Aug 3, 2010 | Uncategorized

Traditionally, equities have commanded a 5% premium over the bond yield, largely due to bonds remaining the asset class that is routinely ignored, and investors preferring stocks and currencies for reasons yet to enjoy proper justification. Not only has this become entrenched in the psyche of investors everywhere, but significantly, the fundamentalist revolution will tolerate it no more.

As history shows us, other stock markets around the world have suffered a number of catastrophic events, to provide the investor with as much as two opportunities to lose 100% of their investment in the past century. The United States however, remains the exception. It is extraordinary that it has not come to the same grim end as the Japanese or European stock markets, and in that respect ought to be treated discriminately.

Simply, the 5% premium in favor of equities is concomitant to the risk that stocks pose vis a vis bonds. If the risk is not reflective of a 5% premium it cannot be justified. Economic growth is achieved through innovation. If there is no innovation to speak of, there will be no economic growth and neither in this situation can a 5% premium be argued. The premium that equity enjoys over bond yields is dependent on inflation; if inflation is rising, bond prices will be under pressure. Due to the fact that equities are a good hedge against inflation, the premium in this scenario however, may well merit some consideration. The incontrovertible truth however, is that fundamental analysis of the real interest rate achieved is mandatory in the counter-revolution that will emerge.

Currently, inflation is targeted by the Federal Reserve to be 1.8% over the next 10 years. The inflationary component priced into the 5-year bond is 1.8% and that priced into the 10-year bond is 2.1%. In the fullness of time, as the economy builds momentum, the target will appear to be more and more inappropriate. See now, when inflation is at 5% it will still receive the familiar rhetoric of a central bank who will insist that their target is 1.8%, in an effort to coerce the market. On this occasion however, the power of suggestion as fortified by efficient markets theory, will prove ineffective. Regardless, the global economy including Europe will set a course along the path of inflation.

Further, there is ambiguity in the real rate of inflation. Hedonic adjustments have been rife, and while it may assist a Central Bank in the discharging of its duties, the real rate of inflation will be considerably magnified. It is intangible anomalies such as these that efficient markets theory fails to consider, and it is precisely what will be required of sound investments in the coming new environment – fundamental analysis. Again, traditionalists have held the view that stocks will outperform bonds however, in the past 10 years bonds have triumphed, with considerable economic growth resulting despite a return being postponed by equities. Growth stock investors have disregarded the importance of dividends in the past, but now alternatives will be available. The divide between fixed interest markets and equity will be a practice of the past. Comparisons will be made between the yield offered by bonds and the dividend yield on stocks.

Jul 30, 2010 | Uncategorized

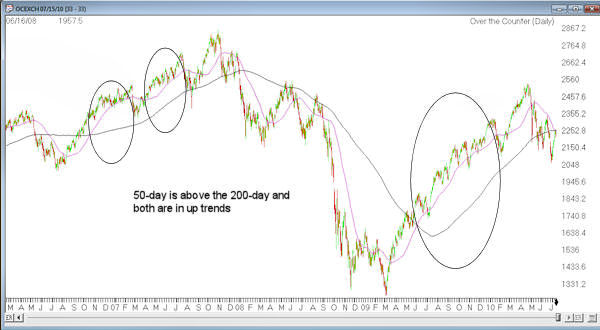

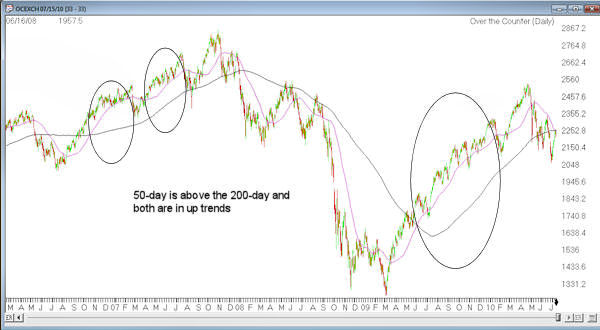

Simple moving averages are not rocket science. They provide a benchmark from which any given days price can be measured for it’s degree of deviation from the average. Crossovers of moving averages by price action whether to the upside or downside are not so much buy or sell points as warning signs. Of course it depends on your moving average. Historically a 200-day arithmetic for the NASDAQ has provided a pretty good indication of the long trend. Dramatic breaks through this average often spell a trend change. Now add in a shorter moving average like the 50-day and a little more clarity appears.

Take a look at the NASDAQ going back to early 2006 in the chart below. When the 50-day is above the 200-day and both are rising, this is the time when bulls hold the court.

Conversely when the 50-day is blow the 200-day and both are falling, this is the time when bears reign.

This is not a timing mechanism for entering or exiting, merely a confirmation of which direction the market is going when these averages display this pattern.

