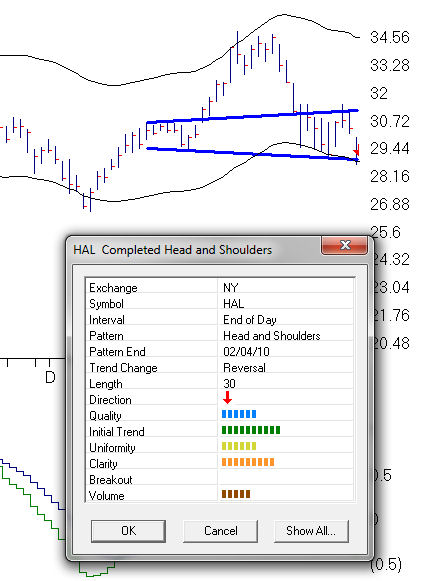

11 head and shoulder patterns show completing in SP1500 last night. Halliburton [HAL] breaking down below the neckline today. $28.11 at 3:30 eastern

Feb 4, 2010 | Uncategorized

In bull markets everyone suddenly becomes an expert when their investments appreciate. What a marvelous turn of events. It is however that small segment of traders who have traded both sides of the divide using an informed trading procedure that will appreciate the irony of having the Midas touch.

The kind of protégés the bull market produces are deluded into believing in their rapidly acquired expertise, while engaging in the rampant growth investing demanded by Efficient Markets Theory. They are deprived of any opportunity to undertake any fundamental analysis to speak of, and a rarely called upon to exercise any discipline. Their clearly profitable trading process will most likely avoid review.

Security of property and resources is fundamental to Maslow’s Hierarchy of Needs, and in the pursuit of self interest, a human being will rarely find anything remotely attractive about a loss. Still, the inability to appreciate something ought not to be determinant of its existence, and a small loss will most definitely endure to be preferred over a large one.

Ultimately, no one participant is bigger than the market however, some individuals such as Warren Buffet standout with alarmingly consistent success. In response to how he became so wealthy A.J. Rockefeller merely replied ‘I guess I took my profits too soon’. The premise that traders such as these are simply lucky is ludicrous.

Integral to a trader’s systemic process is self realization. Unless traders can identify Maslow’s Hierarchy at work in themselves, they will be at continual risk of the inherent emotion that the Market feeds upon. For this reason, a non-reflective person will provide an easy target in the routine short covering rally, or the institutional sell-off that triggers all but the Governor’s stop loss order. Greed will cause such a person to watch a profitable position dissolve and crystallize into a loss; a traumatizing experience. Similarly, when looking into the abyss of capital loss, rather than finding character, such a person finds the fortitude to demand their preferred exit price. In the face of a disastrous inflation figure or even a war, this is the kind of stuff that nightmares are made off.

When a trader knows themselves, and caters for their idiosyncratic limitations within a considered trading process, they will find that taking responsibility for that process and the decisions therein, actually sets one free – free to trade again with undivided attention. When taking a loss, take it all at once, it only hurts for a little while.