In other market conditions these moving averages will be trending differently from each other and the picture is mixed.

So to the last few days July 13 – 15, 2010. We are at a confluence of the 50-day moving average and the 200-day moving average. The 50-day is in a down trend and now just crossing the 200-day. Yet the 200-day is barely turning down, and has been moving back up in the last 2 days. Until there is a clear down trend in the 200-day, with the 50-day still below and also down trending the sweet spot for shorts is still not in place.

One interesting point to note. The price is also very close to the moving average confluence. The last time this setup occurred was back in May 2005. Check out the chart below. Notice the similarities between May 9, 2005 and July 15, 2010?

Back in 2005 the confluence resolved to the upside, with the market rebounding more than 10% in 2 1/2 months, eventually meeting resistance at the prior high. July 2010 more time is required for the averages to play out before we have an idea where the market is headed.

Jul 8, 2010 | Uncategorized

The recent OIC implementation of its new option symbology in February of 2010 finally gave AIQ the opportunity to fully chart options symbols. There are two methods of charting. In AIQ Charts, you can now enter an option symbol and receive a real-time chart (not end of day). In AIQ RTalerts you can add any number of option symbols and see both real-time and end of day charts.

AIQ opted for what we considered the easist to use implementation of the OIC recommendations. For example the SPY July 2010 106 calls can be charted by entering the ticker

SPY JUL10 106 C

Note there is a single space between the underlying ticker, the month/year, the strike price and the call(C) or put (P).

Try it for yourself. We recommend using RTalerts for tracking multiple options, as the capability to see end of day and real-time price charts is limited to real-time only in AIQ Charts. Further developments to accommodate the weekly and quarterly options are being investigated.

Jul 3, 2010 | Uncategorized

Trading is about risk management. I manage risk by adjusting position sizes, and the number of positions I am trading. When the market is trending I am willing to have more funds invested, so I use more trading positions and larger position sizes. When the market is not trending, I reduce my exposure by reducing position sizes, and the number of positions I am trading.

When the market is in a narrow base I might only be trading two positions. That does not imply I only make two trades while the market is in the base, because when a position hits its limit or stop I will replace it with another setup that triggers. It is just that I am only holding two positions at a time; most of my account is in cash or ETFs. Only having a few positions at a time, limits my exposure to the market during periods of market uncertainty.

Testing and experience shown that a three day holding period can be an effective exit strategy during trading range markets and that longer holding times can be used during trending markets. In practice I use this as a guideline and not a hard and fast rule. If a position approaches support or resistance I will generally take the profit whether or not it has been three days. The most likely thing for a stock to do at a key support or resistance level is to bounce or retrace. If the stock is going to bounce or retrace from support or resistance most of the time, then…in the short term the run is over and I am better off to be taking profits.

When a stock approaches support or resistance it is either going to break through or retreat from it. If, based on the definition of support/resistance the stock retreats most of the time then by taking profits in the support/resistance area I will maximize my return and not be ‘giving back’ profits as the stock retreats. In the cases where the stock does not retreat, and moves through support/resistance I will still have my profits and can roll them into another position. I do not need to continue making money on a specific stock, I can roll my profits into whatever is working.

When trading I want to be positioned to profit if a stock, or the market, does the usual thing in a given situation. When the stock does not take the usual path I may lose a little, but since by definition stocks do the usual thing most of the time, that is the way to bet. Since downtrending stocks usually bounce from support, I am better off to take my profits before the stock reacts to a support level by bouncing which would reduce profits on short positions. If I have a long position and the stock is moving up toward resistance, then I want to take profits before the resistance area in case the stock follows the normal pattern and retraces from resistance which would then decrease my profits.

Some traders are reluctant to take profits when a short position approaches support because they do not want to ‘be wrong’ and worry that they will ‘miss out’ if the stock keeps going down instead of bouncing. They are trading on emotion and ego, not logic. If the stock is most likely to bounce at support then most of the time you are better off to close the short position before it gets to support. There is no way to know what will happen on any particular trade. There are not magic indicators or super systems that will tell you the outcome on a specific trade. You are not smart if the trade worked and dumb if the trade failed. Traders focus on managing risk and being positioned to profit if the normal thing happens. When something unusual happens they may lose money, but it is by definition better to bet on the normal thing happening rather than the unusual. If the normal thing for declining stocks to do is bounce at support then I want to take advantage of this knowledge and use it to prioritize trades based on risk/reward, and also to take profits when a short position approaches support.

In a trending market I may be holding 8-12 trading positions, and close to fully invested for the swing trading account, and replacing them when they hit their stops or triggers. I will also be taking larger position sizes and holding the positions longer when the market is trending. The clearer the market direction, the more funds I will have invested. When the market is uncertain I reduce exposure to stocks, and increase exposure to ETFs. The ETFs do not have the same bang for the buck as stocks, but there is usually something trending up and trends are good for the account.

Steve Palmquist a full time trader who invests his own money

in the market every day. He has shared trading techniques and

systems at seminars across the country; presented at the Traders

Expo, and published articles in Stocks & Commodities, Traders-

Journal, The Opening Bell, and Working Money.

Steve is the author of,

“Money-Making Candlestick Patterns, Backtested for Proven Results’,

in which he shares backtesting research on popular candlestick

patterns and shows what actually works, and what does not. Steve

is the publisher of the, ‘Timely Trades Letter’ in which he shares

his market analysis and specific trading setups for stocks and ETFs.

To receive a sample of the ‘Timely Trades Letter’ send an email to sample@daisydogger.com. Steve’s website:www.daisydogger.com

provides additional trading information and market adaptive trading

techniques.

Jun 7, 2010 | Uncategorized

A trading log is an important element of a successful trading strategy.This presentation, recorded from last week’s free presentation will take you through the process of developing a trading log and why a trading log is critical to successful trading. Click on this link to view the archive

http://prowebinars.na5.acrobat.com/p10075144/

During the presentation Steve shared his personal trading log with attendees. This log is available for you to download at the following location

http://www.aiqsystems.com/market log 2010.xls

May 21, 2010 | Uncategorized

An Excerpt from the Timely Trades Letter.

The large drop in the market on Thursday was interesting, but the question is always what does it mean, and what is likely to happen next. In order to get some insight into this question I ran a test that looked back over the last three years to see how many times the market was down at least 80 points, and what would happen if I had bought at the opening the next day. The table to the left shows that during the last three years the market was down at least 80 points 16 times. If you bought the market the next day, and sold the following day, you would have been profitable eight times and shown eight losses. Essentially being down more than 80 points has not been predictive of whether or not the market will be up or down in the short run. When the market shows strong down days, like we saw on Thursday, the news media is full of stories about major corrections and the like. The news media’s job is to sell commercials, advertising space, and not necessarily to provide actionable information for traders. The market’s behavior over the last three years indicates that in the short-term it is just as likely to bounce after an 80 point drop as it is to continue going down. Based on this data we need to look elsewhere to determine an effective trading plan.

Extensions below the lower Bollinger band are unusual, as you can quickly verify by just scanning a NASDAQ chart for the last couple of years. The Bollinger bands contain the vast majority of the price action, and movements outside the band rarely last more than two or three days. The market typically moves back inside the lower Bollinger band by either moving sideways for a few days, or bouncing. I ran another test that bought the market every time the NASDAQ closed at least 10 points below the lower Bollinger band. I ran this test over the last 36 months using a one-day holding period to determine whether or not closing below the lower band was predictive of short-term behavior. The results, as shown in the chart to above indicate that during the last three years the market closed at lease 10 points below the lower band 21 times, and buying the open the next day and holding for one day was profitable 12 times and showed losses nine times. 57% of the time the market bounced. This data, along with other extensive testing, is why I take profits on short positions when the market becomes extended below the lower Bollinger band. It’s not a guarantee, but if the market bounces in the short-term 57% of the time then in the long run I am better off to have taken profits on shorts when the market moves below the lower band.

Trading is a statistical business, there are no magic indicators that tell you what is going to happen in a given situation every time. Trading is about knowing how the market, and different stock patterns, usually behave in a given situation; and then being positioned to profit if the market, or the stock set up, do the normal thing. Since by definition they do the normal thing most of the time, over the long run I have a good chance to see profits. On any given trade I do not know what is going to happen, it may be a winner or a loser, but over the long run being positioned to profit when the market or stock position does the normal thing is the way to bet.

Sometimes traders will start trading more aggressively when they are down in an attempt to get back to even. Draw downs are a fact of life in trading. Trading is not like drawing a paycheck. You do not get paid because it is Friday. I research the systems and then use that information when trading. If I have a losing streak I know that is to be expected and just stay focused on using the knowledge and skills that come from fully testing and analyzing trading systems.

Steve Palmquist a full time trader who invests his own money in the market every day. He has shared trading techniques and systems at seminars across the country; presented at the Traders Expo, and published articles in Stocks & Commodities, Traders-Journal, The Opening Bell, and Working Money.

Steve is the author of, “Money-Making Candlestick Patterns, Backtested for Proven Results’, in which he shares backtesting research on popular candlestick

patterns and shows what actually works, and what does not. Steve is the publisher of the, ‘Timely Trades Letter’ in which he shares his market analysis and specific trading setups for stocks and ETFs.

To receive a sample of the ‘Timely Trades Letter’ send an email to sample@daisydogger.com. Steve’s website:www.daisydogger.com provides additional trading information and market adaptive trading techniques.